Salaries in Germany: Employment laws and compensation trends

Germany’s tech scene is thriving.

Germany is now home to over 20,000 startups which employ over 620,000 people (German Startup Monitor) – and has been the birthplace of over 30 tech unicorns, from Celonis to Personio to N26.

The tech industry is supported by the German government too, through direct investment in high-potential spaces like the semiconductor industry and through schemes like High-Tech Gründerfonds which provides funding and support to early-stage startups.

Through this, Germany has also become home to some of Europe’s top tech talent – so it’s a great location to scout for talent.

But hiring talent in Germany means you need to know what fair and competitive compensation looks like.

To help, in this guide we cover everything you need to know about German labour law, mandatory benefits, and market competitive compensation.

Table of contents

Section 1: Salaries in Germany

- Minimum wage in Germany

- The cost of living in Germany

- Average salaries in Germany

- Example: Software Engineer salaries in Germany

- Example: Salaries in Germany compared to France and UK

- 13th month salary in Germany

- The gender pay gap in Germany

- Salary benchmarking in Germany – where to find market data

Section 2: German employment and labour laws – payroll taxes, mandatory benefits, and working conditions

- Payroll and tax contributions in Germany (employer and employee): pension, health insurance, unemployment insurance, accidence insurance, insolvency

- Working conditions: German works councils, working hours in Germany

- Mandatory employee benefits in Germany: holidays, sick leave, bereavement leave, wedding leave, educational leave, parental leave

- Working hours in Germany

- Annual leave entitlements in Germany: paid holidays, wedding leave, bereavement leave, sick leave, parental leave, educational leave

Section 3: The most common optional employee benefits in Germany

- Subsidised office meals

- Subsidised transport costs

- Sabbaticals

- Flexible working arrangements

Section 1: Salaries in Germany

The minimum wage in Germany

The minimum wage in Germany is €12.82 per hour, as of 1 January 2025 – as per the Fourth Minimum Wage Adjustment Ordinance in November 2023.

This is a slight increase from 2024 when the minimum wage was set at €12.41 per hour.

In Germany the minimum wage was made uniform in 2015 via the Minimum Wage Act (MiLoG), which means the minimum wage is the same for all workers regardless of factors like age.

The cost of living in Germany

According to Numbeo, Germany is ranked at 23 on the global Cost of Living Index – with a score of 58.4.

Numbeo uses New York City as the base city for the Index, scoring at 100.

At a COL Index of 58, Germany ranks equally to France (58.4), the Netherlands (60.5), and the UK (59.2).

In terms of cities, Munich has the highest COL Index in Germany at 65.9 – with its closest city neighbours being Luxembourg at 66.0 and Haarlem in the Netherlands at 65.3.

Average salaries in Germany in 2025

According to the German Federal Statistical Office (Statistisches Bundesamt) the overall average (mean) salary in Germany is €4,323 per month – or €51,876 per year. The latest data is from 2023, so it’s likely that the average is actually slightly higher today.

Of course, in reality, there’s a lot of variance in employee compensation in Germany depending on the industry, company size, job level, role, location, and so on – and the Statistical Office does highlight that two-thirds of German workers have a salary which is below this average.

Let’s take a look at a couple of examples using Ravio’s salary benchmarking data for Germany to put this into context.

Software Engineer salaries in Germany

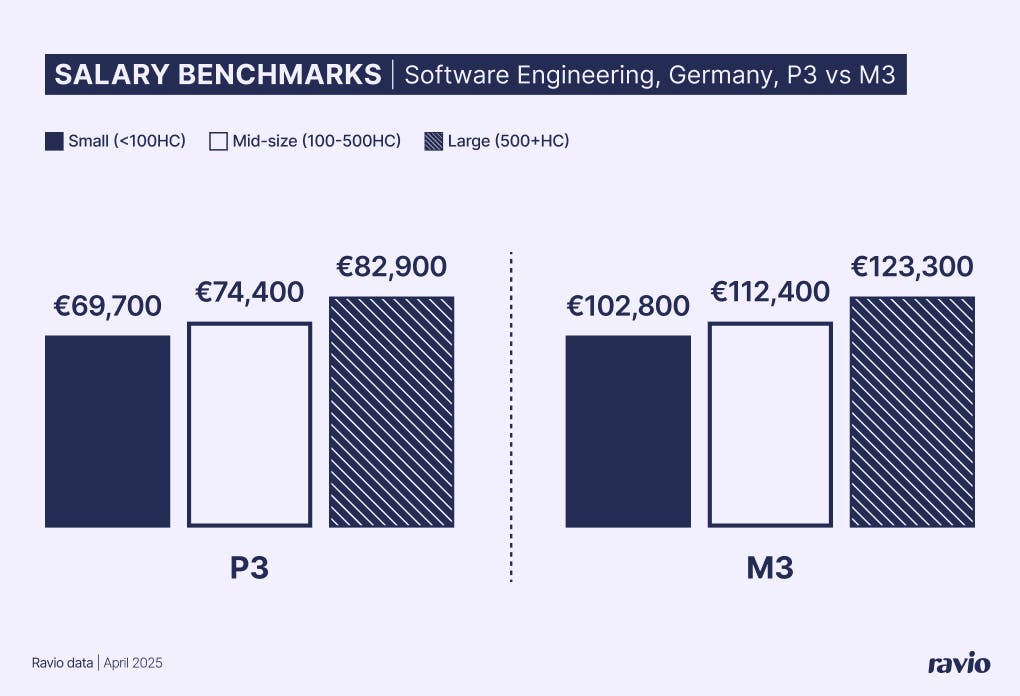

According to Ravio’s global salary benchmarking data, the median salary for a mid-level Individual Contributor Software Engineer (P3 established) in Germany is €74,700 (£64,554).

This overall median salary reflects mid-size companies of 100-500 employees.

The same P3 Software Engineer in a small company (<100 employees) has a lower median salary of €69,700 (£60,202), and in a large company (500+ employees) a higher median salary of €82,900 (£71,612).

For a Senior Manager in Software Engineering (M3 level), the median salary is €102,800 at a small company, €112,400 at a mid-sized company, and €123,300 at a large company.

How do salaries in Germany compare to France and the UK?

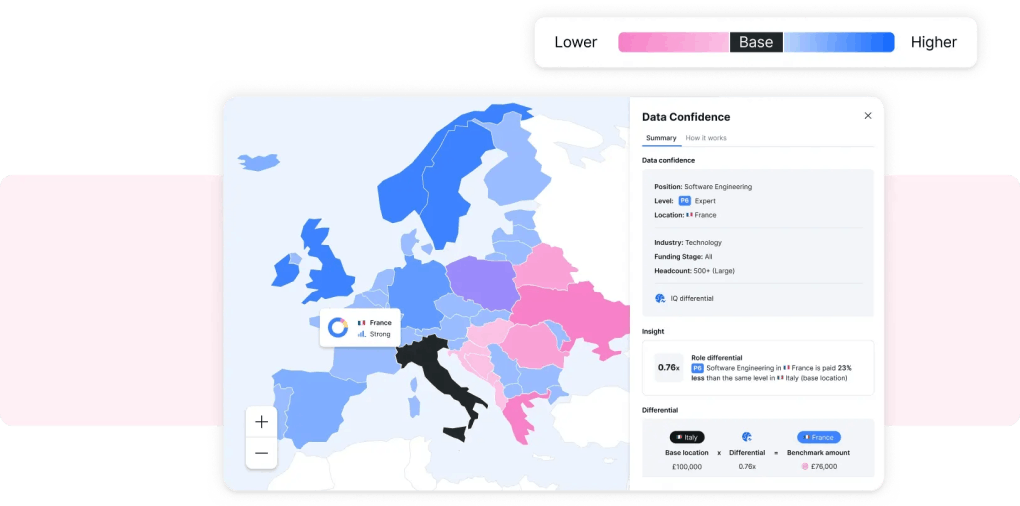

When hiring in new locations it’s useful to understand how market competitive compensation compares to other core locations – so let’s take a look at how those average salaries compare for between Germany, France, and the UK.

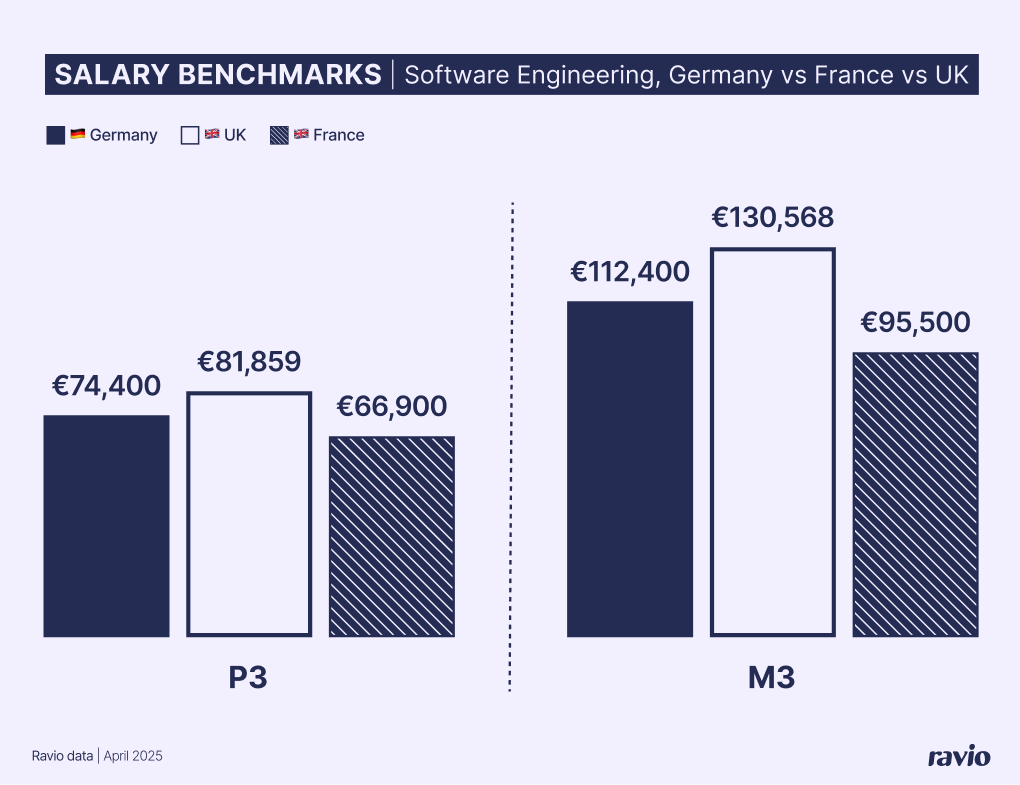

If we compare the same Software Engineer and Senior Manager Software Engineer roles in Ravio’s salary benchmarking dataset we can see that salaries in Germany are typically higher than in France, but lower than in the UK.

In the UK the median salary for a P3 Software Engineer at a mid-sized company is £68,900 (€81,859) – making the average salary at this level 9% higher in the UK than in Germany.

In France the median salary for a P3 Software Engineer at a mid-sized company is €66,900 (£56,288) – making the average salary at this level 11% lower in France than in Germany.

The same trend is true at the M3 Senior Manager level.

The median salary for an M3 Software Engineer (Senior Manager) in the UK is £109,900 (€130,568) – making the average salary at this level 14% higher in the UK than in Germany.

In France, the median salary for an M3 Software Engineer (Senior Manager) is €95,500 (£80,346) – making the average salary at this level 16% lower in France than in Germany.

This highlights the importance of access to reliable market data to see how compensation varies across local markets when hiring employees in different locations – and is why many international companies opt for a location-based compensation approach to ensure fair and competitive pay for all employees.

💡Do employees in Germany typically receive equity compensation?

Unlike countries like the UK (EMIs) and France (BSPCE), Germany does not have a tax efficient equity scheme run by the government.

However, the German government has introduced new rules in recent years which make equity a more attractive proposition for German employers and employees:

- In 2021 the Fund Location Act (Fondsstandortgesetz) ruled that employees would only be taxed at the employee’s personal income tax rate for the market value of their shares, with any increase in value subject to capital gains tax instead at a much lower rate. This Act also ruled that any equity grant allowed employees at companies of under 250 headcount to defer the tax on their equity grant until they left the company or sold their shares (up to a maximum 12 years).

- In 2024 the the Future Financing Act (Zukunftsfinanzierungsgesetz) increased the tax-free allowance on equity from €1,440 to €2,000 per year. It also expanded the reach of the deferred tax ruling to companies of under 1,000 headcount (instead of 250 as per the Fund Location Act).

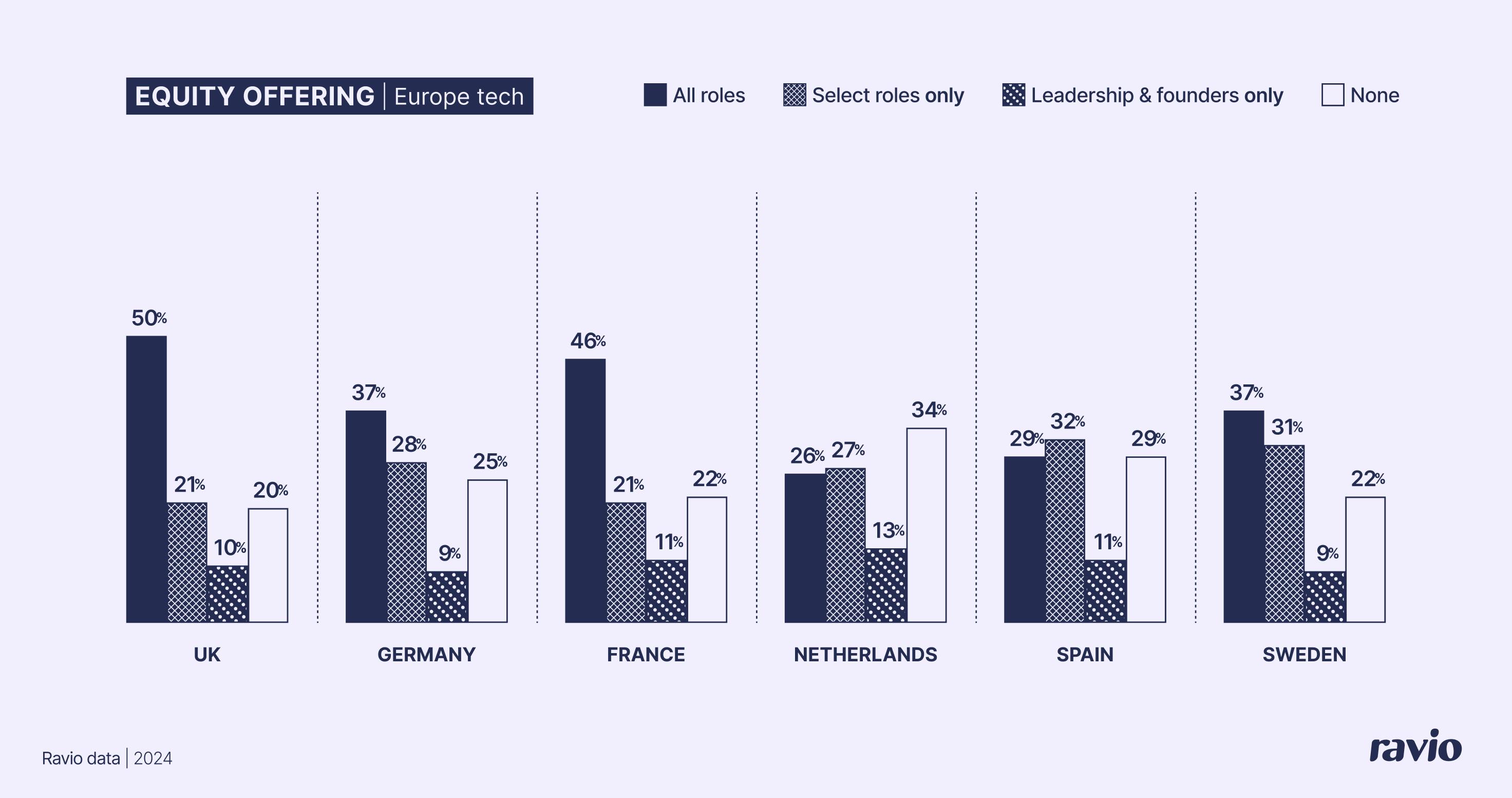

Ravio’s equity benchmarking data shows that equity compensation is no a common element of total rewards packages in Germany – 75% of German companies offer equity compensation to employees in some capacity.

It’s most common for equity to be offered to all employees (37% of employers), but equity compensation for select roles only is fairly close behind (28% of employers).

13th month salary in Germany

It’s customary in Germany for employees to receive a 13th month salary as a kind of bonus at the end of the calendar year, sometimes known as ‘Christmas money’.

The 13th month salary is a type of bonus or variable pay structure wherein employees receive an additional paycheck annually, outside of the usual monthly structure. It’s customary in several countries and even mandatory in some – like Belgium or Greece.

The gender pay gap in Germany

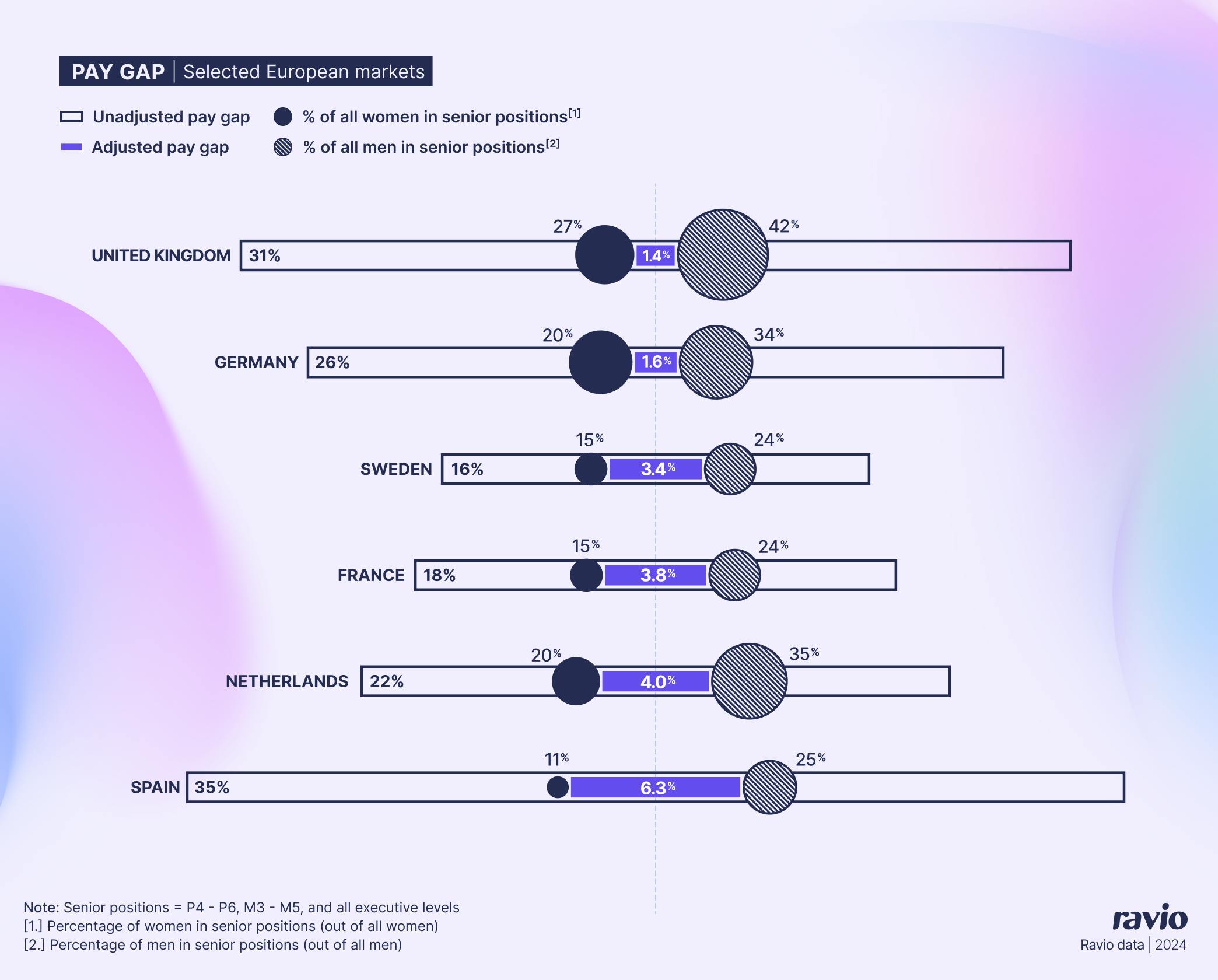

Looking at Ravio’s pay equity data, Germany has an overall unadjusted gender pay gap of 26%. This is relatively high compared to other locations in Europe, with France (18%) and Sweden (16%) the lowest overall, though still with significant gaps to close.

However, Germany has one of the lowest adjusted gender pay gaps in Europe at 1.6% – with only the UK lower at 1.4%.

The adjusted gender pay gap takes into account known differences in pay between different job roles or levels of seniority to give a more accurate representation of the difference in pay between men and women who perform work of equal value.

Germany already has pay transparency laws in place to enforce equal pay for women.

The Transparency in Wage Structures Act has been in existence since 2017, with the aim to enforce the right to equal pay for women and men for equal work or work of equal value.

- Companies with 500+ employees must report annually on gender equality and equal pay, including outlining initiatives and actions to promote equal pay at the company.

- In all companies with 200+ employees, the employees are entitled to disclose salary information to one another (i.e. pay secrecy clauses are banned) and can request salary information on groups of employees who perform work of equal value to them.

From June 2026 the EU Pay Transparency Directive will also be implemented in Germany, which will lead to heightened regulations on pay transparency and gender pay gap reporting. Germany have yet to announce their transposition plans (as of April 2025).

Salary benchmarking in Germany – where to find accurate market data

When hiring and paying employees in Germany it’s vital to have access to accurate salary benchmarking data to understand what fair and competitive pay looks like.

Ravio provides real-time global compensation benchmarking data, with over 300,000 data points and 1,300+ companies contributing to the database.

This includes a strong presence in Germany, with companies like Deezer, Alan, Adyen, Netflix, Bolt, Wise, and many more contributing to the salary benchmarks for Germany.

So, if you’re looking for reliable salary data for hiring employees in France, Ravio will help you pay with confidence.

Section 2: German labour laws – payroll taxes, mandatory benefits, and working conditions

Germany has robust employment laws and a social security system which all employers must comply with – which dictates employer and employee payroll contributions as well as mandatory benefits that employers must offer.

Payroll and tax contributions in Germany: employer and employee

In Germany the following mandatory social security contributions are required by law for all employers and employees, deducted from the employee’s (pre-tax) income and paid in part by employer and part by employee:

- Pension insurance (Rentenversicherung)

- Unemployment insurance (Arbeitslosenversicherung)

- Health insurance (Krankenversicherung)

- Long-term care insurance (Pflegeversicherung)

- Accident insurance (Unfallversicherung)

- Continued payment of income insurance (Umlage 1, 2, 3)

Plus, there’s also income tax, of course.

Pension insurance (Rentenversicherung)

Pension insurance is a requirement for Germany’s state pension scheme.

In Germany all employees who have been insured for the minimum insurance period when they reach retirement age receive old-age pension payments from the government.

As of 1st January 2024, the contributions are as follows:

- Total contribution: 18.6% of income

- Paid by employer: 9.3%

- Paid by employee: 9.3%

- Income ceiling: €8,050 per month (€96,600 annual salary)

Unemployment insurance (Arbeitslosenversicherung)

Unemployment insurance is a requirement to receive unemployment benefits in Germany. Any employee that has been insured for the minimum insurance period is eligible to receive benefits payments if they lose their job.

As of 1st January 2024, the contributions are as follows:

- Total contribution: 2.5% of income

- Paid by employer: 1.25%

- Paid by employee: 1.25%

- Income ceiling: €90,600 (€89,400 in the new federal states)

Health insurance (Krankenversicherung)

Health insurance contributions by employer and employee give employees access to the state healthcare system in Germany. Anyone receiving unemployment benefits does not need to be insured to access healthcare.

- Total contribution: 14.6% of income

- Paid by employer: 7.3%

- Paid by employee: 7.3%

- Income ceiling: €84,600 (€81,000 in the new federal states)

Employees typically also make an additional contribution on top of this general mandatory contribution – depending on the health insurance provider they opt for.

Long-term care insurance (Pflegeversicherung)

In Germany long-term care insurance covers important additional healthcare services for the elderly, such as nursing home payments or home carers.

As of 1st January 2025, the contributions are as follows:

- Total contribution: 3.6% of income

- Paid by employer: 1.8%

- Paid by employee: 1.8%

- Income ceiling: €58,050

Employees who have no children and are over the age of 23 pay a surcharge of 0.6% on top of their standard contribution.

Accident insurance (Unfallversicherung)

State accident insurance in Germany provides cover for employees who are impacted by an accident or occupational disease whilst at work.

The contribution required varies depending on the workplace and the amount of risk involved for employees, with the average contribution being around 1.14% by the employer.

The employee does not have to contribute to accident insurance.

Continued payment of income insurance

Employers in Germany must also may two levies which are contributions to enable employees to continue to receive pay when they are unable to work due to sick leave or maternity leave.

- Umlage 1 (U1) sick leave pay (Krankheitsfall). The employer pays monthly contributions to their health insurance provider, who then supports with covering salary payments during employee sick leave. The contribution varies depending on the health insurance provider, but is typically between 1.4-5.1% of the employee’s salary.

- Umlage 2 (U2) maternity leave pay (Mutterschaft). The employer pays monthly contributions to their health insurance provider, who then supports with covering salary payments during employee sick leave. The contribution varies depending on the company’s headcount and the % of women on the team.

- Umlage 3 (U3) insolvency benefit (Insolvenzgeldumlage). Employers contribute 0.06% of an employee’s salary (reduced from 0.09% in 2022) to cover employee salary payouts if the company goes bankrupt.

Income tax in Germany

German employees pay income tax on their earnings, with the tax rates from 0-45% as follows (as of 2025):

- 0% tax rate – up to €12,096 annual income (will go up to €12,348 in 2026)

- 14-24% tax rate – between €17,444 to €68,480 annual income (will go up to €17,800-€69,878 in 2026)

- 24-42% tax rate – between €68,481 to €277,825 annual income (will go up to €69,879-€277,825 in 2026)

- 45% tax rate – €277,826 (this has remained unchanged in recent years).

The middle two income tax rates in Germany are progressive – meaning that the tax rate is higher for higher earners, with a difference percentage of tax paid on each portion of salary based on the brackets (e.g. with a salary of €15,000 you would pay 0% tax up to €11,604 and 14-24% tax on the remainder). If you’re unsure, the Federal Ministry of Finance has a handy income tax calculator.

In addition to normal income tax rates, many employees in Germany pay an additional Solidarity Tax Contribution (Solidaritätszuschlag – commonly shortened to ‘Soli’).

The standard rate is 5.5% of income, but since 2021 individuals earning less than €16,959 and couples earning less than €33,912 are exempt. For income above this, soli is charged in brackets depending on the salary, up to a maximum contribution of 5.5% on an income of €96,820+ for individuals and €193,641+ for couples.

The soli was introduced to finance the costs of German unification and to level out the income differences between former-western and former-eastern states.

Subscribe to our newsletter to get insights from Ravio's compensation dataset and network of Rewards experts once a month 📩

Working conditions in Germany

The role of the German works council

In Germany, a works council (Betriebsrat) is a group of employees elected to represent the rights of the company’s whole workforce in conversations with leaders and board members.

The Works Constitution Act makes it a requirement for all companies with five or more employees to allow the creation of a works council

They exist to ensure that employers observe employment law and collective agreements, and to raise the views of employees regarding workplace improvements. Works councils typically have input on decisions including:

- Company working hours, break times, overtime policy

- Holiday days

- Compensation structures – including pay discrimination

- Compliance with employee data protection rulings

Employees are elected onto the council for a four year term.

The number of employees on the council increases with the company’s headcount (see section 9 of the Act) e.g. companies with 51-100 employees will have a works council made up of five employees, whereas a company with 1001-1500 employees will have 15 works council members.

Working hours in Germany

The typical working week in Germany is between 35-40 hours.

Under German employment law, the maximum working day is 8 hours, meaning the absolute maximum is a 48 hour working week, which has been the case since the initial introduction of the Working Time Act (Arbeitszeitgesetz) in 1994.

In 2023 new amendments were proposed to the Working Time Act. The major change is the introduction of an employer obligation to record working time: the beginning, end, and duration of each working day. The aim of this is to enable the enforcement of the EU Working Time Directive and ensure that employees have enough rest time and are compensated for any overtime worked.

Exact working hours are stipulated on a company-by-company basis via an employment contract between employer and employee – and approved by the works council.

Expectations can also vary depending on the sector – collective agreements are common in Germany, which can lead to decisions on things like wages and working hours being negotiated for an entire sector via trade unions.

There is no specific employment law regarding paid overtime in Germany.

But it is common for German employers to offer either overtime pay or time off in lieu for employees that work overtime beyond their contractual working hours – this is stipulated within the employment contract for each employer, and is often an initiative driven by work councils.

💡What about working hours for working students?

In Germany, students are entitled to work up to 20 hours per week alongside their studies – and so ‘working students’ are fairly commonplace at German companies.

The ‘20 hour rule’ means that if students work less than 20 hours per week, they are still legally seen as a full-time student and are covered under insurance as a student.

Therefore, working students have a limit of 20 hours per week in work – and if they stick within this limit they do not pay social security contributions from their income. Furthermore, working students only have to pay income tax on their earnings if their salary is above €556 per month or €6,672 per year (as of January 2025).

If students work more than 20 hours per week, they will be subject to social security contributions on their pre-tax income.

Mandatory employee benefits in Germany

On top of the social security contributions (which include benefits like pension contributions and accident insurance), employers in Germany are also mandated to offer certain leave entitlements for workers, as follows.

Paid time off / holiday entitlements in Germany

Under German labour law all full-time employees are entitled to paid annual leave, a minimum of 20 paid days per year for those working a 5 day work week or 24 paid days per year for those working a 6 day work week.

💡 Is it common for German employers to give more than the statutory minimum of annual leave?

Ravio’s compensation benchmarking platform includes insights on the benefits that employees are given as part of their total compensation package, including annual leave.

Our data shows that the vast majority of employers are offering above and beyond the statutory minimum annual leave required in Germany:

- 2% offer the statutory minimum (20 or 24 days)

- 8% offer up to 25 days

- 81% offer 26-30 days

- 2% offer more than 30 days

- 7% offer unlimited holiday days

Public holidays in Germany

In all 16 federal states in Germany the following nine public holidays are observed:

- New years day – 1 January

- Good Friday

- Easter Monday

- Ascension Day

- Whit Monday/Pentecost Monday

- 1 May

- Day of German Unity – 3 October

- December 25 and 26.

Additional public holidays are observed in specific states and cities, including:

- International Womens Day (Berlin and Mecklenburg-Western Pomerania)

- Universal Childrens’ Day (Thuringia).

- Epiphany (Bavaria, Saxony-Anhalt, Baden-Württemberg)

Sick leave in Germany

Under German employment law, all employees that have been with an employer for at least 4 weeks are entitled to 6 weeks of paid sick leave per year.

A doctor’s note is required as proof that the employee cannot work.

Employers cover the cost of continued salary payments, but this is supported through their health insurance provider via umlage 1 contributions (see above).

After 7 weeks or 43 days of sick leave, state health insurance covers continued sick leave payments, taking over from the employer. Employees with health insurance can access up to

78 weeks of sick pay at 70% of their pre-taxed salary (to a maximum of €5,175 per month).

Bereavement leave in Germany

German employment law on working conditions mandates that employees must be legally allowed to take time off for bereavement or compassionate leave, as follows:

- A death in the family – 2 working days leave

- A birth in the family – 1 working day leave

- Severe illness of close relatives – up to 10 working days leave

- Celebrating your own wedding – 1 working day leave.

Wedding leave in Germany

Weddings also sit under ‘compassionate leave’ (see above) and so in Germany employers are entitled to one day of leave to celebrate their own wedding.

Educational leave in Germany

German employment law also mandates that all employees have the legal right to take 5 days per year off work for educational purposes – known as educational leave or bildungsurlaub.

This could be for professional courses specific to your role, or it could be other skills related to continued professional growth e.g. yoga teaching, learning a new language etc.

Parental leave in Germany: Maternity, paternity, adoption

Under German employment law, all parents are entitled to take time off work to care for their children, as parental leave.

This can legally be up to three years off work (negotiable between an individual employer and employee), is applicable both to the birth and non-birth parent, and can also be used for adoptions, foster children, caring for grandchildren, and other scenarios.

The employer is not obligated to pay salary as normal during parental leave. However, you are eligible for parental allowance to make up for the lack of income.

There are three levels of parental allowance in Germany:

- Basic parental allowance. A new parent is entitled to 12 months of basic parental allowance (or 14 months split between two parents, if applicable). The amount granted varies depending on the percentage difference between income before birth and after birth, as well as other factors such as a siblings bonus, a multiple births bonus, and additional months of allowance if a child is born at least six weeks before due date. Those with a low income of less than €1,240 before birth also receive higher allowance. Basic parental allowance can be claimed in conjunction with any maternity pay offered by your employer.

- Parental allowance plus. Available for up to 28 months after birth for new parents who do not want to return to work (or do not want to return full-time). The payments are half as much as the basic parental allowance payments. Parental allowance plus cannot be claimed if you are receiving maternity pay from your employer.

- Partnership bonus. For parents who share work and family commitments as equal partners, an additional 2-4 months of parental allowance can be claimed if you work less than 32 hours per week combined.

As of 1 April 2024, a new income limit applies for parental allowance in Germany due to austerity targets. This means that from April 2024 to April 2025 on parental allowance is only available for parents who earn a combined income of under €200,000, and from April 2025 onwards the income limit is €175,000.

It’s a complex system, but essentially it means that some level of support is available for new parents for up to 36 months after birth – much longer than is typical across Europe.

Section 3: The most common optional employee benefits in Germany

Alongside these requirements on paid time off work – and the social security contributions highlighted earlier in this guide – the following optional employee benefits are common from Germany employers.

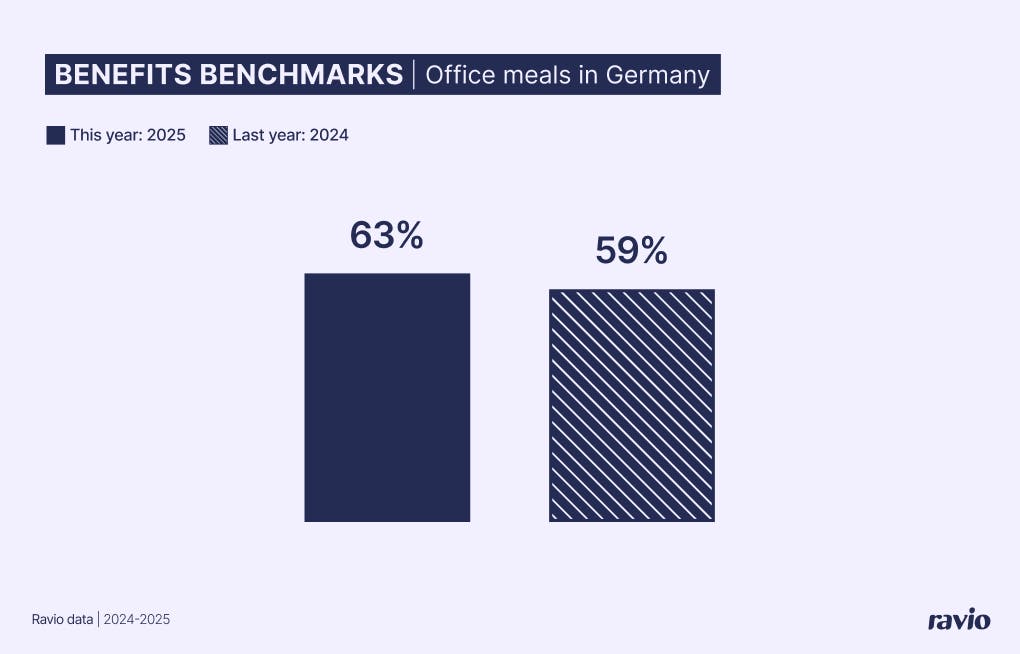

Subsidised office meals in Germany

It’s common for employers in Germany to support employees with covering the costs of meals during work hours. Often, workplaces will have a canteen which is subsidised by the company.

Today it’s also becoming more and more common for companies to provide free lunch at least one day a week – especially in hybrid working companies who want to encourage employees to come into the office more often.

Ravio’s employee benefits benchmarking data shows that in 2025 63% of employers in Germany offer office meals. This is a slight increase compared to 2024, when 59% of employers offered office meals.

Subsidised transport costs in Germany

There is no legal requirement for companies to support employees in Germany with the costs of commuting and business travel.

However, it is very common for companies to choose to offer this as part of their employee benefits package – and companies can ccess tax exemptions for these costs.

Particularly common in Germany is a ‘jobticket’ where the company pays for a monthly or annual travel card for employees, covering their public transport costs for getting to and from their place of work.

It’s also possible for employees to claim a tax deduction on income tax in Germany for work-related expenses, which includes travel costs – employees are able to claim €0.30 back for every kilometer travelled, up to a maximum of €4,500 per year.

Ravio’s employee benefits benchmarking data shows that:

- 43% of employers in Germany provide employees with a jobticket (or other form of support) to subsidise their travel to work

- 15% reimburse employees for their commuting costs

- 21% offer a cycle to work scheme.

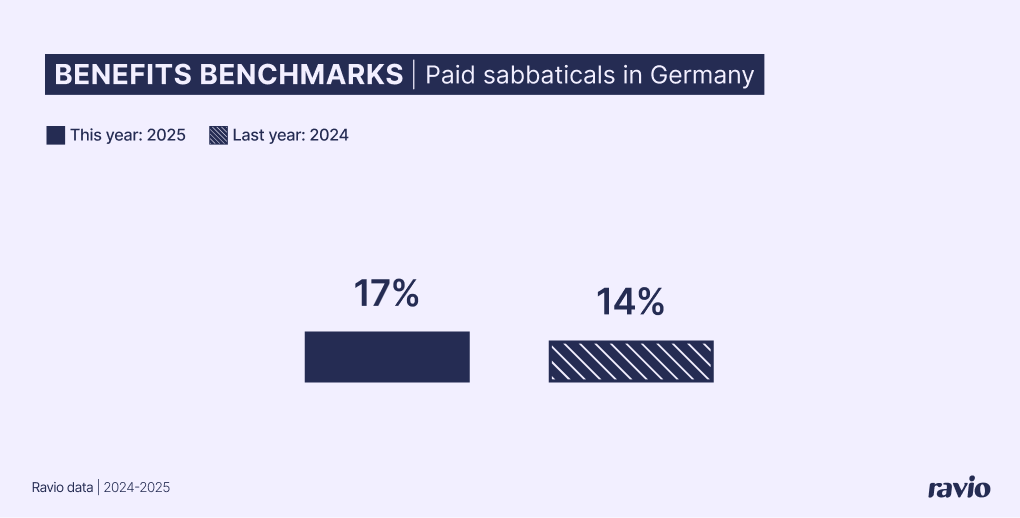

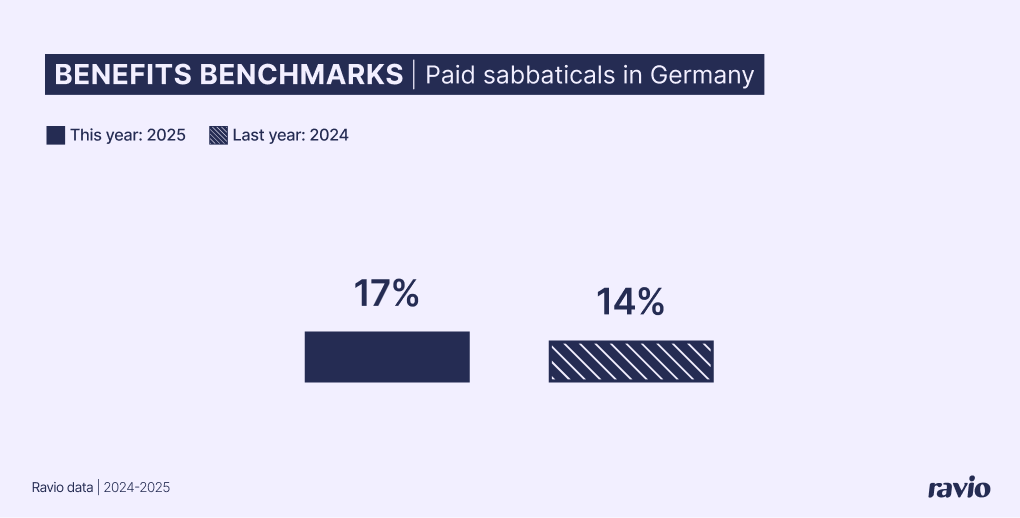

Paid sabbaticals in Germany

Whilst there is no legal right for employees to take a paid sabbatical in Germany, it is a common feature of many workplaces.

Ravio’s employee benefits benchmarking data shows that in 2025 17% of German employers give their employees the opportunity to take a paid sabbatical.

Often sabbaticals are related to tenure, so, for instance, a company may have a rule that employees are able to apply for a sabbatical after being with the company for five years.

Some companies offer to continue paying or part-paying salary during the sabbatical, which is a very attractive benefit for many employees.

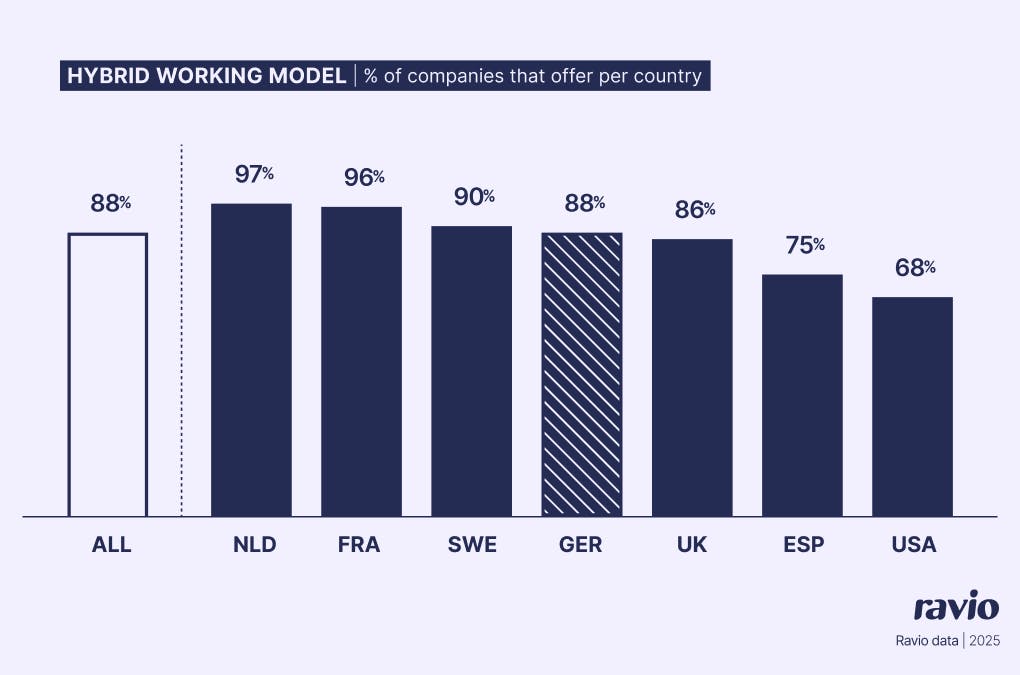

Flexible working arrangements in Germany

Flexibility is also hugely important in today’s world of work.

Ravio’s data shows that 88% of employers in Germany offer a hybrid model of working wherein working time is split between onsite and remote working – and 50% of employers offer a fully remote working model for at least some employees.

This is right in line with the average across the globe – with some countries like the Netherlands (97% of employers) and France (96% of employers) having more uptake of hybrid models, and other locations having lower.

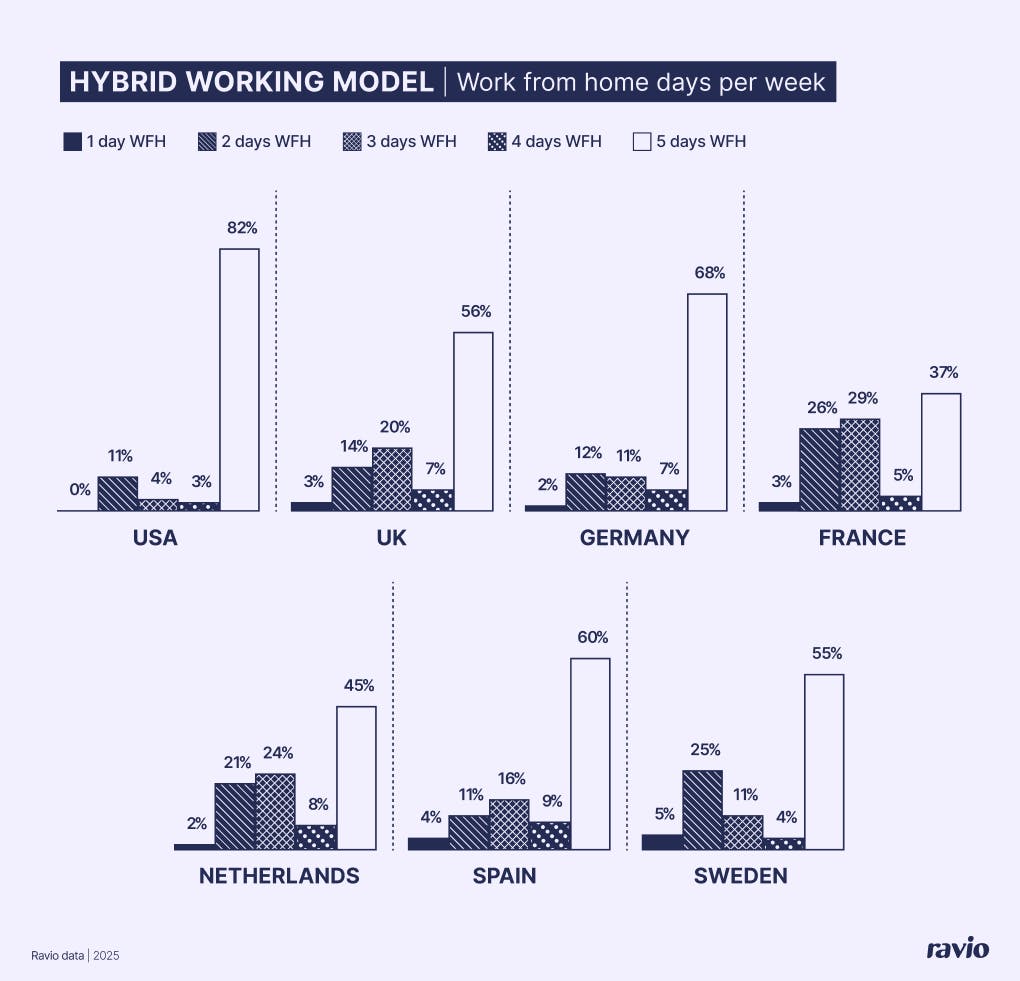

The most common form of hybrid working in Germany is to enable employees full flexibility on whether they work from home or the office, with employees able to work from home 5 days per week (68% of employers).