Salaries in France: Employment laws and compensation trends

Looking to hire remote workers in France? Or opening a new French office location?

It’s important to understand the talent and compensation market, as well as local labour laws and working culture, first.

To help, in this guide we’re covering everything from average salaries in France to payroll contributions to working hours – and much more.

📖 Table of contents

Section 1: Compensation in France

- Minimum wage in France

- Average salaries in France

- Software Engineer salaries in France: Software Engineer and Senior Software Engineer

- Average salaries in France vs UK

- Cost of living in France

- 13th month salary in France

- Equity compensation in France

- The gender pay gap in France

- How to use Ravio to ensure fair and competitive compensation when hiring employees in France

Section 2: Payroll in France

- Employer payroll and tax contributions in France

- Employee payroll contributions in France

Section 3: French employment and labour laws

- Working hours in France

- Holiday entitlements in France

- Sick leave entitlements in France

- Parental leave entitlements in France

- Mutual health insurance in France

- Public transport allowance in France

Subscribe to our newsletter for monthly insights from Ravio's dataset and network of Rewards experts, to help you navigate a career in compensation 📩

Section 1: Compensation in France

Average salaries in France

The overall average salary in France is €23,504 (£19,785) per year, according to the French National Institute of Statistics and Economic Studies (INSEE). The latest data is from 2023, so the actual average is likely to be slightly higher.

Of course, in reality, there’s a lot of variance in employee compensation in France depending on the industry, company size, job level, role, location, and so on.

Let’s take a look at an example of a specific role for a closer understanding of average salaries in France – Software Engineers.

Software Engineer salaries in France: Software Engineer and Senior Software Engineer

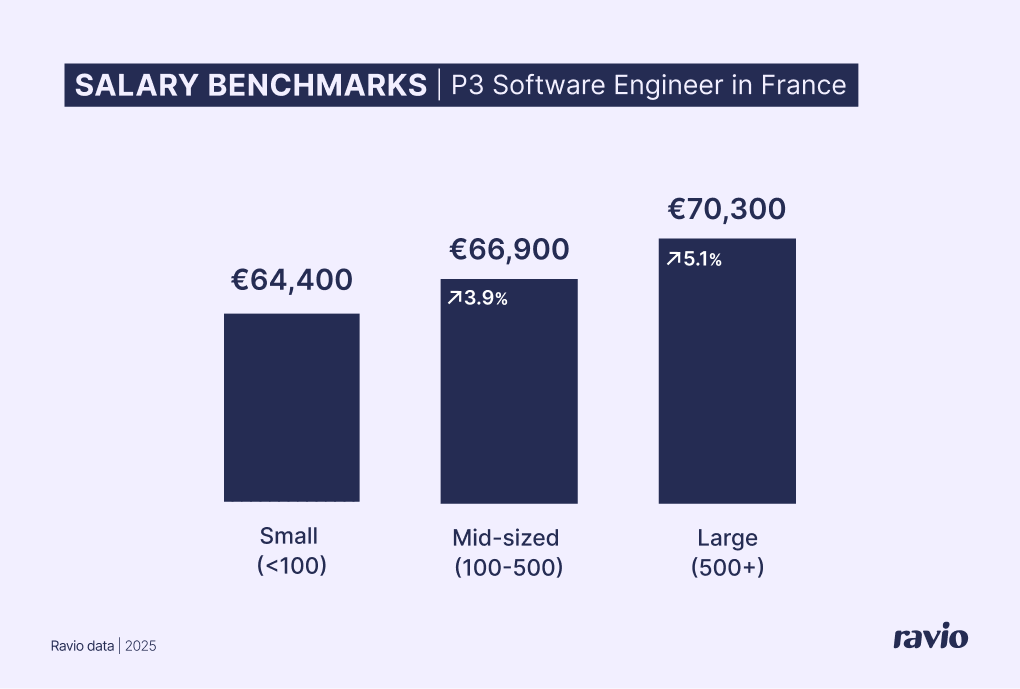

According to Ravio’s global salary benchmarking data, for a mid-level Software Engineer (P3 established), the average (median / 50th percentile) salary in France is €66,900 (£56,288).

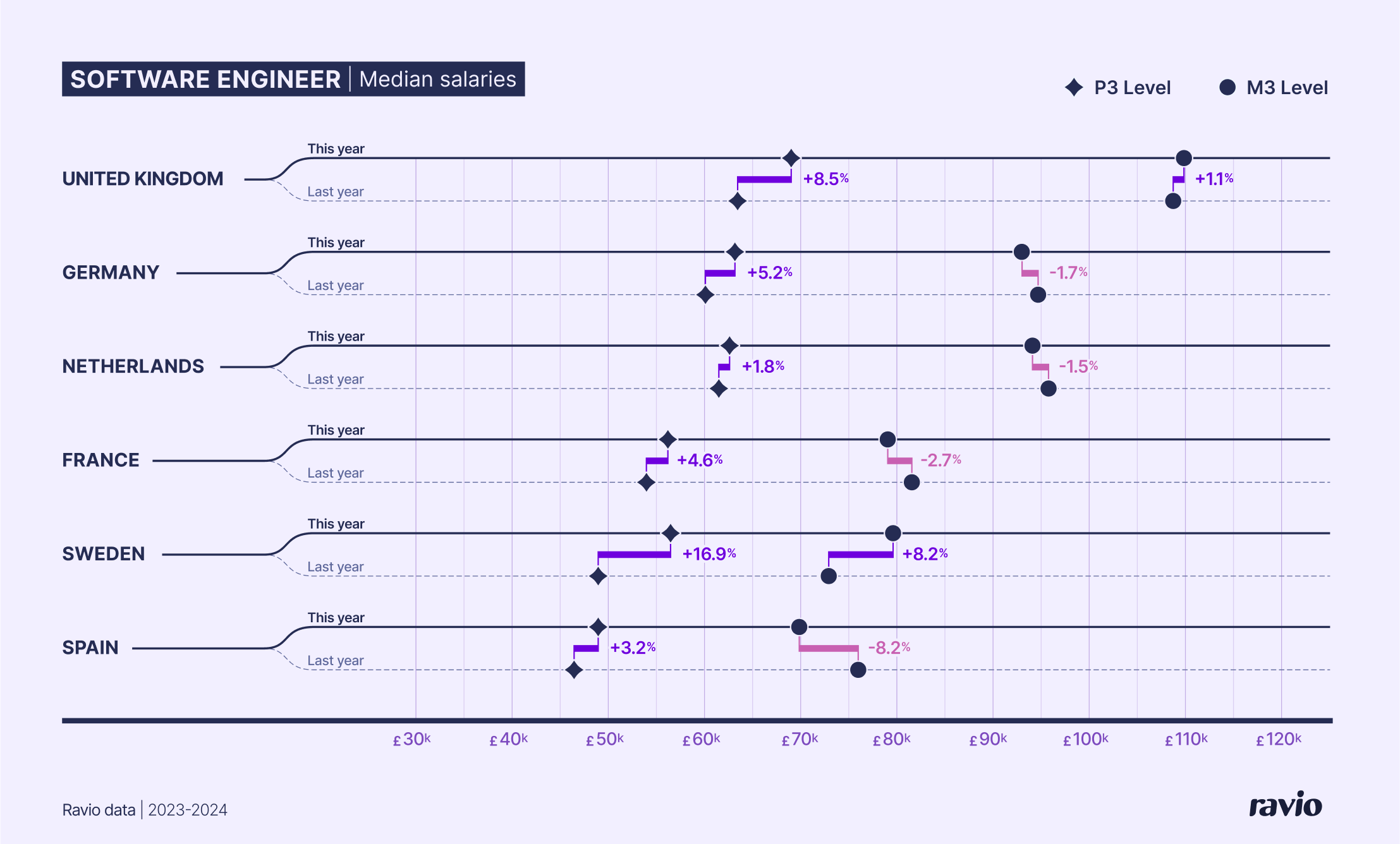

The median salary increased by 4.6% in the last year (2023-2024), which is consistent with the overall average salary increase in that period.

This overall median salary reflects mid-size companies of 100-500 employees.

The same P3 Software Engineer in a small company (<100 employees) has a lower median salary of €64,400 (£54,200), and in a large company (500+ employees) a higher median salary of €70,300 (£59,157).

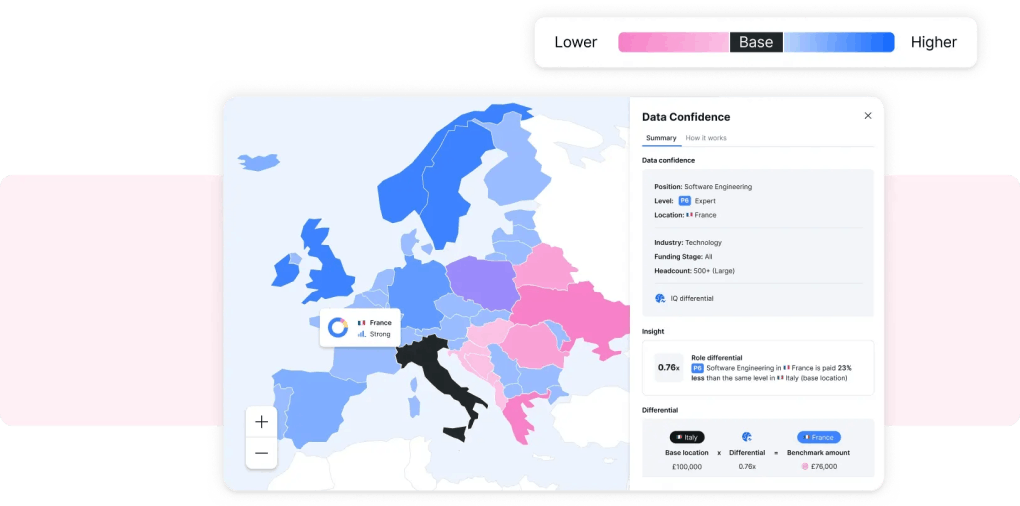

Similarly, the overall median salary also reflects the average for the whole of France – but salaries can vary significantly by location.

If we look specifically at the benchmark for Paris, the median salary for the same mid-level Software Engineer at a mid-sized company is slightly higher at €67,900 (£57,127). On the other hand, for all locations outside of Paris, the median is lower, at €63,200 (£53,173) – reiterating the importance of having access to accurate compensation data when employees are working from different locations.

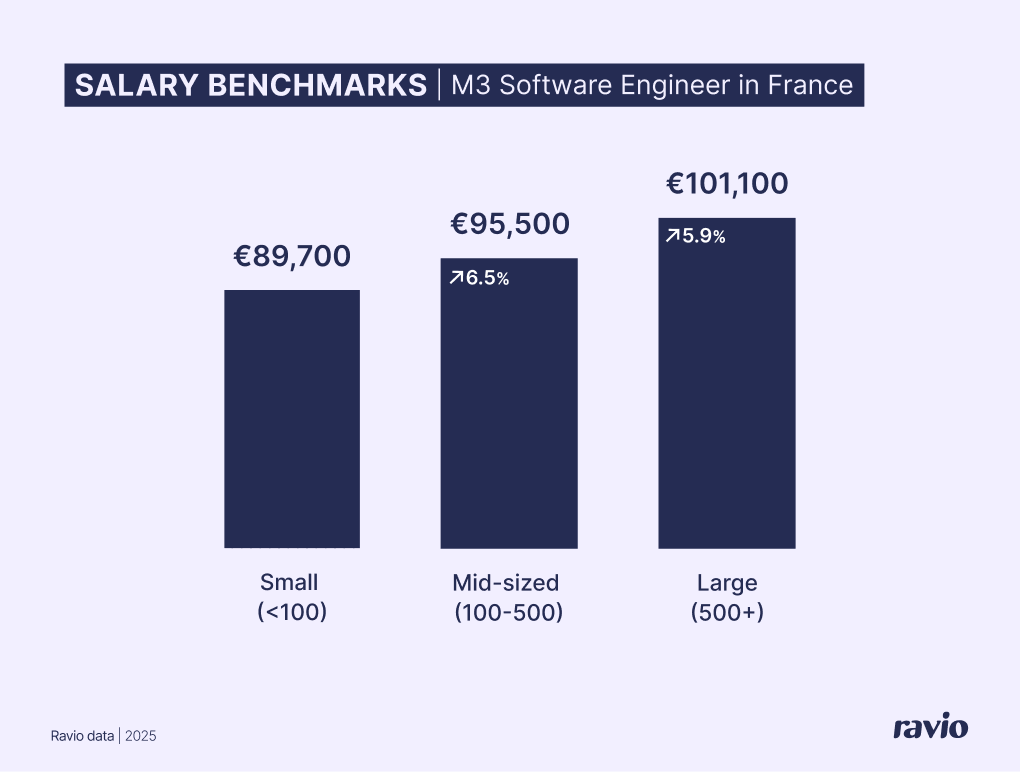

Of course, salaries also increase with seniority. The median salary for a Senior Software Engineer (M3, Senior Manager) at a mid-sized company in France is €95,500 (£80,346) – substantially higher than the P3 salary.

Interestingly this actually represents a slight decline in the past year, down by -2.7% compared to the median salary in 2023.

Average salaries in France vs UK

When hiring in new locations it’s useful to understand how market competitive compensation compares to other core locations – so let’s take a look at how those average salaries compare for France vs UK.

In the UK, the overall average salary for full-time employees is £37,430 (€44,465) according to the Office of National Statistics (as of April 2024) – significantly higher than France’s overall average of €23,504 (£19,785).

If we compare the same Software Engineer and Senior Software Engineer roles in Ravio’s salary benchmarking dataset we can see that salaries in the UK are typically higher than in France.

In the UK the median salary for a P3 Software Engineer (mid-level, IC) at a mid-sized company is £68,900 (€81,859) – making the average salary at this level 22% higher in the UK than in France.

The median salary for an M3 Software Engineer (Senior Manager) in the UK is £109,900 (€130,568) – making the average salary at this level 38% higher in the UK than in France.

Again, this reiterates the importance of understanding how compensation varies across local markets, to ensure fair and competitive pay for employees across multiple locations.

Minimum wage in France

As of 1st November 2024, the minimum wage in France is €11.88 per hour. This equates to a minimum salary of €1,801.80 per month or €21,621.10 per year.

The minimum wage increased by 1.97% on 1st November 2024, having previously been €11.65 per hour between 1st January 2024 and 1st November 2024.

Cost of living in France

According to Numbeo, France is ranked at 24 on the global Cost of Living Index – with a score of 58. Numbeo uses New York City as the base city for the Index, scoring at 100.

At a COL Index of 58, France ranks similarly to Germany (58.4), the Netherlands (60.5), and the UK (59.2).

In terms of cities, Paris has the highest COL Index in France at 68.2 – with its closest city neighbours being Amsterdam at 67.7 and Copenhagen at 71.3. Lyon is the second highest at 63.2.

13th month salary in France

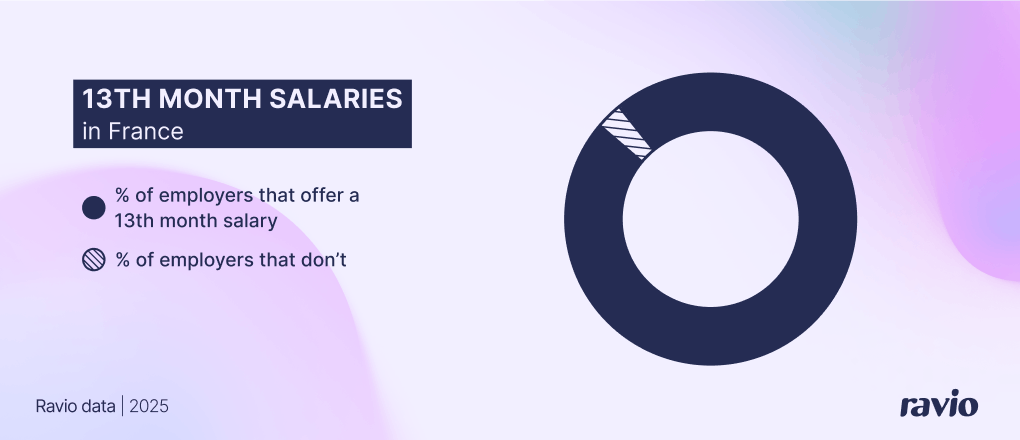

It’s often cited that the 13th month salary is a customary employee benefit in France.

The 13th month salary is a type of bonus or variable pay structure wherein employees receive an additional salary instalment annually: a 13th paycheck.

In some countries, such as Belgium, it is mandatory to pay a 13th month salary. In Greece it’s required to pay both a 13th and 14th month salary at the major annual public holiday periods – the 13th month’s salary is paid at the end of the year, and the 14th month divided between Easter and the summer break.

In others, the 13th month salary isn’t mandatory but is a market norm benefit which is common for employers to offer – this is commonly seen as the case in France, where the 13th month salary is not mandatory, but is typically offered.

However, when we looked at Ravio’s data on the 13th month salary in France, we found that only 3% of employers in France actually offer a 13th month salary – so it seems like it’s less common in reality.

Equity compensation in France

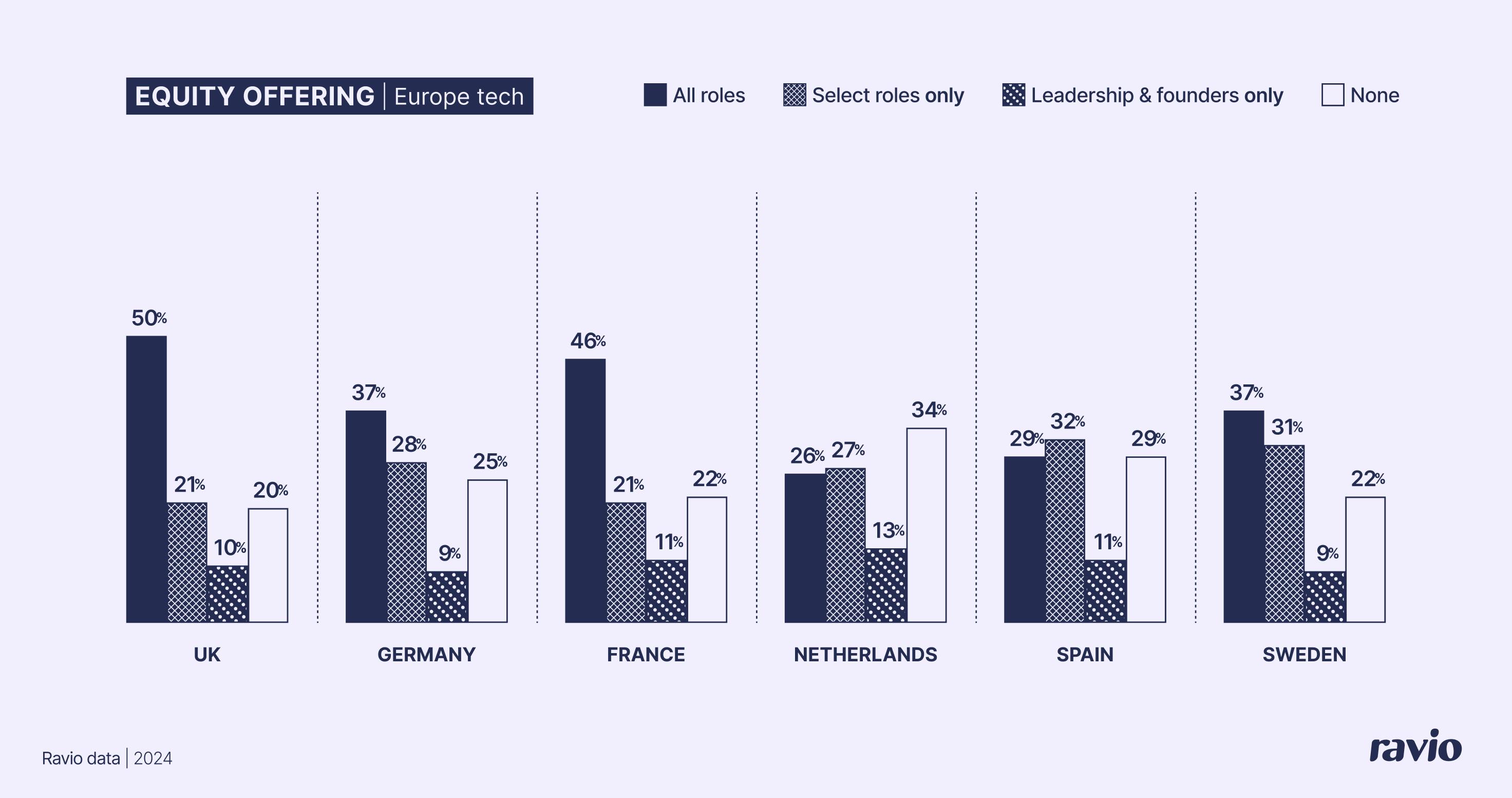

Ravio’s equity benchmarking data highlights that equity compensation is a very common element of total rewards packages in France – 78% of French companies offer equity compensation to employees in some capacity.

In France it’s most common for equity to be offered to all employees (46% of employers) rather than select roles.

The French government offers a tax efficient incentive for companies offering equity compensation to employees: the bon de souscription de parts de createur d’enterprise (BSPCE).

The BSPCE is a type of stock option which is tax efficient for both employers and employees, to encourage companies to offer equity to employees. Employees are only taxed at the sale of equity (not at exercise) with a flat rate of 47.2% tax – though if the employee has been in role for at least 3 years they are eligible for a reduced rate of 30%. Employers are not taxed, but there is a withholding tax required for non-resident employees.

The tax advantages of the BSPCE make it a particularly attractive option for companies with employees in France.

To be eligible, companies must be less than 15 years old, headquartered in the EU, be a privately-held company or a public company with less than €150 million market capitalisation, have at least 25% of the company’s shares held by natural persons, and only issue options to employees (not contractors).

The gender pay gap in France

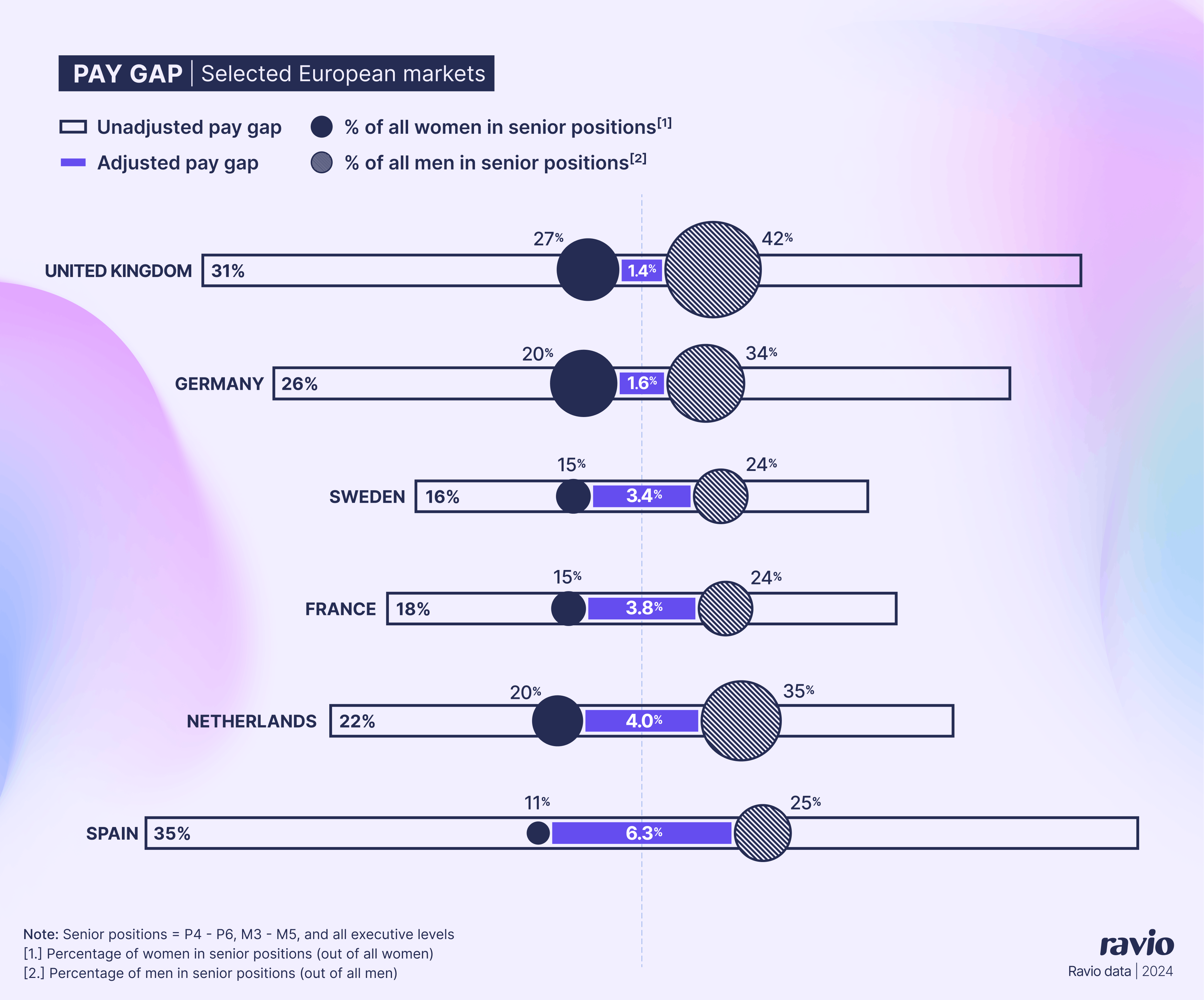

Looking at Ravio’s pay equity data, France has a relatively low unadjusted gender pay gap of 18% – compared to, for instance, the UK at 31% or Germany at 26% – though, of course, there’s still a long way to go towards equitable pay.

However, France’s adjusted gender pay gap is 3.8% which is substantially higher than the UK at 1.4% or Germany at 1.6%.

The adjusted gender pay gap takes into account known differences in pay between different job roles or levels of seniority to give a more accurate representation of the difference in pay between men and women who perform work of equal value. In France only 15% of women are in a senior position (P4-P6, M3-5), so this higher adjusted gender pay gap is likely largely driven by poor representation of women in leadership.

Pay transparency laws in France

France already has pay transparency laws in place through the Index de l’égalité professionnelle femmes-hommes (Gender Equality Index).

Employers with more than 50 employees are legally required to measure and publish five key indicators relating to the gender pay gap:

- The pay gap percentage between women and men in the same age group and job category

- The gap in the rate of salary increases between women and men

- The gap in the rate of promotion between women and men

- Percentage of women who received a salary increase in the year following return from maternity leave

- Number of women among the 10 highest-paid employees.

Each of these indicators is scored, and employers are required to reach a minimum score of 75 points (out of 100). Employers who score below this must conduct a comprehensive pay equity analysis annually to identify gender pay gaps and develop corrective measures.

All companies must also publish their Gender Equality Index score by 1st March each year so that employees have access to the data.

By June 2026 France will have transposed the EU Pay Transparency Directive into local laws, which will mean changes to these existing pay transparency laws.

Use Ravio to ensure fair and competitive salaries when hiring employees in France

Ravio provides real-time global compensation benchmarking data, with over 300,000 data points contributing to the database.

This includes a strong presence in France, with companies like Bolt, Netflix, Alan, Octopus Energy, and more contributing to the salary benchmarks for France – if you’re looking for reliable salary data for hiring employees in France, Ravio will help you pay with confidence.

Section 2: Payroll in France

France has a robust social security system, which means comparatively high payroll contributions for both employee and employer.

Employer payroll and tax contributions in France

For employers, the overall payroll contributions are around 45% of each employee’s salary.

This is broken down as follows:

- Old-age insurance: 8.55% of earnings up to the monthly social security ceiling of €3,666; 1.9% of earnings beyond the ceiling

- Supplementary pension: 4.72-12.95% of earnings

- Health, maternity, disability, death insurance: 7% of earnings for salaries up to 2.5x minimum wage; 13% of earnings for salaries above

- Family benefits: 3.45% of earnings for salaries up to 3.5x minimum wage; 5.25% of earnings for salaries above

- Autonomy solidarity (a fund for the autonomy of elderly or disabled people): 0.3% of earnings

- Accidents at work: varies depending on workplace risk

- Unemployment insurance: 4.05% of earnings, up to a ceiling of €14,664 (4x monthly social security ceiling)

- Wage guarantee insurance (AGS): 0.15% of earnings.

Employee payroll contributions in France

For employees, payroll social security contributions total around 20-23% of the employee’s base salary.

This is broken down as follows:

- Old-age insurance: 6.9% of earnings up to the social security ceiling of €3,666; 0.4% of earnings beyond the ceiling

- Supplementary pension: 3.15-8.64% of earnings

- Social security surcharge (contribution sociale généralisée or CSG): 9.2% of earnings

- Social security debt reimbursement contribution (contribution pour le remboursement de la dette sociale/CRDS): 0.5% of earnings.

💡How does the state pension work in France?

In France the government provides a ‘basic’ state pension, given after the age of retirement (62-64) which varies depending on an individual’s average salary throughout their career. Employers and employees both contribute to this via the payroll (see above) as old-age insurance.

Through the social security scheme there is also a mandatory supplementary pension scheme to top up the basic pension for all private-sector employees.

This is done through payroll contributions by employer (60%) and employee (40%), but separate to social security – these are managed by industry bodies, most commonly AGIRC (for executives) and ARRCO (for non-executives).

There are two salary brackets for the supplementary contributions:

- Bracket 1: monthly income €0-€3,666. Employee contributes 3.15% of income, employer contributes 4.72% of income.

- Bracket 2: monthly income €3,666 and €29,328. Employee contributes 8.64% of income, employer contributes 12.95% of income

Source: Le Cleiss

Employees in France also pay income tax on their earnings.

Income tax rates are progressive tax from 0% to 45% based on salary, with the income brackets updated annually as part of the government’s budget. The latest update was during the 2024 budget, applicable to income in 2023, with the brackets as follows.

- Up to €11,294 – 0% tax rate

- From €11,295 to €28,79 – 11%

- From €28,798 to €82,341 – 30%

- From €82,342 to €177,106 – 41%

- More than €177,106 – 45%

Section 3: French employment and labour laws

When hiring employees in France it’s also important to understand French employment and labour laws – particularly how they influence working culture and the mandatory benefits you’re required to provide for employees.

Working hours in France

Since 2000 French labour law has included a requirement that all employees in France must have standard working hours of 35 hours per week. Within that, each working day must be no more than 10 hours.

Employees are able to work overtime above the standard 35 hour working week. However, it’s common for employment contracts to include an overtime policy for these instances – the two most common approaches being to offer one of:

- Réduction du temps de travail or RTT (reduction of working time). Employees receive additional paid time off in exchange for overtime worked.

- Overtime pay rate above salary. Overtime pay is offered at 125% of regular salary for the first 8 hours, and 150% after that. Overtime pay is typically at least 110% of salary.

This is very important to be aware of if you’re hiring employees in France and have a standard contract with a working week of more than 35 hours – which is common in other countries. This will need to be accounted for either by reducing their hours or by offering additional time off through RTT for employees based in France.

Holiday entitlements in France

Under French employment law, all full-time employees (working a 35 hour week) are entitled to a minimum of five weeks or 25 working days of paid annual leave per year.

Holidays are accrued from an employee’s starting date at a rate of 2.5 days per calendar month worked.

📊 Is it common for French employers to give more than the statutory minimum of annual leave?

Looking at Ravio’s employee benefits benchmarking data, we can see that in France most employers only offer the statutory required amount of annual leave – which means that offering more than this could be a great way to compete in the talent market when hiring in France.

- 87% offer the statutory minimum of 25 days

- 8% offer 26-30 days

- 4% offer more than 30 days.

- 1% offer unlimited holidays

Public holidays in France

There are 11 public holidays per year in France:

- 1 January – Jour de l'An (New Year's Day)

- March / April (moveable) – Vendredi Saint (Good Friday)

- March / April (moveable) – Lundi de Pâques (Easter Monday)

- 1 May – Fête du Travail (Labour Day)

- 8 May – Victoire 1945 (Victory Day)

- May (moveable) – Ascension (Ascension Day)

- May / June (moveable) – Lundi de Pentecôte (Whit Monday)

- 14 July – Fête Nationale Française (National Day)

- 15 August – Assomption (Assumption Day)

- 1 November – Toussaint (All Saints' Day)

- 11 November – Armistice 1918 (Armistice Day)

- 25 December – Noël (Christmas Day)

- 26 December – Saint Etienne (Saint Stephen's Day)

Only Labour Day on 1st May is a statutory paid holiday on which employers must grant leave – but most employers do give all 11 public holidays as paid time off.

Sick leave entitlements in France

All employees who have worked at least 150 hours during the prior three calendar months are entitled to unlimited paid sick leave under French labour law.

The first three days of sick leave are seen as a ‘qualifying period’ and the employer isn’t obliged to pay wages.

After day three the sick leave is paid for by social security at 50% of the employee’s salary. After day eight, the employer must top that up as follows:

- 90% of salary for 30 days (increased by ten days for every five years of service)

- 66% of salary for the following 30 days (increased by ten days for every five years of service) if there has been at least one year of service

It’s common for employers to top this up to full salary.

Parental leave entitlements in France

In terms of maternity leave in France, all working mothers in France who have been employed for at least 150 hours during the prior three calendar months are entitled to 16 weeks of fully paid maternity leave (6 weeks pre-birth, 10 weeks after) under French employment law.

Maternity leave may also be granted above 16 weeks, in the following circumstances:

- If there are complications, an additional 2-4 weeks of fully paid leave are given

- For the third birth and above, 26 weeks of fully paid leave are given (8 weeks pre-birth, 18 after)

- For twins, 34 weeks of fully paid leave are given (12 weeks pre-birth, 22 weeks after)

- For triplets or more, 46 weeks of fully paid leave are given (24 weeks pre-birth, 22 weeks after).

In terms of paternity leave in France, all working fathers in France who have been employed for at least 150 hours during the prior three calendar months are entitled to 25 days of fully paid paternity leave as standard.

Four days must be taken after the child’s birth, and the remaining days can be divided into two periods before the child reaches six months. For multiple births, 32 days of fully paid leave are given.

French employees are also entitled to adoption leave. All adoptive parents in France who have been employed for at least 150 hours during the prior three calendar months are entitled to 16 weeks of fully paid leave as standard.

If more than one child is adopted, 22 weeks of paid leave are given. For people who already have two or more dependent children, 18 weeks of paid leave are given. If the leave is shared between parents, the duration is extended by 25 days (for a single adoption) or 32 days (for a multiple adoption).

In all parental leave cases (maternity, paternity, adoptive), all parents in France are entitled to up to one year of parental leave or part-time working arrangements after the maternity/paternity leave and before the child reaches the age of three – as long as they have been with their company for at least one year.

The year of leave can be taken by one parent or divided, but can be taken simultaneously or consecutively. During the parental leave the employer does not pay salary. However, benefit payments can be received from the state.

Mutual health insurance in France

Mutuelle ou complémentaire santé (mutual health insurance) is private health insurance in France which is used to cover costs that are not covered by the state through social security contributions.

Employers are required under French labour law to pay at least 50% of the cost of the private health insurance – but it’s very common for employers to cover the whole cost as part of their benefit package.

In fact, looking at Ravio’s benefits benchmarking data, a huge 99% of companies offer mutuelle ou complémentaire santé to their employees, so it’s almost a necessity.

Public transport allowance in France

Employers are required to cover at least 50% of the employee’s cost for commuting to the place of work via public transport, including bike rental, under French employment law.

On top of that, there are also optional schemes in place:

- Prime de transport (transport bonus): grants employers a tax-free amount of €200 per year per employee to pay to employees who use their car to travel to work if the employee’s place of residence or work or their working hours mean that public transport is not an option.

- Forfait mobilité durable (sustainable mobility package): grants employers a tax-free amount of €800 per year per employee to pay to employees who opt for sustainable transportation (e.g. bike, scooter, carpooling – this can be coupled with the public transport costs too).

💡What are the most common optional benefits or perks in France?

Flexible working options, meal vouchers, and wellness allowances are all very common employee benefits in France.

We spoke to French employee benefits experts Alexandra Pharisien, Talent Manager at Skeelz and Boris Jottreau, CEO of May, to find out more about what employees in France look for when it comes to competitive benefits.