The complete guide to compensation reviews: fair and stress-free

‘Fraught’. ‘Frenzied’. ‘Suffering’. ‘Undefined’.

These are the kind of responses received when we asked our community the first word that comes to mind when describing a compensation review.

From determining an unbiased approach to salary raises, to aligning the conflicting opinions of a myriad of stakeholders, to communicating compensation adjustments to hopeful employees, compensation review season can be a tough time of year for People Leaders.

In this article we’ll cover best practices on how to ensure a smooth (for you) and fair (for your employees) compensation review. Whether implementing the process for the first time, or a seasoned veteran seeking insight on how peers handle the key complexities, we hope this end-to-end guide will help make the next compensation review a little less painful and a little more streamlined.

Section 1: Getting to grips with compensation reviews – all the key questions answered

- What is a compensation review?

- How do you run a compensation review process?

- How can you prepare for a compensation review?

- How often should you conduct a compensation review?

- How long does a compensation review take?

- Should compensation reviews be tied to performance?

- What tools can make running a compensation review easier?

Section 2: The three most common approaches to adjusting employee compensation

- Performance-based compensation review

- Market-based compensation review

- Combining performance ratings and market position with a merit matrix

It’s impossible to make fair and objective compensation adjustments without a well-defined process which includes clear rationale behind the decisions being made.

Getting that process right can feel daunting.

So, first things first, let’s cover a few of the key questions around the compensation review process. For old-hands at compensation reviews: take this as our permission to skip this section and head straight on to best practices.

What is a compensation review?

A compensation review is a period of time (often spanning 4-6 months) when a formal evaluation of employee compensation packages is completed.

Regular compensation reviews ensure that compensation remains fair and competitive compared to the market, keeping engagement high and avoiding any regrettable attrition. It can also be an opportunity to reward high performance and career progression.

Some companies will only make adjustments to base salary during the compensation review, whereas others may also increase equity compensation via equity refresh grants, and/or variable pay through increasing on target earnings or issuing one-off bonuses.

How do you run a compensation review process?

Compensation reviews can be a complex process with many steps. The review process is also reliant on a well-defined compensation philosophy, level framework, and compensation benchmarking approach, so it can become an all-encompassing process.

This can quickly become overwhelming, especially in startups with small or one-person People Teams. Because of this, we recommend keeping the process as simple as possible the first time round – focus on getting a process in place that works, and then refine this over time to reflect your company’s unique approach.

Here’s an overview of the key elements involved in a compensation review:

- Stakeholder alignment on the approach. Getting buy-in from several senior stakeholders is never simple and there are several involved in compensation reviews, particularly the executive team and line managers. It’s vital to get alignment up front on the approach to adjusting compensation.

- Agree the budget with Finance. Companies have a set budget available for promotions and salary increases each year, which is typically calculated by the Finance Team. It’s then up to the People Team to determine how to allocate that budget.

- Update benchmarks and refresh salary bands. Most companies use the compensation review as an opportunity to ensure compensation packages are in line with the market, sourcing up-to-date benchmarks from a provider like Ravio and refreshing salary bands (as well as equity or variable if relevant) to reflect this. This is also the time to review internal pay equity within those salary bands and incorporate any adjustments needed into the compensation review.

- Conduct a performance review. Compensation and performance reviews are typically run as part of the same process, with compensation adjustments reflecting performance ratings. There may also be promotions to account for in terms of budgeting and salary bands.

- Determine compensation adjustments. Once the budget, benchmarks, and performance ratings are in hand, the People Team uses these factors to plan compensation adjustments. Different teams approach this in different ways, but a common method is to use a merit matrix (see section 2 for more information).

- Agree compensation adjustments. The plan then needs to be reviewed and agreed with senior leaders, finance team, and line managers – which typically involves calibration meetings. This is one of the big challenges of a compensation review process (see section 3) due to the need to align the many stakeholders who often have differing opinions.

- Communicate compensation adjustments to employees. Once adjustments are signed off, employees must be informed about any changes to their compensation package. The People Team will typically make a company-wide announcement and then handover to line managers for 1-2-1 conversations.

- Update documentation and payroll. The process also involves some logistics: ensuring compensation adjustments are reflected in all documentation, HR systems, and payroll systems.

How can you prepare for a compensation review process?

Given the amount of moving parts and stakeholders involved in a compensation review, getting prepared well in advance of kick off is key.

Here’s a few tips to get prepared:

- Remind the team of your compensation philosophy. A company’s compensation philosophy informs their approach to compensation reviews e.g. how employee compensation should compare to the market, how high-performers are recognised and rewarded, etc. It’s therefore important that all stakeholders have this top of mind.

- Agree the criteria for compensation adjustments. The two biggest factors in compensation reviews are market benchmarks and performance ratings, but how these are factored into adjustments varies from company to company depending on the philosophy and strategy behind compensation. Getting alignment on this early on in the process is key to avoiding issues with conflicting opinions and human bias later down the line.

- Review your benchmarking data provider(s). Accurate and up-to-date benchmarking data is key to a smooth and fair compensation review. This has historically been a lengthy and painful part of the process due to reliance on complex and outdated salary survey spreadsheets from traditional consultants like Mercer or Radford. With software tools like Ravio now available, this no longer needs to be the case, so we’d recommend reviewing your benchmarking options if you’re still using those traditional salary survey providers.

- Set and communicate timelines to all involved. Compensation reviews can take a long time, exacerbated due to the amount of back-and-forth involved due to many stakeholders. Ensuring that the People Team has enough time to deliver the process is vital. Being clear about the timeline and the key milestones when input will be needed with stakeholders will help to keep the process on track.

- Communicate transparently with employees. Remember that your employees will also be thinking about how they can prepare for the compensation review. The number one way that you can support them during this time is to communicate transparently and document how the compensation review process will work – including the timeline and the criteria involved in compensation decisions.

How often should you conduct a compensation review?

The typical approach is to conduct a compensation review once per year, and we’d definitely recommend no less than this to ensure compensation remains fair and competitive and attrition is minimised.

However, it has become more common in recent years for companies to conduct a compensation review more than once a year – with some large companies even opting for every quarter, making compensation increases in a ‘little but often’ way. One example of this is Accenture, who publicly switched to a ‘continuous review’ model in 2015.

More regular compensation reviews can give a psychological boost for employees through a regular increase to pay. But, at the same time, they’re a lengthy and involved process, so this can be difficult to keep up with, especially for smaller teams.

How long does a compensation review take?

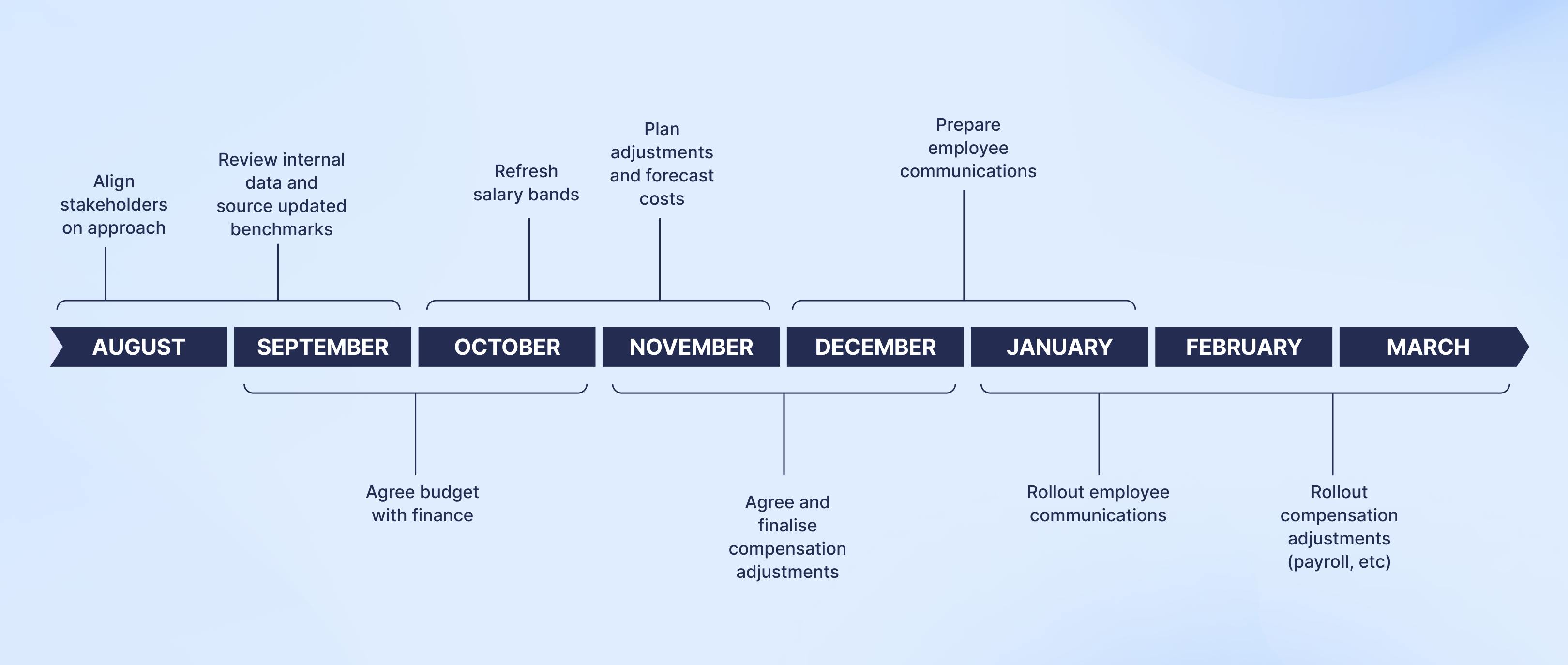

The length of a compensation review varies from company to company, but the most typical timeline is to begin in August or September and roll out adjustments between January and March:

- August to September. Align stakeholders on the planned approach to compensation decisions; source updated compensation benchmarks; review internal data on employees compensation packages and internal pay equity; review performance ratings.

- September to October. Budget for compensation adjustments is agreed with the finance team.

- October to November. Salary bands are refreshed; compensation adjustments are planned and costs forecast.

- November to December: Compensation adjustments are agreed with stakeholders and finalised.

- December to January: Communications are prepared.

- January to March: Rollout takes place.

Should compensation reviews be tied to employee performance?

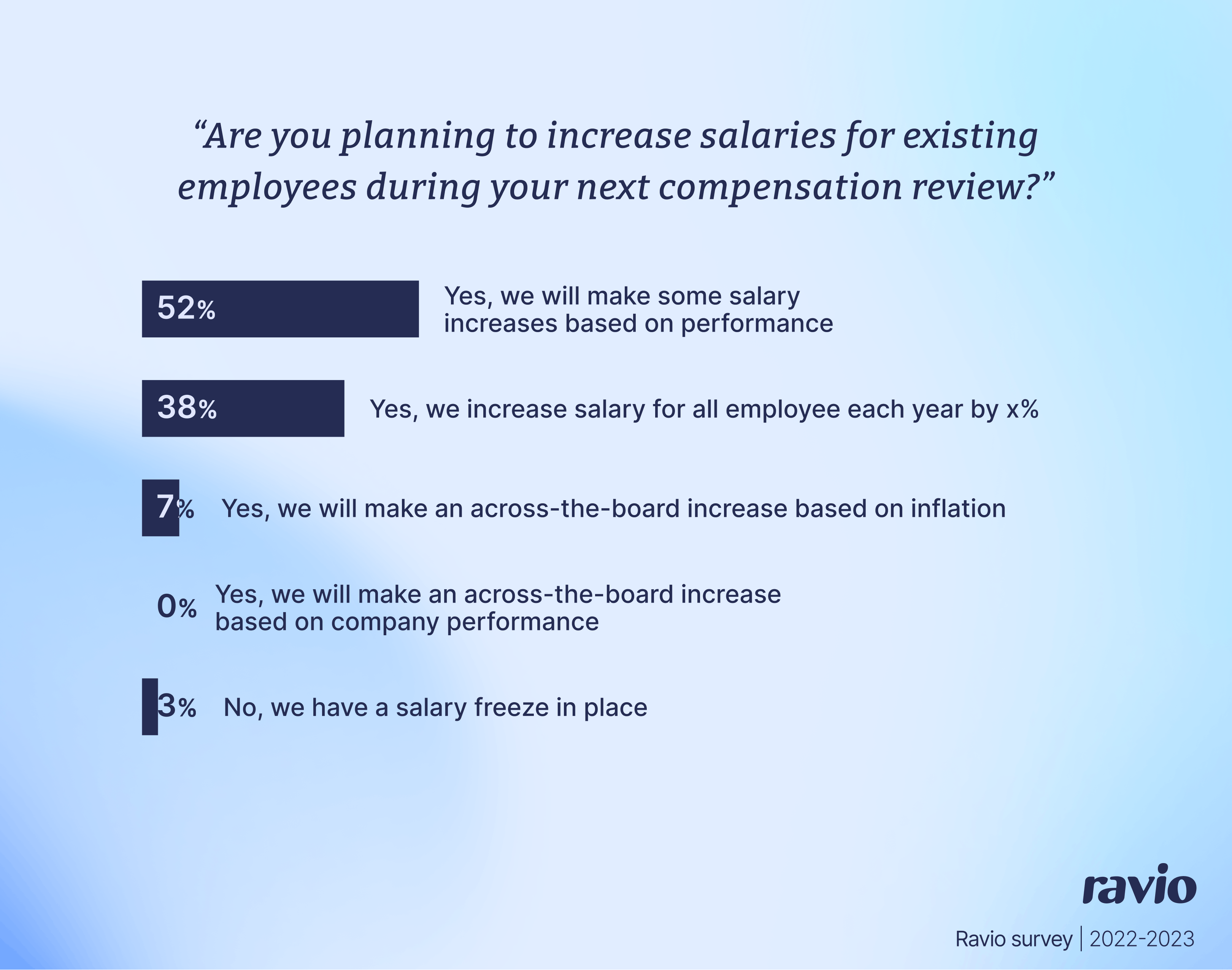

Most companies do tie compensation reviews to employee performance.

Compensation is a vital lever for recognising and rewarding the contributions of employees towards company goals – whether through a merit increase to base salary and/or equity compensation, or a performance bonus system. Plus, performance-based salary increases are a way to ensure career development is linked to pay progression within salary bands, as employees work towards a promotion to the next level.

However, some People Leaders argue that pay-for-performance isn’t always positive.

The arguments against increasing compensation based on performance are that it can encourage an individualistic workplace culture which reinforces hierarchies, raises feelings of unfairness, and discourages cooperative working. Research also suggests performance raises can damage the intrinsic motivation of employees to engage with their work.

An alternative to strictly pay-for-performance models is to adjust compensation to align with changes to market rates, using a data-driven approach to ensure fair and competitive pay for all without being tied to individual performance. Naturally, some companies also opt to combine the two.

What is the average salary increase given at compensation review?

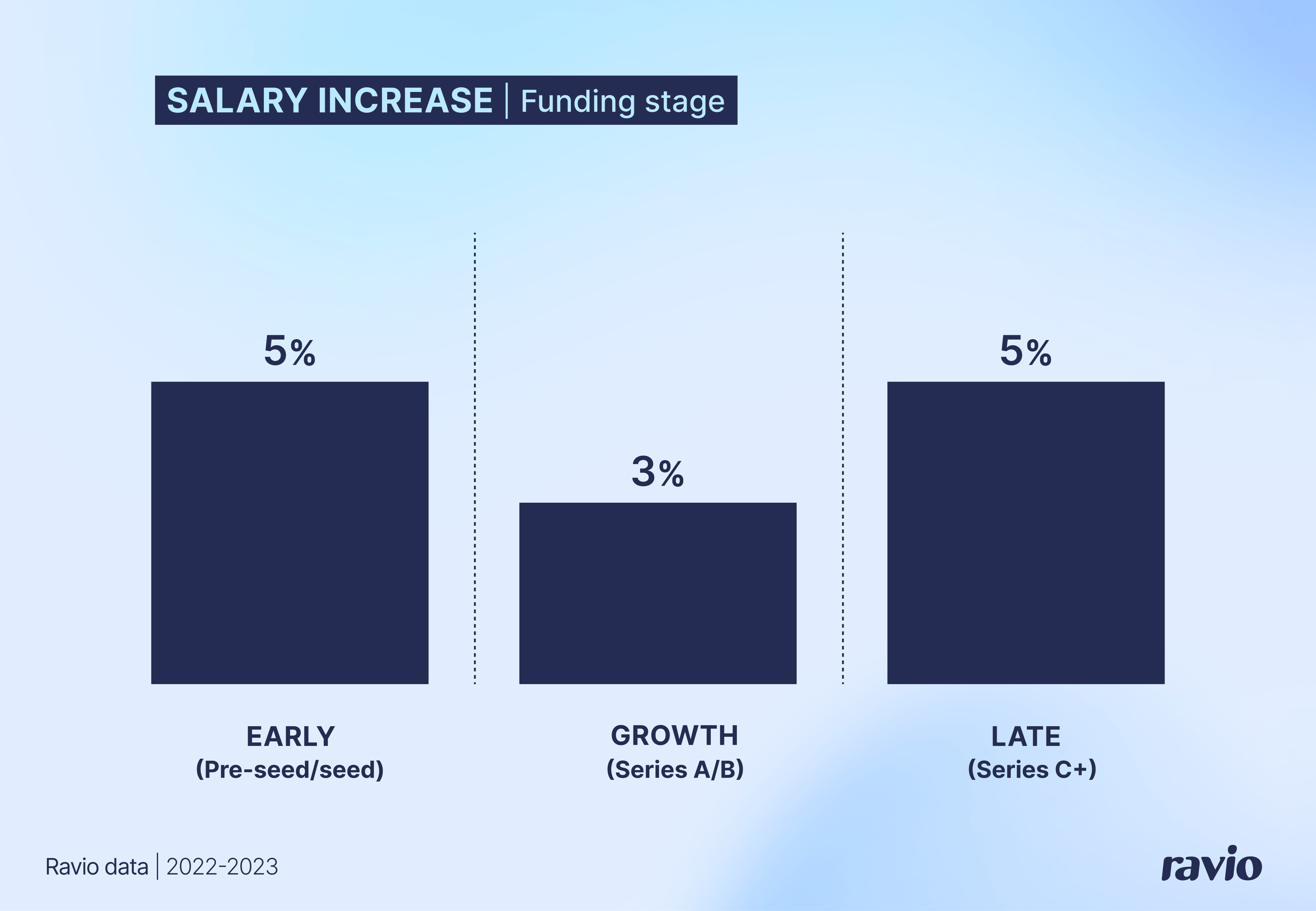

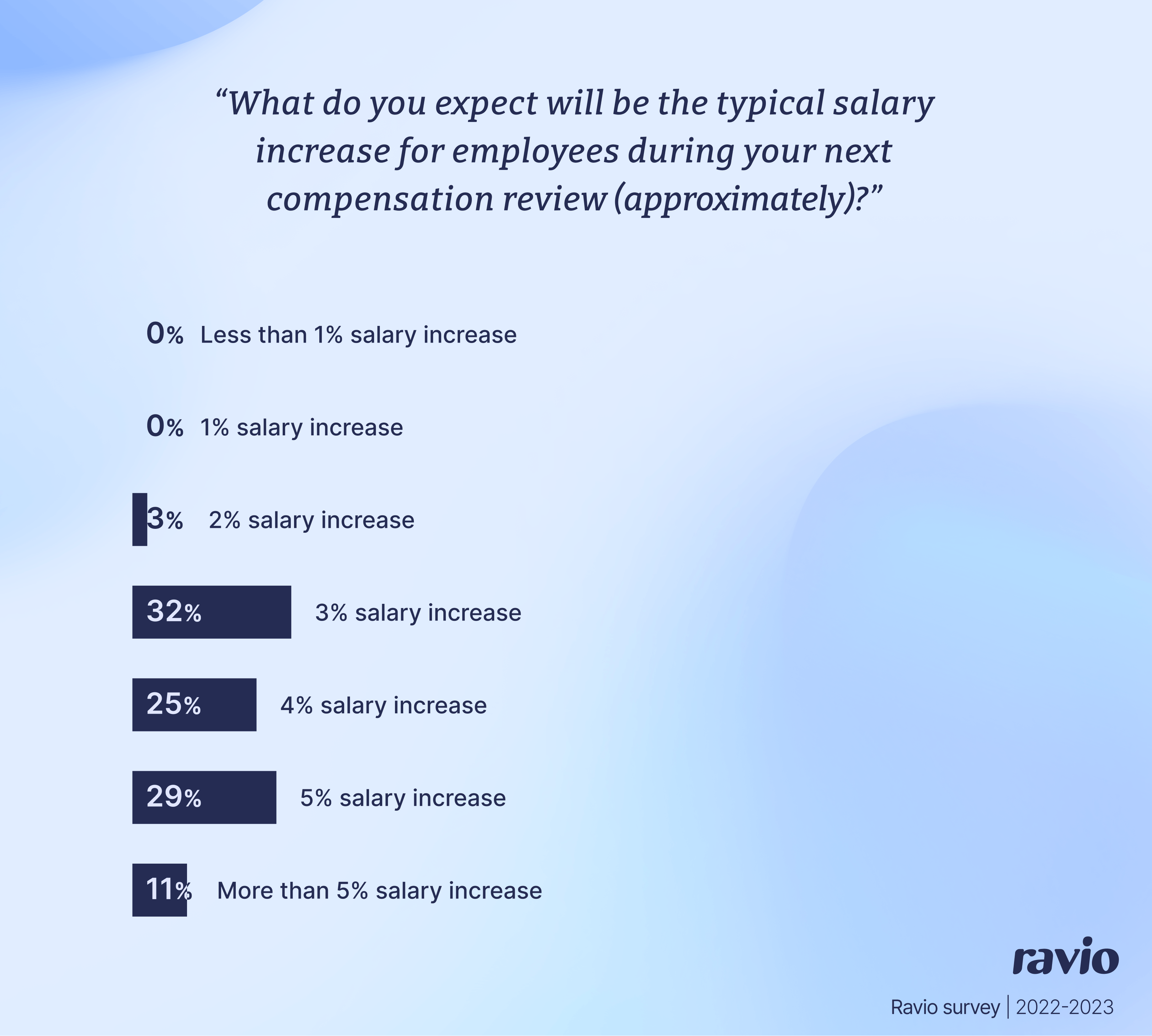

It varies from company to company, but the standard annual salary increase is 3-5%.

According to Ravio’s market trends data, the average salary increase across European tech in 2022-2023 was 4.8%.

And when we asked People Leaders how much they were planning to increase salaries in 2024, the vast majority said they were planning a 3-5% salary increase for non-promotions.

Of course, this is an average across all roles, levels, and locations, with many factors influencing the actual salary increase for each individual employee.

Should compensation reviews include an annual across-the-board inflation raise?

The economy has been shaky (to say the least!) in recent years, which has led to much discussion around whether compensation reviews should include an across-the-board inflationary raise.

Inflation brings with it increased cost of living for employees, and a pay raise in line with inflation ensures that employees are no worse off year on year.

However, inflation also brings with it an increased desire for job security, meaning that churn is lower as employees are less willing to change roles and there is less need to incentivise retention through compensation increases. Plus, there’s also the question of what happens when the economy is strong and in negative inflation – companies can’t roll back the inflationary raise at this point.

Ultimately, the decision of whether to give inflationary raises is personal to your company, and is a principle to be agreed as part of the overarching compensation philosophy and approach.

What compensation review tools can make the process easier?

Traditionally, People Leaders have relied on several tricky spreadsheets to run their compensation reviews.

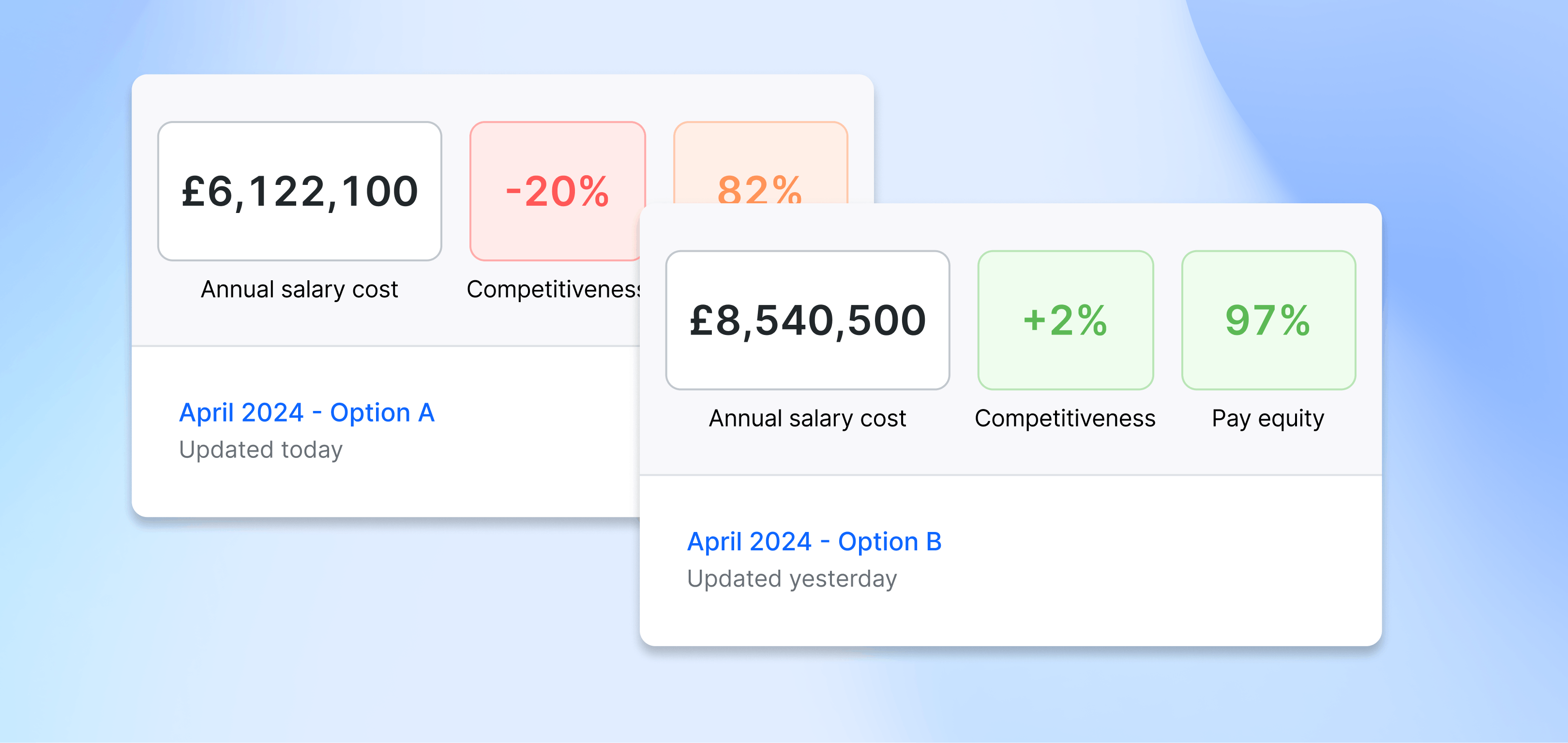

In this scenario benchmarking data is supplied by consultants like Radford or Mercer in large and complex spreadsheets. Salary bands are created using this data (often in another complex spreadsheet), prone to incorrect inputs due to human error. Even more spreadsheets are created to analyse internal pay equity and performance ratings, to enable planning for compensation adjustments against the budget.

Today providers like Ravio make the whole process infinitely less painful, taking the data out of spreadsheets and bringing it together in one tool – benchmarking data, salary bands, pay equity analysis. This makes it easy to plan different scenarios for compensation adjustments and to visualise the impact of those scenarios in terms of market competitiveness, internal pay equity, and budget.

Section 2: The 3 most common approaches to adjusting employee compensation

One of the big debates is whether compensation adjustments should be made based on employee performance or based on market alignment.

That gives three main approaches which all have their pros and cons:

- Performance-based compensation reviews

- Market-based compensation reviews

- A combination of performance and market-based.

Performance-based compensation reviews

Linking employee compensation with performance and contribution towards company goals is a common approach, sometimes referred to as a ‘pay-for-performance’ model.

A performance-based compensation review solely relies on one or a combination of:

- Salary increases for high-performers

- Equity refresh grants for high-performers

- Performance bonuses for high-performers.

🤔 Are bonuses an effective incentive for employee engagement?

Whether bonuses should be part of a compensation review is another hotly debated topic amongst People Leaders.

Bonuses based on individual performance or company results have been a standard feature of large corporate workplaces (especially banking) for a long time, and often make up a significant chunk of take home pay for employees at a senior level.

The traditional view is that they’re great for boosting employee motivation by giving employees an extra financial reward. They also protect companies in the case of economic upheaval and black swan events because they do not add to ongoing payroll costs.

Plus, giving performance bonuses instead of adjusting base salaries with a pay raise can also support internal pay equity. If a handful of employees regularly receive performance raises to their base salary, they will end up at the top of their salary band (or even as an outlier) and be paid much more highly than colleagues who perform work of similar value. This wreaks havoc with understanding internal pay equity, as well as making it very difficult for the People Team to understand performance vs market alignment. From this perspective, it’s much better to keep performance as a separate incentive to base salary.

However, in recent times many have questioned the psychological validity of the argument that bonuses are great for employee motivation. Research has particularly highlighted that money is often not the motivator we think it is, and that bonuses create a culture of short-term high performance for reward which can actually damage overall performance and encourage short-cut thinking.

As with all approaches, there are pros and cons.

The key advantages of a performance-based compensation approach are:

- Increased employee engagement. It can be an effective way to boost employee motivation and morale to meet company goals or revenue targets.

- Retention of high-performing employees. Some team members typically have a disproportionately large impact on business success and retaining these high-performers is, therefore, a business priority – recognising and rewarding their performance can be an effective incentive to stay loyal to the company.

- Alignment between business goals and employee work. An approach that clearly outlines the top priority goals of the business and rewards employees who contribute towards those goals creates alignment between the strategic direction of the business and the day-to-day work of the team – encouraging an overall high-performance culture.

And the disadvantages of a performance-based compensation approach are:

- Encouraging an individualistic culture. When individuals are rewarded for their performance and contribution, it can lead to a culture where individual wins are favoured over teamwork and collaboration.

- Encouraging short-term thinking. With a performance review typically occurring once a year, rewarding performance can also incentivise employees to explore low-quality shortcuts that could help them reach performance indicators to achieve their bonus or pay raise, but could have negative consequences for the business later down the line.

- Some level of subjectivity is inevitable and can cause pay inequity. There are many ways to review performance but all are, to an extent, reliant on the feedback and perspectives of colleagues, managers, and senior leaders. Training the team on unconscious bias and conducting calibration sessions can help to mitigate subjectivity, but it’s very difficult to remove entirely. Issues with internal pay equity and gender pay gaps can result from this bias.

- Managers have to handle difficult conversations. Conversations about performance and pay can feel very personal, and the qualitative nature of performance reviews makes it especially challenging to explain and rationalise decisions to employees.

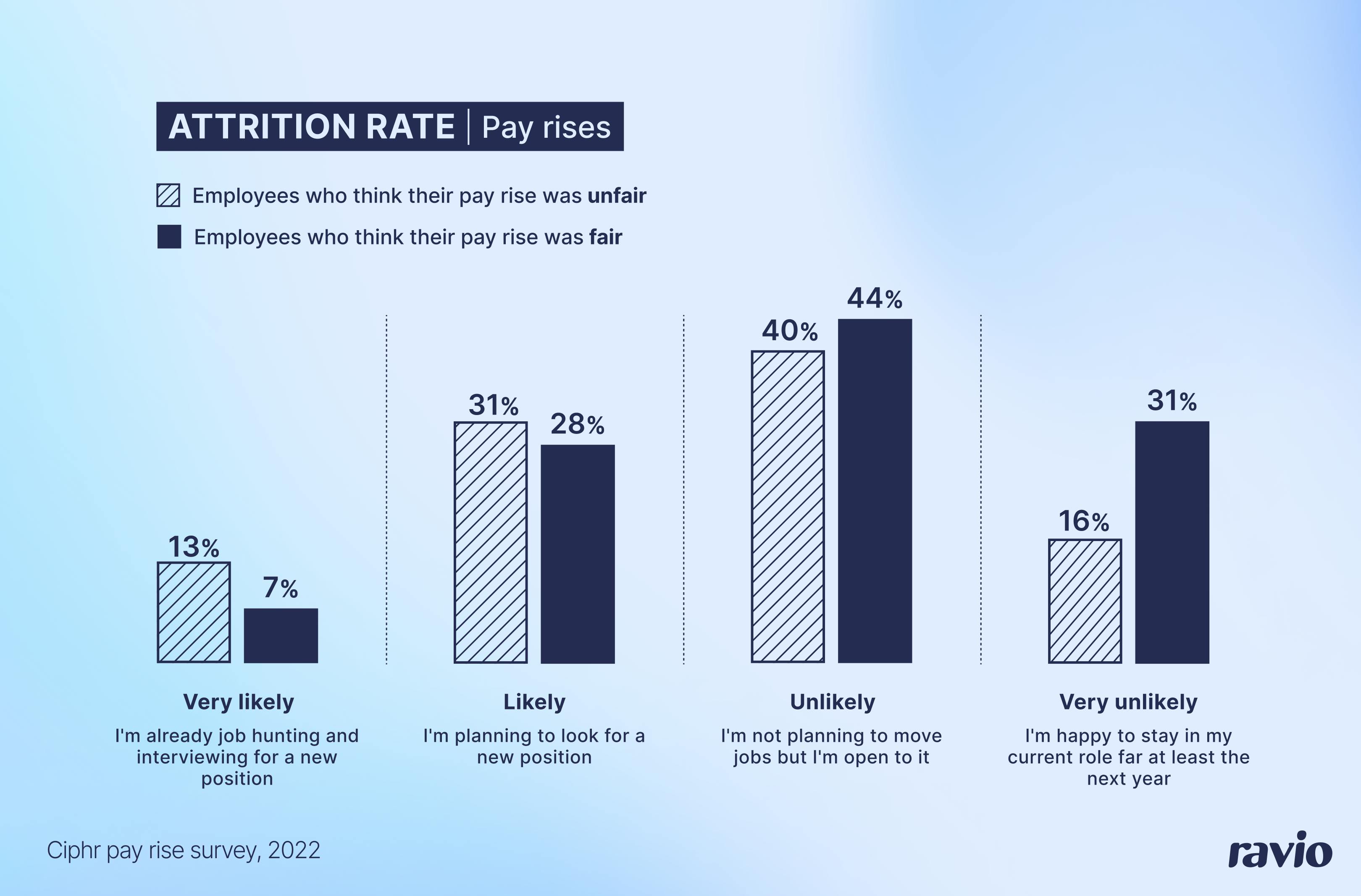

- Perceptions of unfairness can increase attrition. All employees will be hoping that they have performed well and are getting a salary increase, and there is inevitable frustration and feelings of unfairness if this doesn’t arise, which can heighten attrition risk. In fact, when Ciphr surveyed employees about their last pay rise they found that 70% of employees think their last review was unfair and not reflective of their job performance – and 44% of those are likely or very likely to move roles in the next 12 months, compared to 25% of those who see their last pay rise as fair.

Market-based compensation reviews

A market-based compensation review makes compensation adjustments to reflect changes in market benchmarks to ensure that compensation remains fair and competitive against the market. Some companies may include inflationary raises in this to align with economic factors in the market too.

One commonly cited example of a market-based approach is Netflix, who have de-coupled performance and compensation reviews.

Compensation at Netflix is based on a ‘personal top of market’, a market-leading approach wherein employees are always paid higher than the market median salary for their role and level. The market is constantly monitored and if changes occur then salaries are adjusted, rather than waiting for a set compensation review period. Similarly, performance is also monitored via a continuous feedback approach rather than having a set performance review period. The feedback supports career development towards promotion (and a pay increase to reflect their new level), but has no impact on the compensation for their current role.

However, it is worth noting that this has cultural implications too. It’s well-known that Netflix also has a no-nonsense quick firing culture – everyone is paid at the top of the market, but if performance drops then employees are quickly at risk of losing their jobs. So, whilst performance and compensation are separated in terms of adjustments, they’re still connected in the sense that Netflix is able to pay so competitively because they demand top performance in return.

The key advantages of a market-based compensation approach compared to a performance-based approach are:

- Data-driven decisions for pay equity. Whereas performance reviews are always somewhat qualitative and subjective, a market-based approach is quantitative and data-driven. This can help to avoid any unconscious bias and maintain internal pay equity.

- Clear rationale for employee conversations. The rationale behind a market-based approach driven by data is typically easier for employees to understand because it follows clear logic and eliminates the personal element which can creep into conversations focused on pay-for-performance.

How do you know where to start with improving internal pay equity?

Identifying and addressing the root causes of pay equity issues within your team isn’t easy. But the right data and insights make it easier.

So for our 2024 pay equity report, we analysed over 1,000 companies and 300,000 data points to bring to you the most up-to-date view on the main areas that drive pay equity today, answering questions like:

- How does our gender pay gap compare to other companies like ours?

- Do gender pay gaps typically arise at hiring or promotion?

- How does representation impact the gender pay gap?

- How does perception differ between genders on equal opportunities and progression?

- What are other People Leaders prioritising to improve pay equity?

A combination of performance and market-based compensation reviews

Given the pros and cons of aligning compensation reviews with performance and market shifts, many companies decide to include both as important factors.

This could be done by using different elements of total compensation e.g. salary increases made to align with up-to-date salary benchmarks and an equity refresh grant or performance bonus granted to high-performers.

Alternatively, the overall model for calculating compensation adjustments could combine performance ratings with market data – with a common method being to use a merit matrix.

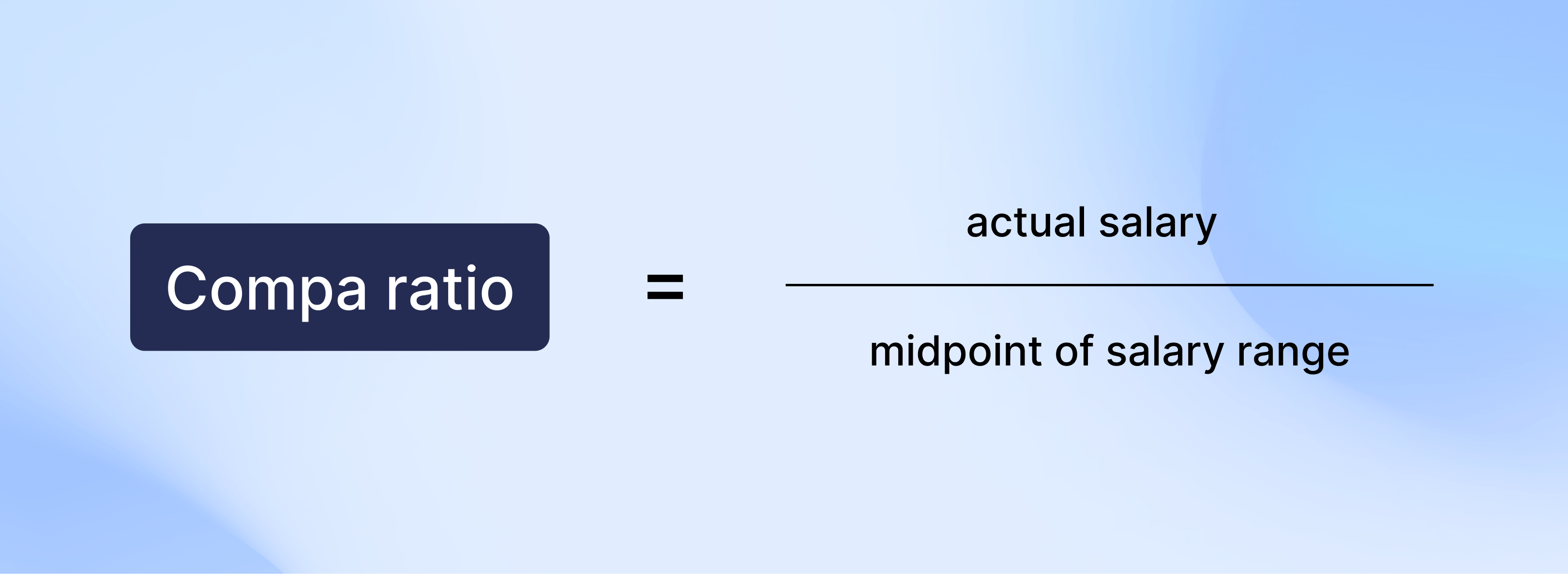

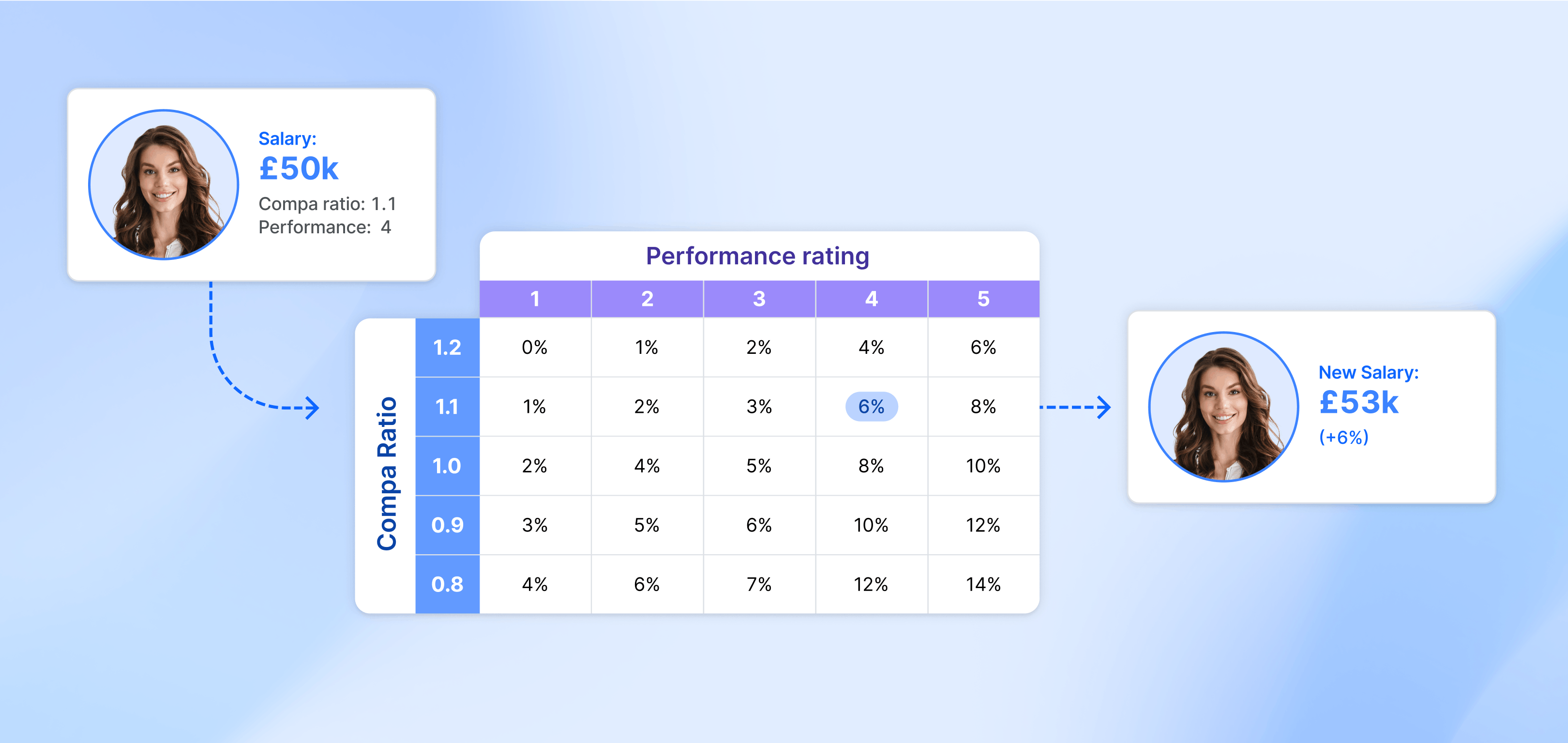

A merit matrix allocates compensation increases based on an employee’s performance and how competitive their salary is compared to the current market, through a table with two inputs:

- Compa ratio. A comparison of an employee’s salary to the midpoint of their salary band. The compa ratio has two purposes. Firstly, it gives a great sense of how fair salaries are across the board with just a quick scan, enabling an apple-to-apple comparison of employee compensation both within the same salary band and across different bands. Secondly, once the salary bands have been refreshed using up-to-date salary benchmarking data it also enables adjustments to bring employee salary back in-line with the market – because typically the midpoint of the salary band should represent the market median salary (depending on target percentiles).

- Performance rating. A quantification of employee performance – we won’t delve into the different approaches to performance rating scales here, but for the purposes of the merit matrix whatever point system you use will need to be given as a percentage.

A merit matrix table is then used to determine the percentage salary increase an employee should receive based on these two factors.

As an example, an employee with a base salary of £50,000 has a compa ratio of 1.1 (or 110%) and a performance rating of 4 out of 5 (or 80%) would receive a 6% salary increase – bumping them up to a £53,000 base. The same approach can also be taken for equity compensation or variable pay, depending on the company’s compensation philosophy.

The merit matrix approach enables a data-driven and quantitative approach to including performance ratings within compensation reviews. This offers a best of both worlds scenario: high-performers can be rewarded whilst ensuring a fair and evidence-based approach which maintains internal pay equity and competitiveness against the market.

Conclusion

Conducting a fair and stress-free compensation review is no easy feat. However, by establishing a clear compensation philosophy, aligning stakeholders early, and leveraging the right tools like Ravio, People Leaders can navigate the complexities of compensation reviews with confidence.

Whether you're opting for a performance-based, market-based, or combined approach, the key is to maintain transparency, fairness, and consistency throughout the process. With these best practices in place, you can ensure that your compensation reviews not only meet your company’s goals but also support employee satisfaction and retention.