German employment and labour laws: a comprehensive guide

Germany has a thriving tech sector which has grown substantially in the past decade.

It’s a hub for both mature, established companies and startups alike.

In terms of the startup scene, Germany has now produced over 30 tech unicorns – from Celonis to Personio to N26, and many more. Germany is now home to over 20,000 startups which employ over 620,000 people (German Startup Monitor). And, until 2023 Germany had the tech startup ecosystem with the most VC funding in Europe.

Germany’s tech industry is supported by the Government too, through direct investment in high-potential spaces like the semiconductor industry as well as through schemes like High-Tech Gründerfonds (HTGF) which provides funding and support to innovative, early-stage startups.

Through this, Germany has also become home to some of Europe’s top tech talent – so it’s a great location to scout for talent.

But, if you are hiring talent in Germany, what do you need to know about German employment and labour laws?

That’s exactly what this guide covers.

Table of contents

Section 1: Employment and labour laws in Germany

- What is the minimum wage in Germany?

- What are standard working hours in Germany?

- What social security contributions are made in Germany? (employer and employee)

- What is income tax in Germany?

- What paid and unpaid time off is mandatory for employees in Germany? (annual leave, sick leave, maternity leave, special leave, educational leave)

Section 2: Optional employee benefits in Germany

- What optional employee benefits are common in German?

Section 3: Compensation trends in Germany

- What is the average salary in Germany?

- Is it typical for companies in Germany to offer equity compensation?

Section 4: Pay transparency in Germany

- What pay transparency legislation exists in Germany?

- When will Germany implement the EU Pay Transparency?

- What is Germany’s gender pay gap?

[Article last updated: August 2024]

Section 1: Employment and labour laws in Germany

What is the minimum wage in Germany?

The minimum wage in Germany is €12.41 per hour, as of 1 January 2024. It will increase to €12.82 in 2025 – as per the Fourth Minimum Wage Adjustment Ordinance in November 2023.

In Germany the minimum wage was made uniform in 2015, meaning it does not vary across ages (as in the UK) or any other factor.

What are standard working hours in Germany?

The typical working week in Germany is between 35-40 hours.

Exact working hours are stipulated on a company-by-company basis via an employment contract between employer and employee. Expectations can also vary depending on the sector – collective agreements are common in Germany, which can lead to decisions on things like wages and working hours being negotiated for an entire sector via trade unions.

Under German employment law, the maximum working day is 8 hours, meaning the absolute maximum is a 48 hour working week, which has been the case since the initial introduction of the Working Time Act (Arbeitszeitgesetz) in 1994.

In 2023 new amendments were proposed to the Working Time Act. The major change is the introduction of an employer obligation to record working time: the beginning, end, and duration of each working day. The aim of this is to enable the enforcement of the EU Working Time Directive and ensure that employees have enough rest time and are compensated for any overtime worked.

There is no specific employment law regarding paid overtime in Germany. But it is common for German employers to offer either overtime pay or time off in lieu for employees that work overtime beyond their contractual working hours – this is stipulated within the employment contract for each employer, and is often an initiative driven by work councils.

💡 What you need to know about German works councils

A works council (Betriebsrat) is a group of employees elected to represent the rights of the company’s whole workforce in conversations with leaders and board members.

They exist to ensure that employers observe employment law and collective agreements, and to raise the views of employees regarding workplace improvements. Works councils typically have input on decisions including:

- Company working hours, break times, overtime policy

- Holiday days

- Compensation structures – including pay discrimination

- Compliance with employee data protection rulings

In Germany, the Works Constitution Act makes it a requirement for all companies with five or more employees to allow the creation of a works council.

Employees are elected onto the council for a four year term. The number of employees on the council increases with the company’s headcount (see section 9 of the Act) e.g. companies with 51-100 employees will have a works council made up of five employees, whereas a company with 1001-1500 employees will have 15 works council members.

What social security contributions are made in Germany? (employer and employee)

In Germany the following mandatory social security contributions are required by law for all employers and employees, deducted from the employee’s (pre-tax) income and paid in part by employer and part by employee.

Pension insurance (Rentenversicherung)

Pension insurance is a requirement for Germany’s state pension scheme.

In Germany all employees who have been insured for the minimum insurance period when they reach retirement age receive old-age pension payments from the government.

Total contribution: 18.6% of income

Paid by employer: 9.3%

Paid by employee: 9.3%

Income ceiling: €84,600 (€81,000 in the new federal states).

Unemployment insurance (Arbeitslosenversicherung)

Unemployment insurance is requirement to receive unemployment benefits in Germany.

Any employee that has been insured for the minimum insurance period is eligible to receive benefits payments if they lose their job.

Total contribution: 2.4% of income

Paid by employer: 1.2%

Paid by employee: 1.2%

Income ceiling: €84,600 (€81,000 in the new federal states)

Health insurance (Krankenversicherung)

Health insurance contributions give employees access to the state healthcare system in Germany. Anyone receiving unemployment benefits does not need to be insured to access healthcare.

Employees can also choose to pay for private health insurance instead of receiving the statutory insurance if they earn an annual salary of £69,300 or above (as of 2024).

Total contribution: 14.6% of income

Paid by employer: 7.3%

Paid by employee: 7.3%

Income ceiling: €84,600 (€81,000 in the new federal states)

Long-term care insurance (Pflegeversicherung)

In Germany long-term care insurance covers important additional healthcare services for the elderly, such as nursing home payments or home carers.

Total contribution: 3.05% of income, or 3.4% for childless individuals over the age of 23

Paid by employer: 1.525% (or 1.875%)

Paid by employee: 1.525% (or 1.875%)

Income ceiling: €58,050

Accident insurance (Unfallversicherung)

State accident insurance in Germany provides cover for employees who are impacted by an accident or occupational disease whilst at work.

The contribution required varies depending on the workplace and the amount of risk involved for employees, with the average contribution being around 1.14% by the employer.

The employee does not have to contribute to accident insurance.

Continued payment of income insurance

Employers in Germany must also may two levies which are contributions to enable employees to continue to receive pay when they are unable to work due to sick leave or maternity leave.

- Umlage 1 (U1) sick leave pay (Krankheitsfall). The employer pays monthly contributions to their health insurance provider, who then supports with covering salary payments during employee sick leave. The contribution varies depending on the health insurance provider, but is typically between 1.4-5.1% of the employee’s salary.

- Umlage 2 (U2) maternity leave pay (Mutterschaft). The employer pays monthly contributions to their health insurance provider, who then supports with covering salary payments during employee sick leave. The contribution varies depending on the company’s headcount and the % of women on the team.

- Umlage 3 (U3) insolvency benefit (Insolvenzgeldumlage). Employers contribute 0.06% of an employee’s salary (reduced from 0.09% in 2022) to cover employee salary payouts if the company goes bankrupt.

💡 Do these social security contributions apply for working students in Germany?

In Germany, students are entitled to work up to 20 hours per week alongside their studies – and this is fairly commonplace at German companies.

The ‘20 hour rule’ means that if students work less than 20 hours per week, they are still legally seen as a full-time student and are covered under insurance as a student.

Therefore, working students do not pay social security contributions from their income. If students work more than 20 hours per week, they will be subject to social security contributions on their pre-tax income.

Furthermore, working students only have to pay income tax on their earnings if their salary is above €522.50 per month (as of January 2024).

What is income tax in Germany?

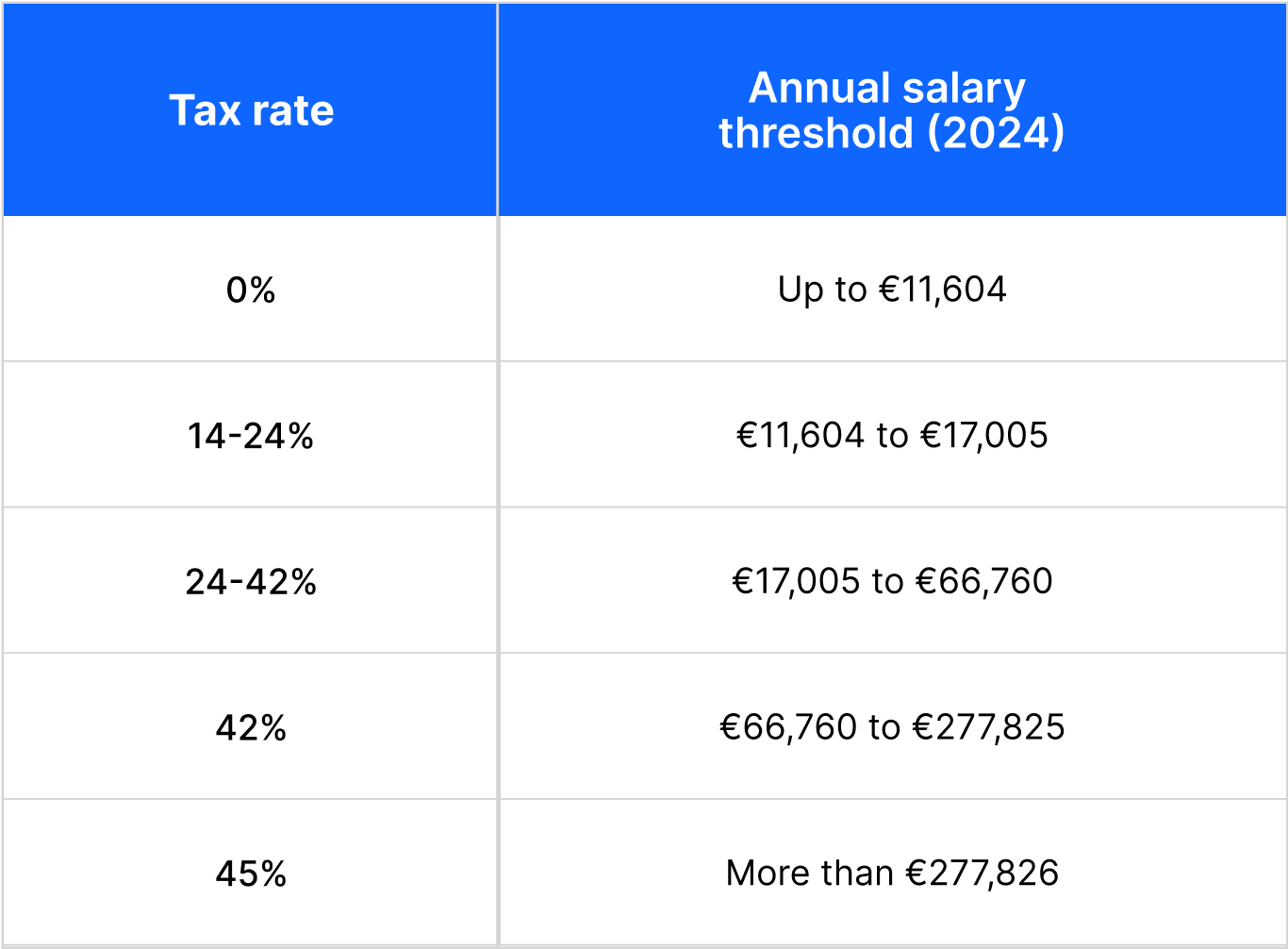

German employees pay income tax on their earnings, with the tax rates from 0-45% as follows (as of 2024):

These income tax rates in Germany are progressive – meaning that the tax rate is higher for higher earners, with a difference percentage of tax paid on each portion of salary based on the brackets (e.g. with a salary of €15,000 you would pay 0% tax up to €11,604 and 14-24% tax on the remainder). If you’re unsure, the Federal Ministry of Finance has a handy income tax calculator.

In addition to normal income tax rates, many employees in Germany pay an additional Solidarity Tax Contribution (Solidaritätszuschlag – commonly shortened to ‘Soli’). The standard rate is 5.5% of income, but since 2021 individuals earning less than €16,959 and couples earning less than €33,912 are exempt. For income above this, soli is charged in brackets depending on the salary, up to a maximum contribution of 5.5% on an income of €96,820+ for individuals and €193,641+ for couples.

The soli was introduced to finance the costs of German unification and to level out the income differences between former-western and former-eastern states.

What paid and unpaid time off is mandatory for employees in Germany?

Annual leave entitlements in Germany

Under German employment law all full-time employees are entitled to paid annual leave, a minimum of 20 paid days per year for those working a 5 day work week or 24 paid days per year for those working a 6 day work week.

📊 Is it common for German employers to give more than the statutory minimum of annual leave?

Ravio’s compensation benchmarking platform includes insights on the benefits that employees are given as part of their total compensation package, including annual leave.

Our data shows that the vast majority of employers are offering above and beyond the statutory minimum annual leave required in Germany:

- 2% offer the statutory minimum (20 or 24 days)

- 12% offer up to 25 days

- 76% offer 26-30 days

- 2% offer more than 30 days

- 8% offer unlimited holiday days

Public holidays in Germany

In all 16 federal states in Germany the following nine public holidays are observed:

- New years day – 1 January

- Good Friday

- Easter Monday

- Ascension Day

- Whit Monday/Pentecost Monday

- 1 May

- Day of German Unity – 3 October

- December 25 and 26.

Additional public holidays are observed in specific states and cities, including:

- International Womens Day (Berlin and Mecklenburg-Western Pomerania)

- Universal Childrens’ Day (Thuringia).

- Epiphany (Bavaria, Saxony-Anhalt, Baden-Württemberg)

Sick leave entitlements in Germany

Under German employment law, all employees that have been with an employer for at least 4 weeks are entitled to 6 weeks of paid sick leave per year.

A doctor’s note is required as proof that the employee cannot work.

Employers cover the cost of continued salary payments, but this is supported through their health insurance provider via umlage 1 contributions (see above).

After 7 weeks or 43 days of sick leave, state health insurance covers continued sick leave payments, taking over from the employer. Employees with health insurance can access up to 78 weeks of sick pay at 70% of their pre-taxed salary (to a maximum of €5,175 per month).

Maternity leave and parental allowance entitlements in Germany

Under German employment law, all parents are entitled to take time off work to care for their children, as parental leave. This can legally be up to three years off work (negotiable between an individual employer and employee), is applicable both to the birth and non-birth parent, and can also be used for adoptions, foster children, caring for grandchildren, and other scenarios.

The employer is not obligated to pay salary as normal during parental leave. However, you are eligible for parental allowance to make up for the lack of income.

There are three levels of parental allowance in Germany:

- Basic parental allowance. A new parent is entitled to 12 months of basic parental allowance (or 14 months split between two parents, if applicable). The amount granted varies depending on the percentage difference between income before birth and after birth, as well as other factors such as a siblings bonus, a multiple births bonus, and additional months of allowance if a child is born at least six weeks before due date. Those with a low income of less than €1,240 before birth also receive higher allowance. Basic parental allowance can be claimed in conjunction with any maternity pay offered by your employer.

- Parental allowance plus. Available for up to 28 months after birth for new parents who do not want to return to work (or do not want to return full-time). The payments are half as much as the basic parental allowance payments. Parental allowance plus cannot be claimed if you are receiving maternity pay from your employer.

- Partnership bonus. For parents who share work and family commitments as equal partners, an additional 2-4 months of parental allowance can be claimed if you work less than 32 hours per week combined.

It’s a complex system, but essentially it means that some level of support is available for new parents for up to 36 months after birth – much longer than is typical across Europe.

Special leave in Germany

German employment law on working conditions mandates that employees must be legally allowed to take time off for bereavement or compassionate leave, as follows:

- A death in the family – 2 working days leave

- A birth in the family – 1 working day leave

- Severe illness of close relatives – up to 10 working days leave

- Celebrating your own wedding – 1 working day leave.

Educational leave in Germany

German employment law also mandates that all employees have the legal right to take 5 days per year off work for educational purposes – known as educational leave or bildungsurlaub.

This could be for professional courses specific to your role, or it could be other skills related to continued professional growth e.g. yoga teaching, learning a new language etc.

Section 2: Optional employee benefits in Germany

Alongside these requirements on paid time off work – and the social security contributions highlighted earlier in this guide – the following optional employee benefits are common from Germany employers:

13th month salary

A 13th month salary is an additional month’s salary given to employees as a kind of bonus on top of base salary is commonplace in Germany at the end of the calendar year (though less so in the tech industry) – and is known as ‘Christmas money’.

Subsidised meals during work

It’s common for employers in Germany to support employees with covering the costs of meals during work hours. Often, workplaces will have a canteen which is subsidised by the company.

Today it’s also becoming more and more common for companies to provide free lunch at least one day a week – especially in hybrid working companies who want to encourage employees to come into the office more often.

📊 How many companies in Germany offer subsidised office meals as an employee benefit?

Ravio’s data shows that 59% of employers in Germany offer office meals in some way – very similar to in France, where 57% of employers offer office meals.

For some companies, meals are provided on a daily basis at the workplace, with 17% of companies providing breakfast every day and 15% providing lunch everyday.

However, it’s more common to have a less formal approach, with 46% of companies occasionally providing meals or snacks for employees.

Subsidised transport costs to and from work

There is no legal requirement for companies to support employees in Germany with the costs of commuting and business travel.

However, it is very common for companies to choose to offer this as part of their employee benefits package – and companies can ccess tax exemptions for these costs.

Particularly common in Germany is a ‘jobticket’ where the company pays for a monthly or annual travel card for employees, covering their public transport costs for getting to and from their place of work.

It’s also possible for employees to claim a tax deduction on income tax in Germany for work-related expenses, which includes travel costs – employees are able to claim €0.30 back for every kilometer travelled, up to a maximum of €4,500 per year.

📊 How many companies in Germany offer support with transport costs as an employee benefit?

Ravio’s data shows that:

- 35% of employers in Germany provide employees with a jobticket (or other form of support) to subsidise their travel to work

- 12% reimburse employees for their commuting costs

- 21% offer a cycle to work scheme.

Sabbaticals in Germany

Whilst there is no legal right for employees to take a paid sabbatical in Germany, it is a very common feature of many workplaces.

Often sabbaticals are related to tenure, so, for instance, a company may have a rule that employees are able to apply for a sabbatical after being with the company for five years.

Some companies offer to continue paying or part-paying salary during the sabbatical, which is a very attractive benefit for many employees.

📊 How many companies in Germany offer paid sabbaticals as an employee benefit?

Ravio’s data shows that 14% of German employers give their employees the opportunity to take a paid sabbatical.

Flexible working arrangements in Germany

Flexibility is also hugely important in today’s world of work.

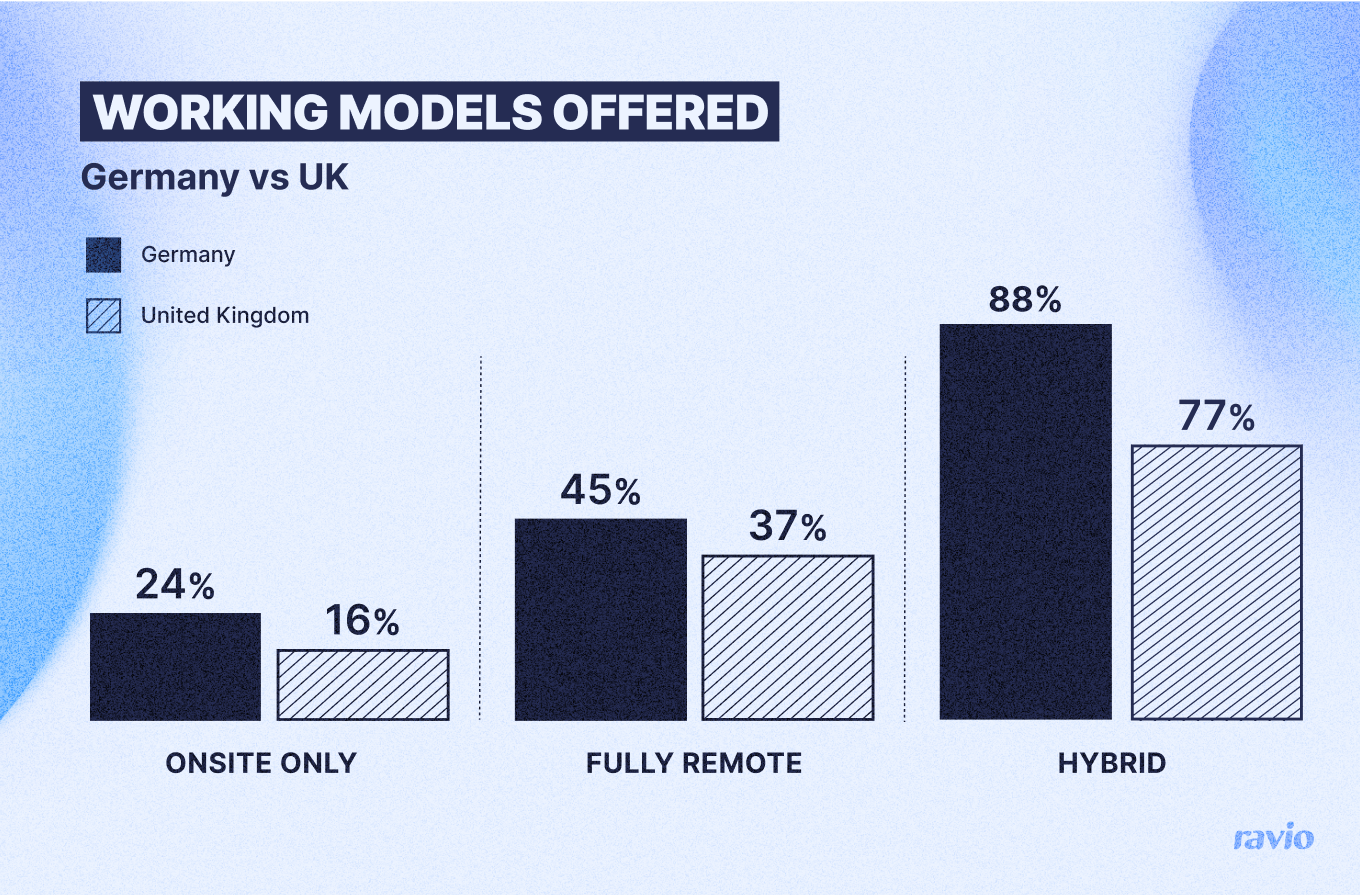

Ravio’s data shows that 88% of employers in Germany offer a hybrid model of working wherein working time is split between onsite and remote working.

This is higher than in the UK where only 77% of UK employers offer hybrid working, and slightly lower than in France where 90% of teams are now hybrid.

🤔 What benefits are most valued by job seekers in Germany?

We spoke to Daria Logvinskaia, founder of HRFull, a community for People, Talent, and Reward Leaders based in Germany, to find out what job candidates and employees in Germany are currently seeking from an employee benefits package.

Daria highlighted that what is seen as a convincing employee benefit has shifted significantly in recent years. In the past, it might have been enough to offer a fruit basket in the office, but today that’s no longer the case, and employers are striving to be more and more creative with their employee benefits.

Three key themes emerged:

- Mental health support. Employees value benefits which support their health and wellness. Previously, it was typical to offer sports benefits, such as subsidised gym memberships or yoga classes in the office. This is still common, but today mental health benefits are emerging as a new priority within the wellness category.

- Paid time off. It has become much more standard for employers in Germany to offer 30 holiday days per year – as we saw with Ravio’s data earlier in the article, with 76% of German employers now offering 26-30 holiday days. This additional holiday allowance is highly attractive for job candidates.

- Remote working. A big shift in recent years is that remote working is now much more common, and is seen as a significant benefit by job candidates. Many companies have adopted hybrid models enabling some amount of working from home. Job candidates find flexible and remote working options particularly desirable if there is the ability to work from anywhere for at least part of the year.

Finally Daria emphasised that a great employee benefits package should reflect the preferences of your specific team. She recommends conducting research to understand what your employees value in terms of benefits, and monitor any changes to see how they impact employee satisfaction and retention.

Section 3: Compensation trends in Germany

So, we’ve looked at employee benefits and payroll contributions.

What about salary?

What is the average salary in Germany?

According to the German Federal Statistic Office (destasis) the average salary in Germany in 2023 was €4,323 per month or €51,876 per year.

This is a high average. The average salary in France in 2021 for comparison was €29,572 per year – €2,464 per month. Of course, it is an average and actual salaries do fluctuate across industries and levels of seniority.

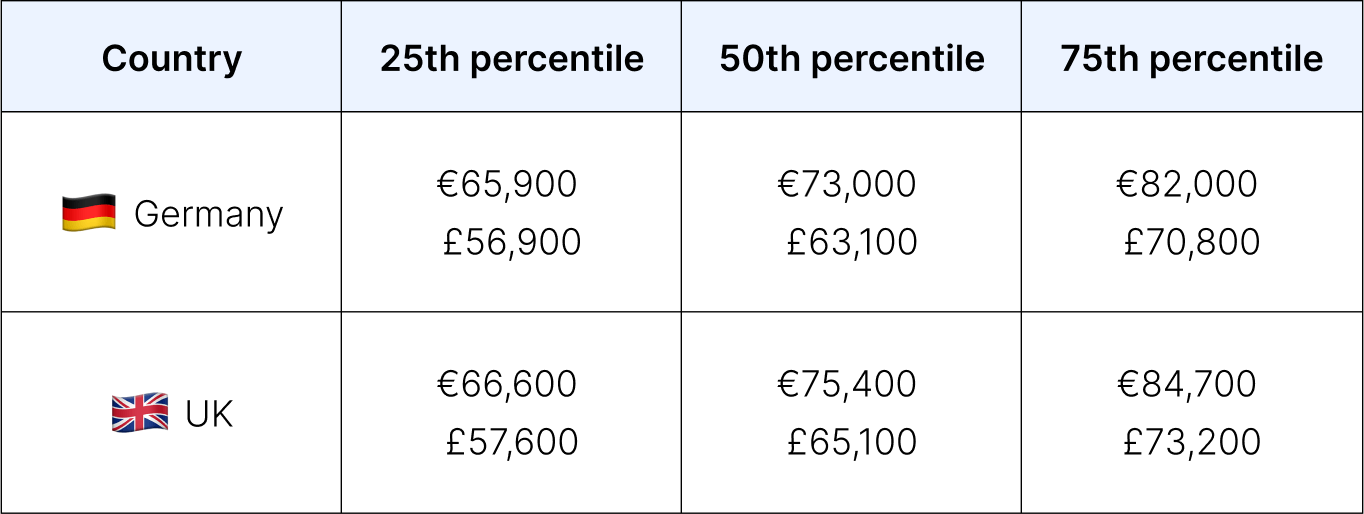

Through Ravio’s salary benchmarking data – the largest and most comprehensive real-time talent dataset for the European tech industry – we can get a more accurate indicator of salaries in German tech currently.

Let’s take a look at two example roles.

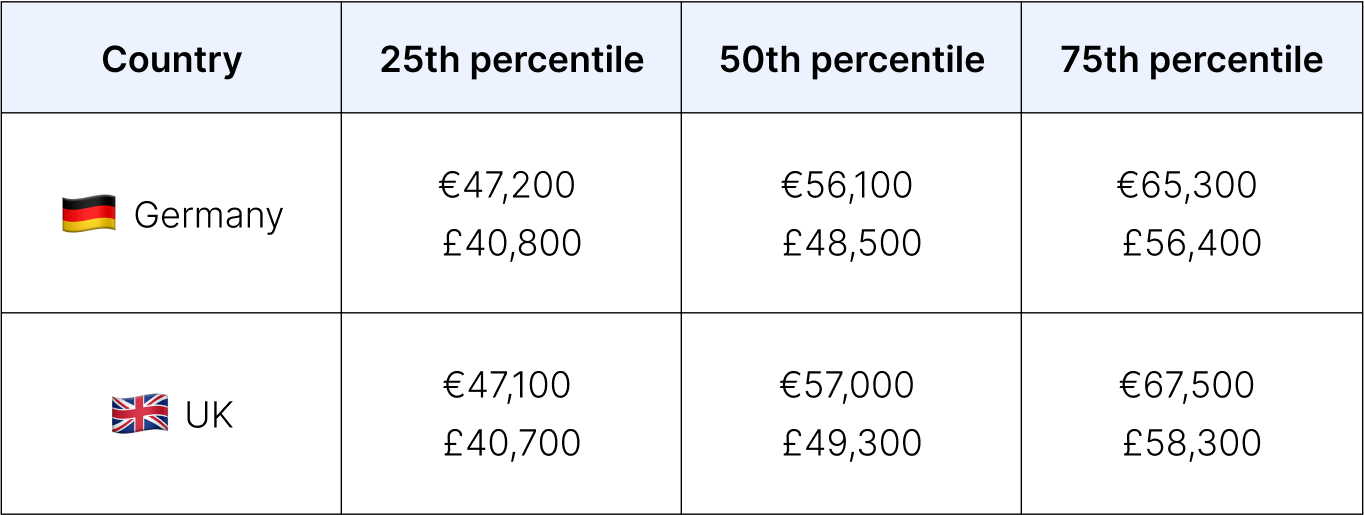

Comparing a P3 (established professional / IC as per the Ravio level framework) software engineer and a P3 account executive in both Germany and the UK, we can see that:

- Engineering salaries tend to be slightly higher than commercial salaries (though it’s also common for sales roles to have variable compensation on top of base salary)

- Salaries in Germany are similar to salaries in the UK, but slightly lower across the board – which is important to know if you employ people across multiple locations in Europe (or beyond!)

Median base salary for a software engineer (P3) in Germany

Median base salary for an account executive in sales (P3) in Germany

💡 Interested in what a competitive salary looks like in Germany for other roles?

In the Ravio Compensation Trends Report 2024 we share typical salaries for a P3 (established, professional) and M3 (senior manager) level in software engineering, product management, and direct sales.

The Report also includes a comparison to more countries in Europe (UK, Germany, Netherlands, Spain, France, Sweden), so you can see how German salaries stack up.

If you’re looking for a role or level not included in this list, access the most comprehensive salary benchmarking dataset in Europe with Ravio ➡️

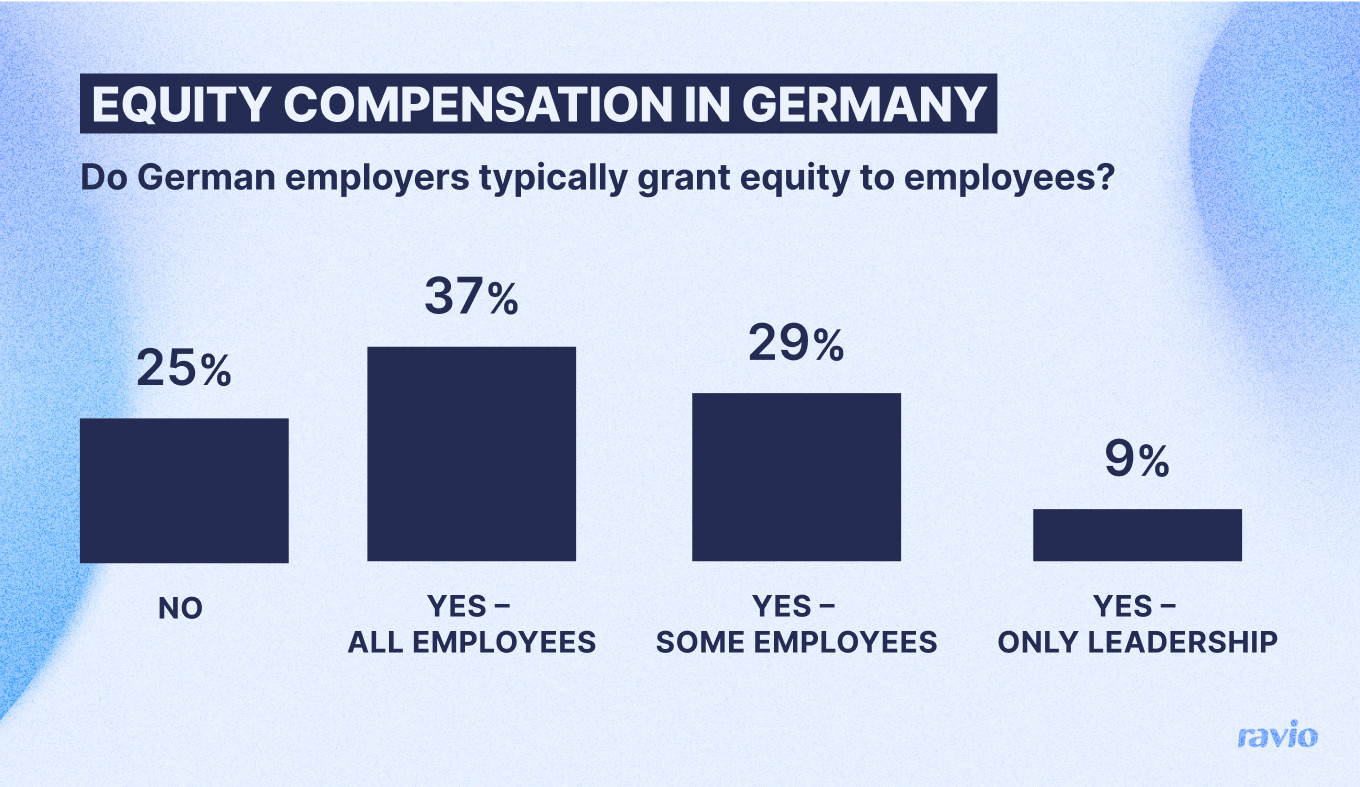

Is it typical for companies in Germany to offer equity compensation on top of base salary?

Ravio's data shows that 75% of German companies offer equity compensation to employees.

This is lower than in France where 85% of companies offer equity compensation to employees and the UK where 80% do.

When it comes to equity compensation:

- 37% of German employers offer equity to all employees

- 38% offer equity to only select roles – with 9% only offering equity to founders and/or C-suite leadership team members.

Section 4: Pay transparency in Germany

What pay transparency legislation exists in Germany?

In Germany the Transparency in Wage Structures Act has been in existence since 2017, with the aim to enforce the right to equal pay for women and men for equal work or work of equal value.

- Companies with 500+ employees must a report annually on gender equality and equal pay, including outlining initiatives and actions to promote equal pay at the company.

- In all companies with 200+ employees, the employees are entitled to disclose salary information to one another (i.e. pay secrecy clauses are banned) and can request salary information on groups of employees who perform work of equal value to them.

When will Germany implement the EU Pay Transparency Directive?

The EU Pay Transparency Directive came into force on 6 June 2023 and is now being rolled out across all EU member states – including Germany.

The Directive is top level guidance, and countries now have until 7 June 2026 to implement the legislation within their own national laws – though it’s possible some will do this more quickly than that official date.

Whilst we don’t know exactly how Germany will, therefore, interpret and implement the EU Pay Transparency Directive, in general there will be much stricter rules on pay transparency than currently exists, across four main areas of ruling:

- Stricter gender pay gap reporting. Companies with over 100 employees will be required to submit reports on their gender pay gap, and any company with a gender pay gap of over 5% will be required to conduct a joint pay assessment in cooperation with employee representatives to further analyse the gender pay gap and take action to reduce it.

- Increased access to pay information for employees. Employees will be entitled to request information on pay levels and the criteria for career and pay progression.

- The burden of proof shifts to the employer. In any case regarding pay discrimination, the employer will need to prove that pay discrimination has not taken place – whereas historically the employee would have to prove that pay discrimination has taken place.

- Increased access to pay information for job applicants. Employers will be required to include the salary range for all job positions to candidates before interviews. Employers will be banned from asking candidates about their salary history.

We’ll update this page once Germany announces exactly how and when the new rulings will be in place - and you can sign up to our monthly newsletter to make sure you receive any updates.

For now it’s worth getting to know the rulings in preparation, so head to our guide on everything you need to know about the EU Pay Transparency Directive to get started.

What is Germany’s gender pay gap?

The gender diversity of teams and pay equity across genders is becoming more and more important for companies, especially with the rollout of the EU Pay Transparency Directive looming, as we’ve seen.

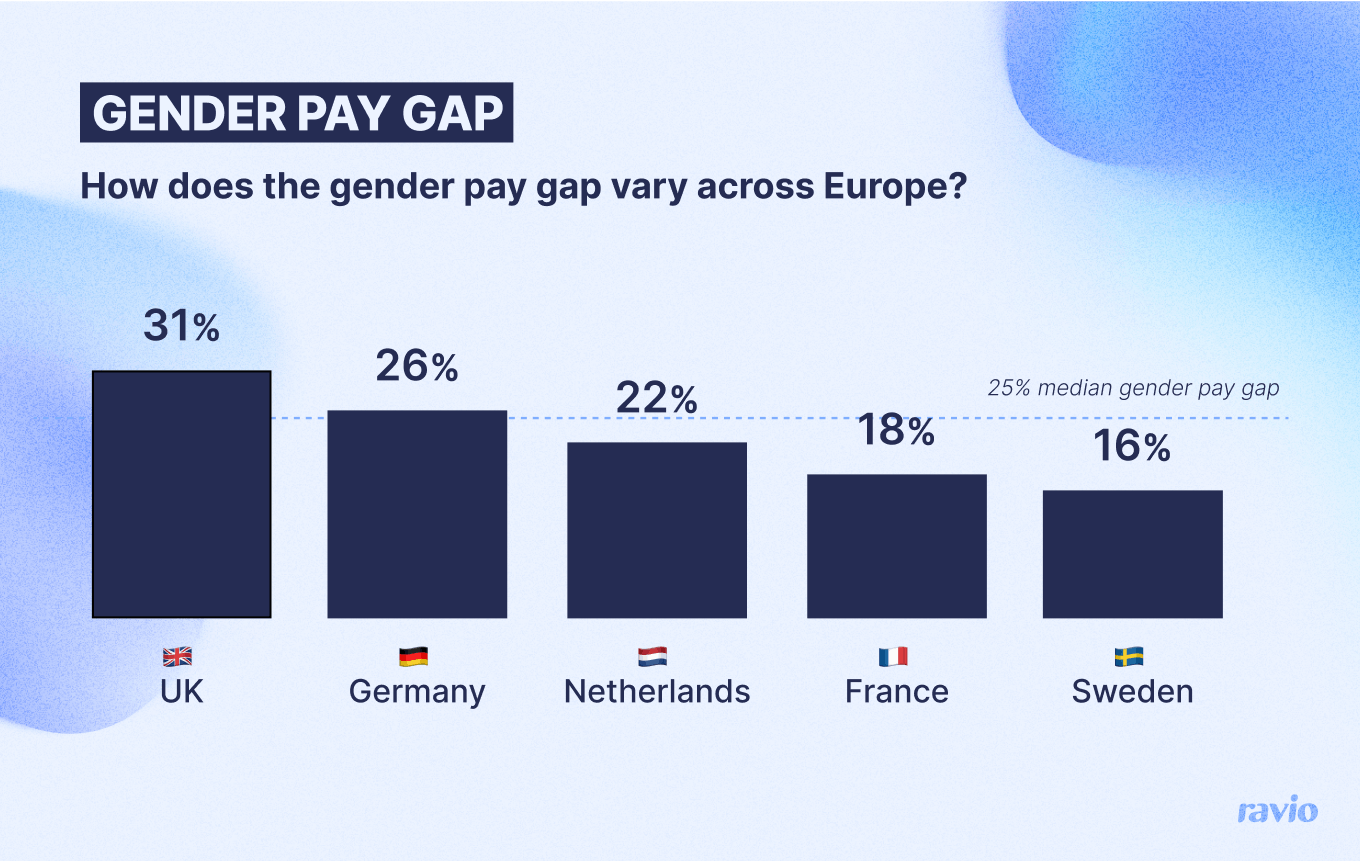

So how does the gender pay gap in Germany compare to elsewhere?

The German Federal Statistic Office reports an 18% unadjusted gender pay gap overall.

However, the gender pay gap can vary significantly across industries.

Ravio’s data shows that in the tech industry the gender pay gap in Germany is much higher, at 26%.

This is higher than many European countries. For instance, France where the tech industry has a much lower (though still significant!) gender pay gap of 18%. So, it’s clear that pay remains far from equal across genders in Germany – there’s much more work to be done by companies.