Salary benchmarking: What is it and how do you do it?

Salary benchmarking helps companies know how much to pay their employees, making it a key component of both a compensation strategy and talent strategy.

Companies use salary benchmarking to remain competitive in the talent market and ensure they are paying their employees fairly.

Without accurate salary benchmarking, HR and People leaders risk underpaying employees and losing talent to other organisations, or overpaying employees, which can be very costly.

In this blog post, we’ll explore:

- What is salary benchmarking?

- How to create a salary benchmark

- Why do companies do salary benchmarking?

- How to do salary benchmarking (the manual approach)

- How to do salary benchmarking (with Ravio)

What is salary benchmarking?

Salary benchmarking is the process of comparing employee salaries to the wider market based on data from relevant organisations.

This process helps People and Reward teams work out what fair pay looks like for their employees across different roles, seniorities, and locations.

Companies typically benchmark their salaries against organisations they compete with for talent and/or organisations that are similar to their own, based on factors such as headcount, geography, or industry.

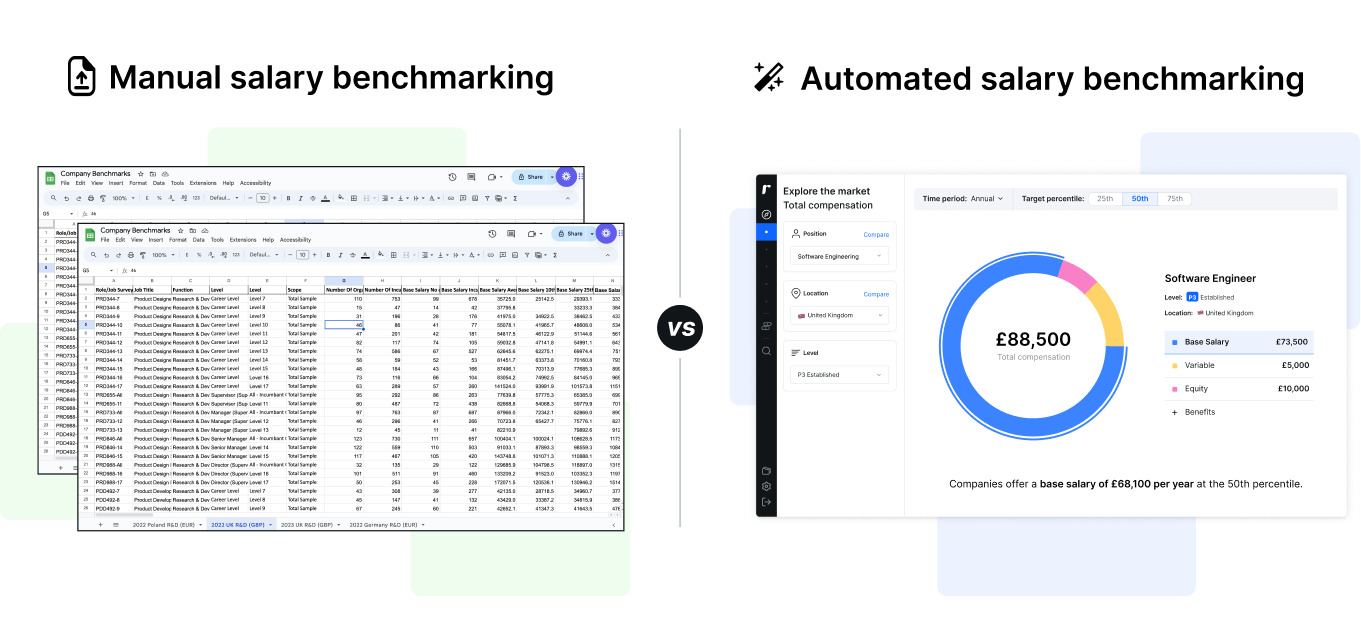

There are two main methods of salary benchmarking.

Manual salary benchmarking (often in spreadsheets)

Manually collecting and analysing salary data from different sources, including government databases, employer surveys like Radford (part of AON), Mercer, or WTW.

This is both painfully time-consuming and error-prone, so smaller companies will often employ a compensation consultant to conduct this research for them.

Automated salary benchmarking (in software)

Using salary benchmarking tools like Ravio, which removes the need for manually searching for benchmarks by already having reliable, real-time market data available in a platform.

💡What about self-reported salary data?

Some companies also resort to self-reported salary data sources for benchmarking, such as Glassdoor or Indeed.

This approach isn’t best practice as the data is unverified and so is often unreliable. It is also prone to errors and outliers.

Interested in learning more? We recently explained the pros and cons of different salary benchmarking tools.

How to create a salary benchmark

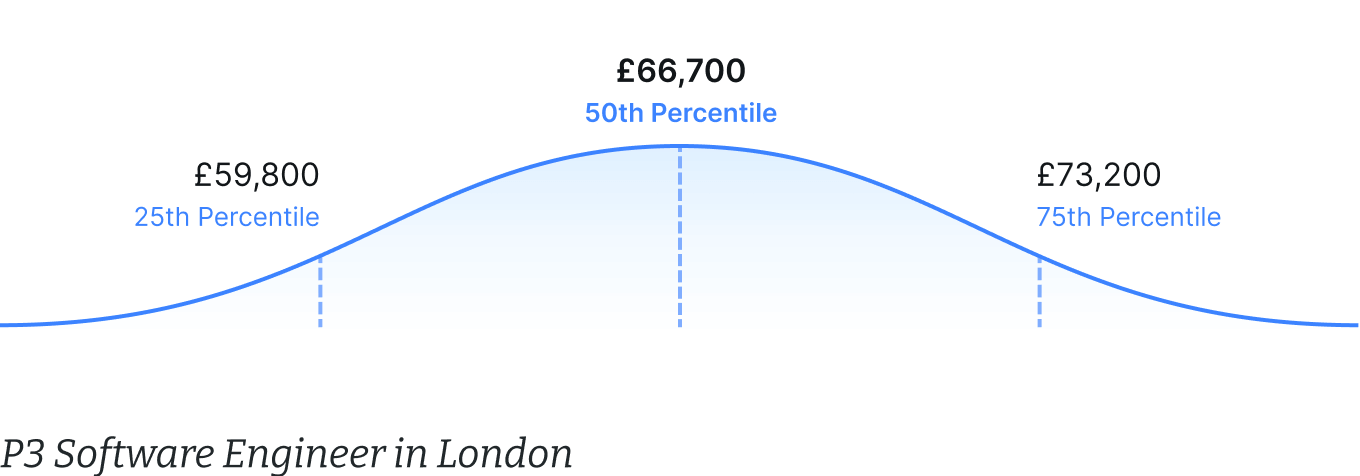

Companies perform salary benchmarking by gathering salary data and using it to calculate different market percentiles for the roles they employ.

Most companies will calculate the market median (also known as the 50th percentile, the middle of the market), the lower and upper quartiles (25th and 75th percentile), and sometimes the 90th and 10th percentiles, too.

The 50th percentile salary means that 50% of companies pay the same or less for that role, whilst the 75th percentile means that 75% of companies pay less for that role, and 25% of companies pay more.

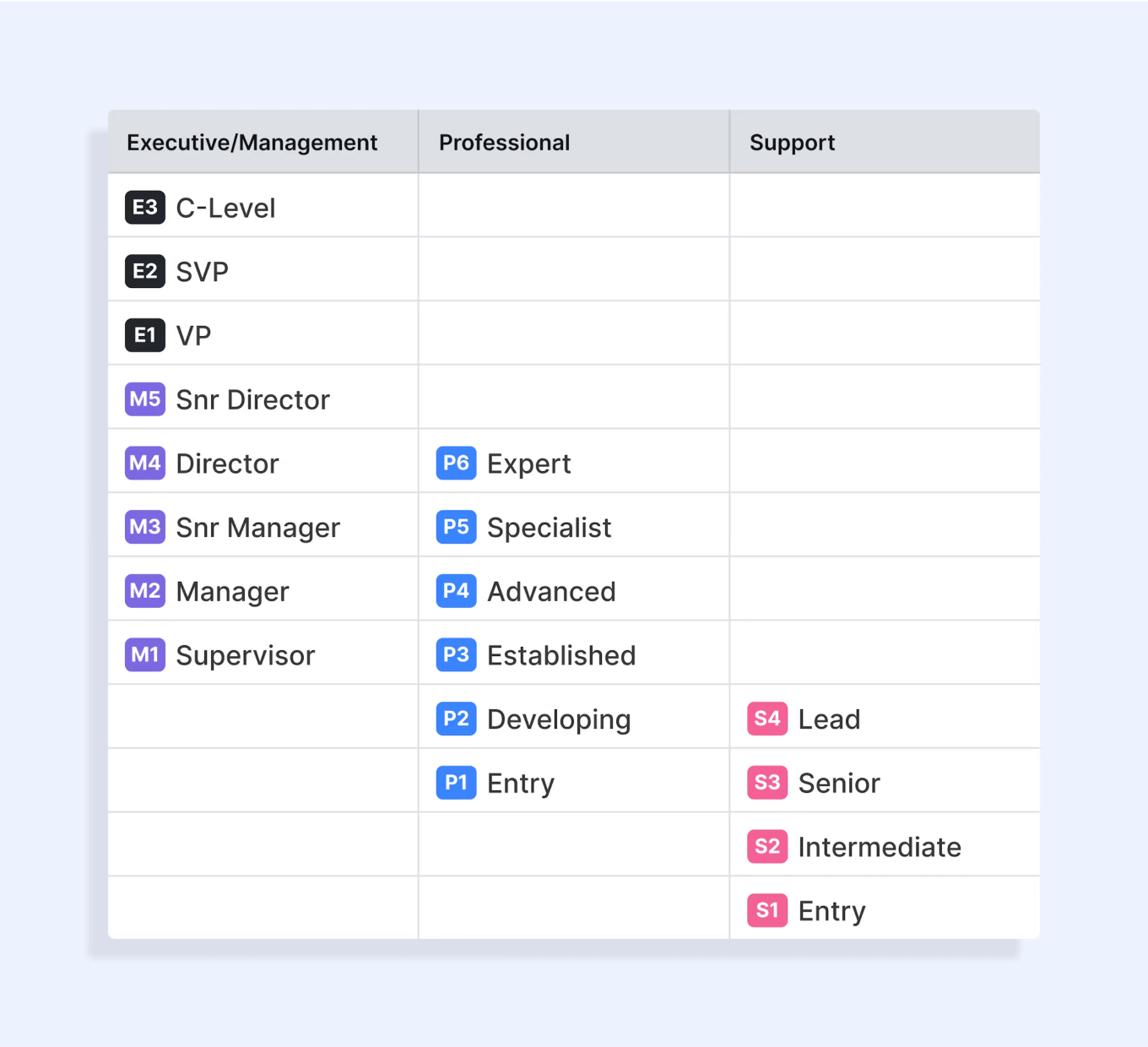

These percentiles are calculated for each role in an organisation, with roles grouped by location (e.g. London vs. Warsaw), job function (Marketing vs. Engineer), and seniority or “job level” (P2 vs P3).

Job levels are defined based on business impact, the level of responsibility, skills, autonomy, and the competencies needed – which may vary across different job functions.

For instance, here is Ravio’s own level framework:

So, what do salary benchmarks look like in practice?

Below are two example benchmarks from Ravio.

The first is for a “P3 Software Engineer” in London, the second is for a “P2 Software Engineer” in Poland, showing the 25th, 50th, and 75th percentiles.

Though both roles are an individual contributor (“Professional” level), one role is more senior (P3 vs. P2) and in a location with a higher cost of living (London vs. Poland). This means it has a much higher market median.

This is why it’s important to perform salary benchmarking by job level, location, and function. It tells companies what fair and competitive pay looks like for these different roles.

People teams, managers, and executives can use this data to have informed conversations with employees and candidates about how much they should be paid, as well as how compensation should be adjusted to reflect market changes, or employee performance and progression.

Plus, they can then use this data to decide where in the market their company wants to pay, known as the “target percentile”. This is usually done as part of setting a compensation philosophy.

Why do companies do salary benchmarking?

Salary benchmarking isn’t a nice-to-have for companies.

The talent market is competitive and the rate for certain roles can move very quickly – offering the right salary to employees is crucial. Otherwise, there’s a risk they simply won’t stick around.

Here’s a few reasons why companies do salary benchmarking.

Employee attrition is expensive. Benchmarking helps to retain talent.

Unhappiness with compensation is the #1 reason why employees leave their jobs, as cited in recent studies by McKinsey, Deloitte, and Pew Research Centre.

If companies do not compensate existing employees up to their market value, then it’s likely that they will seek out better-paid opportunities elsewhere. Salary benchmarking helps companies pay competitively for all roles, as well as keep tabs on certain roles they want to retain.

💰 The cost of attrition

Replacing an employee can cost up to 1.5-2x their annual salary, depending on their seniority and specialisation, per a study by Deloitte.

Example: a P3 software engineer in London earns £67k at the market median (source: Ravio).

Assuming engineers are 25% of total headcount and employee attrition is 5%, a 500-person company would lose over £600k per year just replacing software engineers, excluding all other employees!

Overpaying employees can be very expensive

Whilst underpaying has bad consequences, so does overpaying.

Payroll often accounts for around 70% of total operating expenses. Salary benchmarking helps to control payroll costs, which in turn will fuel sustainable business growth.

This is particularly valuable for tech companies, where people costs are the largest line item on the P&L, and managing runway and getting to profitability are crucial for survival and long-term success.

Benchmarking helps to attract talent and bolster employer brands

Employees want pay transparency.

In fact, 98% of employees are in favour of salary disclosures and 53% would refuse to even apply for a job that does not disclose the salary range, per a recent Monster study.

A company with a good compensation philosophy and that regularly benchmarks salaries knows how much to pay their new hires, and can easily add salary ranges to their job descriptions (which will soon be a legal requirement in the EU under the Pay Transparency Directive).

If 53% of people would refuse to apply for a job that does not disclose a salary range, then the candidate pool is effectively doubled just by showing one.

Further, whilst building an employer brand takes time, paying employees fairly and competitively is a great way to build trust. It shows employees and future hires that a company values them and their contribution.

In short, salary benchmarking helps to hire and retain top talent, and sustainably manage business growth.

But how is benchmarking actually done?

How to do salary benchmarking (the manual approach)

The traditional approach to salary benchmarking can be a complicated and lengthy process – especially if someone has never done it before. It normally happens as part of an annual compensation review, but can take several months to complete.

Smaller organisations, with a limited number of employees, might gather benchmarking data through publicly available sources such as Glassdoor, or simply by asking people in their network.

However, most companies will engage a specific data provider such as Radford or WTW. These providers offer salary surveys, which act as a benchmarking master document.

Going through a survey provider has the benefit of a large dataset, but the data represents a single point in time, and as the market is ever-changing - real-time updates are always best.

These legacy providers also tend to focus on large multinationals, so don’t offer good, relevant data for smaller and mid-size companies such as startups and scale-ups.

Here are 5 steps to do salary benchmarking manually:

1. Define a compensation philosophy

Whether benchmarking salaries through individual research, or engaging a data provider, it’s crucial to define a compensation philosophy. It should contain the guiding principles for how a company pays its employees, and should align with the company’s mission and values.

When starting from scratch, it doesn’t need to be anything complicated. Cover the basics and keep it to 1-2 pages, including things like:

- Will employees be granted equity in the company? If so, how much? And will this apply for all employees, or only some?

- Will variable compensation be offered? If so, again, will this apply for all employees? And what kind of variable compensation model will be used?

- What is the company’s market target percentile? For example, companies may want to target the 50th percentile for Marketing but the 75th for Engineering, if hiring top talent in Engineering is really important.

💡 Ravio tip: establish a compensation philosophy as early as possible

We work with +1,000 tech companies ranging from small startups to global scale-ups. Our recommendation is to establish a compensation philosophy as early as possible.

As companies grow and scale, more questions will be asked from the CEO, CFO, board of directors, line managers, and employees.

A compensation philosophy gets everyone on the same page, helping to explain why a company pays at a certain target percentile, or offers certain forms of compensation and not others.

2. Update job architecture (job titles and descriptions)

Job titles and descriptions can vary from company to company. But before starting to gather market salary data, make sure job titles and descriptions are up-to-date and consistent.

This means that when conducting salary benchmarking, HR and People leaders can easily compare roles to other roles in the market or similar roles in a sample dataset. A good rule of thumb is to compare employees to job descriptions that have an 80% match, according to the Economic Research Institute.

Here are some common job architecture mistakes to avoid.

“No one experiences any joy doing a salary benchmarking exercise for a 500 person organisation that has 500 unique job titles. The overriding principles when creating or updating your job architecture are to eliminate ambiguity - people should be able to understand someone’s role just from their title - and to build for scale, you want your job architecture to grow with you.”

Chief People Officer, Ravio

3. Decide what companies are best to benchmark against

Before starting to benchmark salaries, define the most relevant companies to use for comparison.

For example, a 100-person e-commerce startup in London probably shouldn’t be comparing salaries to FAANG companies like Meta.

A salary benchmarking peer group should be defined by common (or even aspirational) competitors, and/or companies with a similar profile based on funding stage, headcount, geography, and industry.

When manually sourcing data from places such as Glassdoor or job ads on LinkedIn, try to make sure the data being sourced is from relevant roles, locations, and companies.

Even then, it will be very hard to avoid data that is skewed by outlier salaries and irrelevant organisations. Keep in mind that user-submitted salaries cannot be fact-checked, and are well-known to be overstated due to the so-called “social desirability bias”.

“[Before Ravio] it was very difficult for us to compare ourselves with the right sectors, organisations, and competitors as we are a tech scale-up. We have so many developer positions – like different engineering types and product roles – so we needed data for tech scale-ups, versus large corporate organisations.”

Head of People & Culture, Tiqets

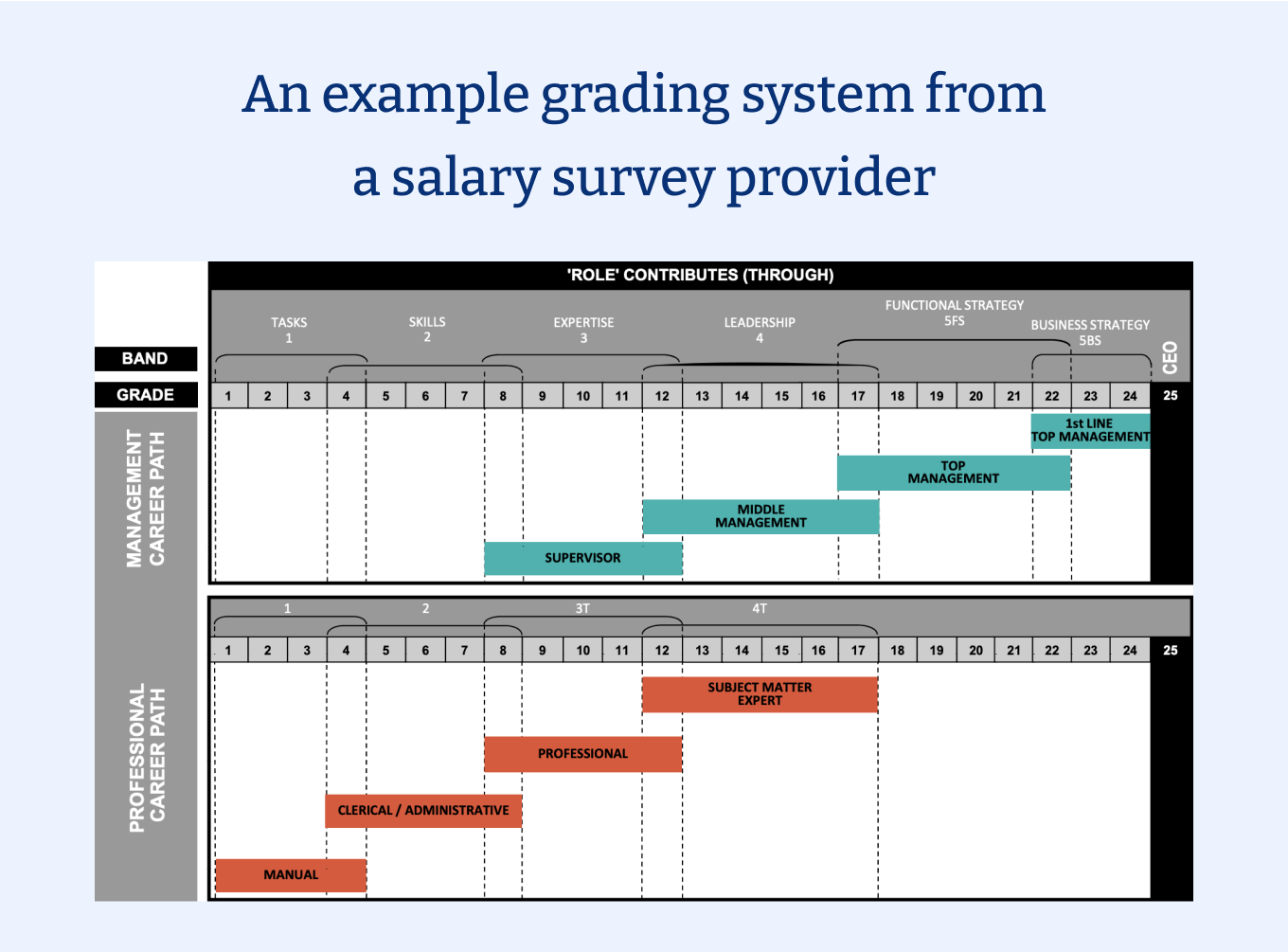

Working with a salary survey provider usually means completing their global grading system, which will usually give scores on three core elements: number of employees, revenue, and complexity.

This will then be used to compare a company’s salaries against similar organisations.

Using an organisation such as WTW requires obtaining a global grade before completing any further steps.

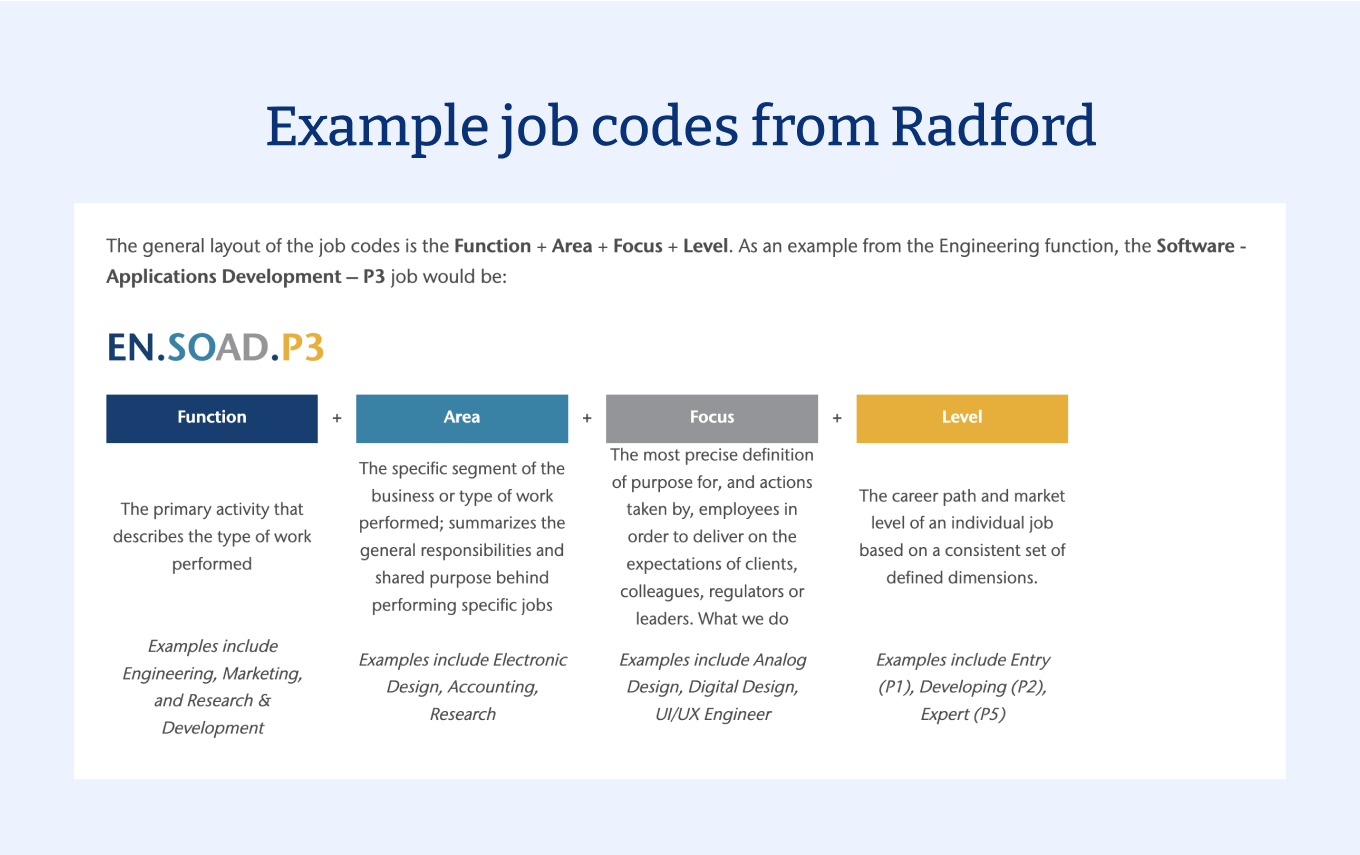

4. Assign job levels and job codes

When using a salary survey provider, companies must update their job descriptions, and then run through each employee and assign them to the right job levels based on their levelling framework, and job codes.

Job codes are used by survey providers to compare similar roles, they are generally defined by function (e.g. Marketing) and discipline (e.g. Digital Marketing).

Salary survey providers will have thousands of job codes, each unique based on the industry of the company, the job function, and the level of the job.

Then, companies must assign each employee to a level / job code to obtain accurate salary benchmarking data.

Below is an example of how Radford creates their job codes.

5. Start gathering data (or send data to a benchmarking provider)

After deciding what roles to benchmark for, and updating descriptions, job levels, and job codes – then it’s finally time to get started with salary benchmarking!

Start to collect salary benchmarking data from various sources such as user-submitted salary databases and government databases.

Alternatively, send the employee data gathered above to a salary survey provider.

💡 Deadlines for submitting data to salary survey providers

It’s worth noting that these survey providers follow a strict survey cycle, and so companies normally need to submit all their data in one go between April and May.

Data will be gathered in May, analysed, and then benchmarks are released later in the year, around September.

Often, the salary benchmarks released later are the benchmarks for that year. That means the data is nearly 6 months out of date by the time it is received, and will be 18 months out of date by the time the data is received for the following year.

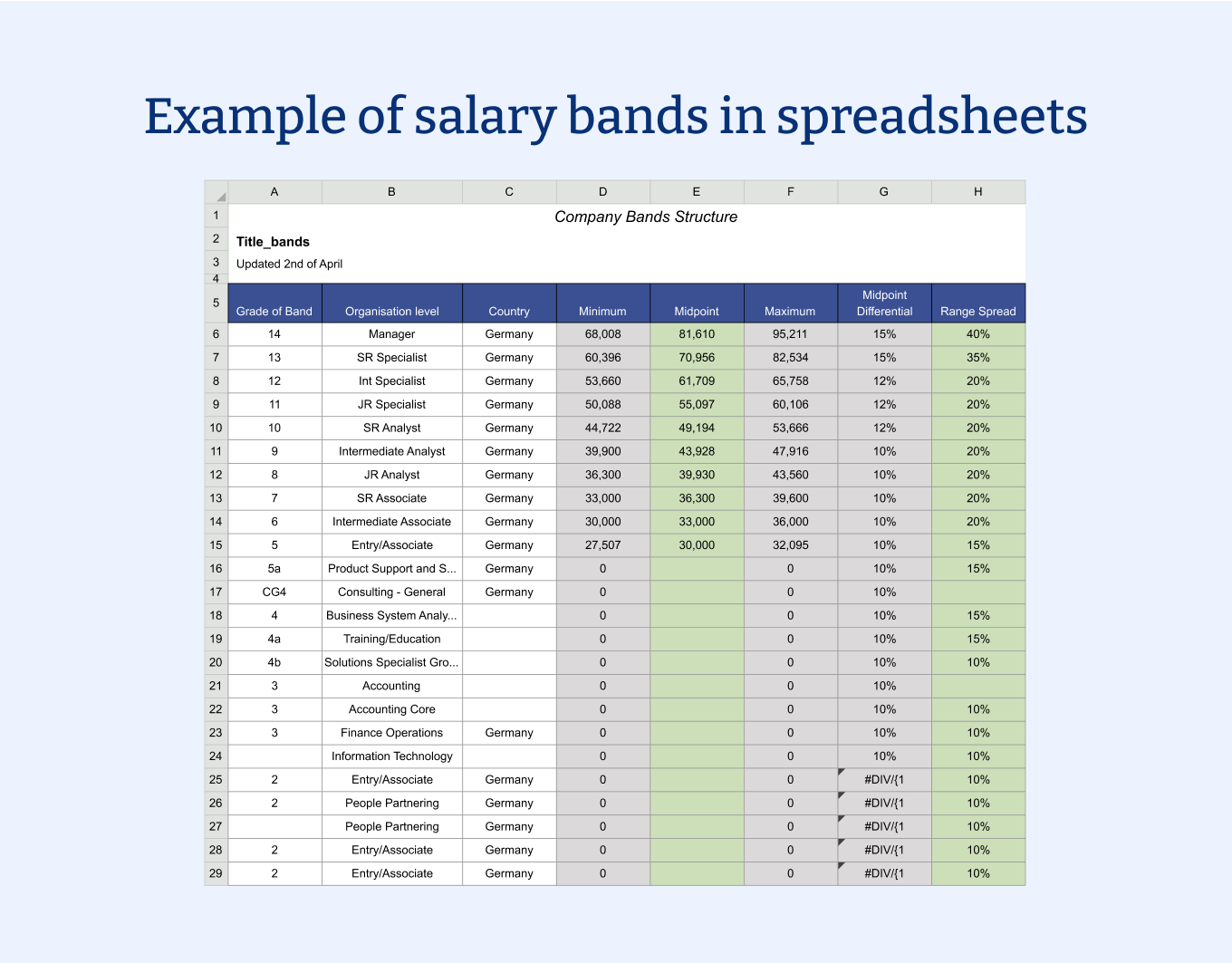

6. Build salary bands

After receiving data on the market average, start building salary bands. This helps with budget planning during a compensation review to better control payroll costs.

Salary bands are usually calculated based on taking a market target percentile (e.g. 50th percentile) and calculating set salary ranges around that target. Then, create salary bands either by department or job function.

Salary bands help in making decisions on how much to compensate employees within a range based on factors such as location, level of experience, and tenure.

For more information on building salary bands, we’d recommend:

How to do salary benchmarking with Ravio

Today, it’s not necessary to have a months-long salary benchmarking process. There are tools that do most of the heavy lifting, and take the whole process out of spreadsheets.

Tools like Ravio can integrate with popular HR systems, keep data and salary benchmarks up to date, and provide real-time insights into market trends.

This means benchmarking data is always as accurate as possible, helping to easily build salary bands, make fair and competitive new hire salary offers, close the gender pay gap, and much more.

Here is a simple step-by-step on what salary benchmarking looks like with Ravio:

1. Connecting your HRIS to Ravio

Ravio integrates with over 100 HR tools. This means we benchmark compensation in real-time from the 1,000+ companies we work with.

This is different from salary surveys, where data is collected at a point in time and released many months later when it is already stale.

Integrating your HRIS with Ravio usually only takes a few minutes. We have detailed integration guides that will help walk you through the process, and we’re SOC-II and GDPR compliant.

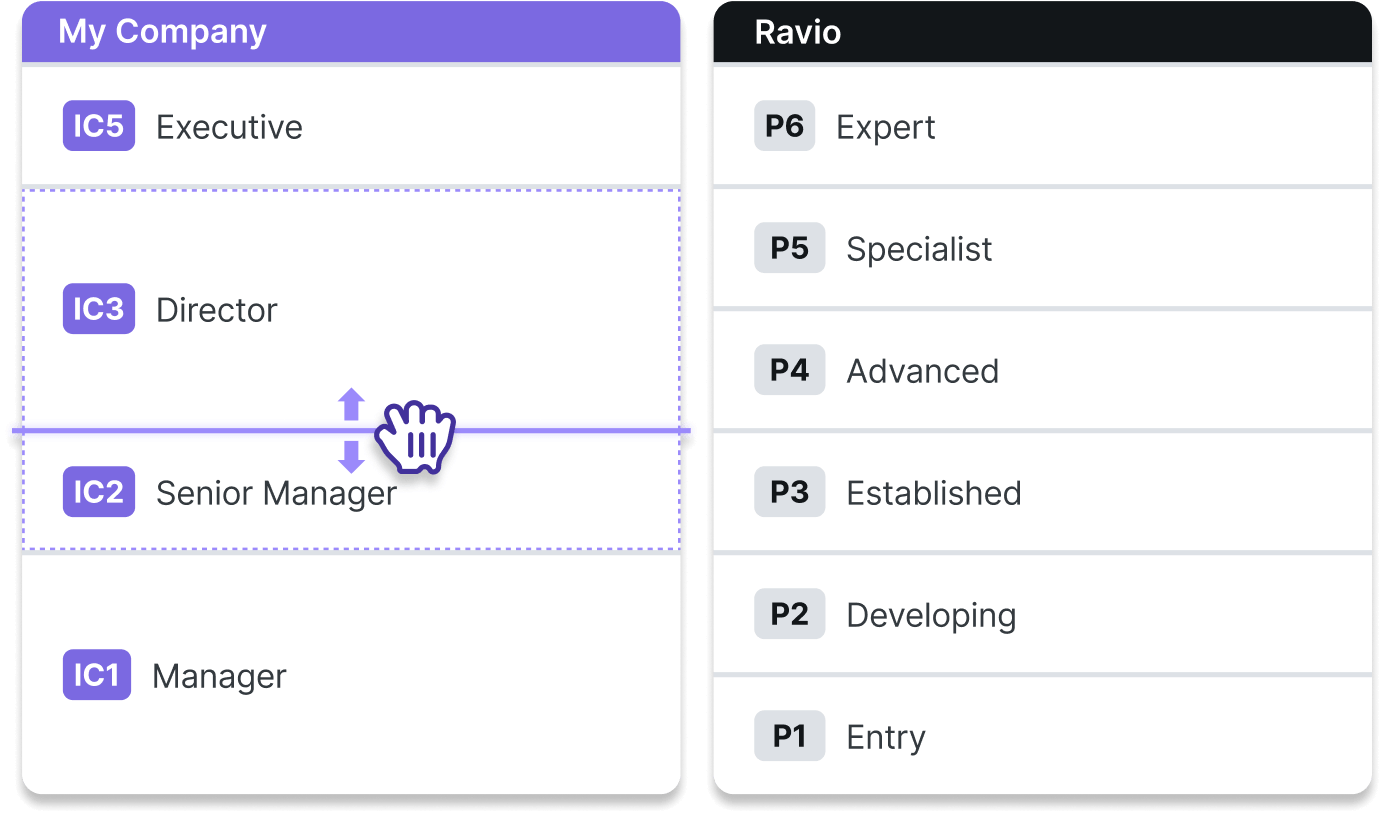

2. Benefit from Ravio’s job levelling

One thing that makes manual salary benchmarking hard is having to level all employees, as salary survey data isn’t automatically mapped to a level framework.

At Ravio, our Benchmarking team will level the employees of our customers or, if they already have a levelling framework, will map their existing level framework to ours using a correlation table.

We do this for free as part of onboarding. It usually takes a few working days. We do this two for two reasons:

- It saves time: manual levelling can take days, if not weeks, especially for a large company or individuals not familiar with the job codes of the salary survey providers. Ravio gives busy teams that time back.

- We level everyone consistently: when companies do their own levelling, inconsistencies arise as they will have different interpretations of how to level the same role. By levelling for our customers, we level everyone consistently. This ensures confidence in benchmarking salaries against relevant roles from other organisations. Plus, our customers can always adjust job levels in Ravio to ensure apples-to-apples comparisons over time.

And that’s it, no further work is required...genuinely!

Once a Ravio customer connects their HRIS, and levelling is done, People & Reward teams can use all of Ravio’s functionality, including:

Benchmarking salaries against the market

Easily assess how salaries stack up against chosen target percentiles, and compare unadjusted gender pay gap and female representation to the market average.

Searching for relevant benchmarking, across total compensation

Whether hiring for a new role or checking a benchmark for a current employee, easily find market benchmarks in Ravio. Filter by different roles, levels, geographies, funding stages, industries, and company sizes.

We offer salary benchmarks from +300,000 data points (as of July 2024) across base, variable, equity, and benefits, and cover 100+ roles in 25+ countries!

“Access to Ravio’s live market data means no more headaches from delayed data sets or having to age compensation data, which has been a real friction point for us in the past. Ravio offers real-time data with amazing visualisations making it the easiest and most user-friendly benchmarking tool we use.”

VP People, Mollie

Building and refreshing salary bands

Building and refreshing bands manually can be very painful.

The formulae are complex, the spreadsheets are vast, and it’s really difficult to analyse the data to draw out useful information.

Ravio helps to easily build salary bands in minutes and visualise them in a beautiful, easy-to-use UI. Model different bands scenarios to understand how to stay within budget whilst achieving people objectives.

Assessing pay equity

Once bands are up and running, it becomes easy to analyse internal pay equity.

Identify employee outliers, and bands that have fallen behind the market, and assess gender pay gap by function, level, and role.

Bring confidence into compensation

Want to see how Ravio can streamline your salary benchmarking process?

With the largest and highest-quality dataset in Europe, Ravio remains the first choice for growing companies across Europe, and across the world.