What’s a fair and competitive salary in the European tech industry today?

Are our employees paid fairly and competitively compared to the market?

It’s still pretty difficult to tell.

Which is far from ideal, because understanding fair and competitive pay is absolutely critical for managing headcount costs whilst attracting and retaining great employees.

The salary benchmarking norm is to combine user-submitted salary information from sites like Glassdoor with expensive salary survey datasets from consultants like Mercer. In both instances, the data is out-of-date before people leaders even get their hands on it – it’s impossible to keep up with the fast-moving market.

Even with real-time salary benchmarking tools, the dataset has to be relevant to be a useful point of comparison.

It needs to show you how companies of a similar size, at a similar stage, in a similar industry etc are paying the job positions that you have, so that you can truly understand what ‘competitive salary’ means for you.

Which is why at Ravio we’re laser-focused on building the most comprehensive compensation dataset specifically for European tech companies.

And it’s also why we’re releasing a snapshot of that dataset, to help you see what fair and competitive salaries currently look like in the European tech industry.

Unveiling the data on what a fair and competitive salary is in European tech right now

As we’ve highlighted, what ‘fair and competitive salary’ means changes depending on the job position, level, location, company size/stage, industry, and so on – which is why relevant benchmarking data is vital, especially if you hire across multiple locations in Europe.

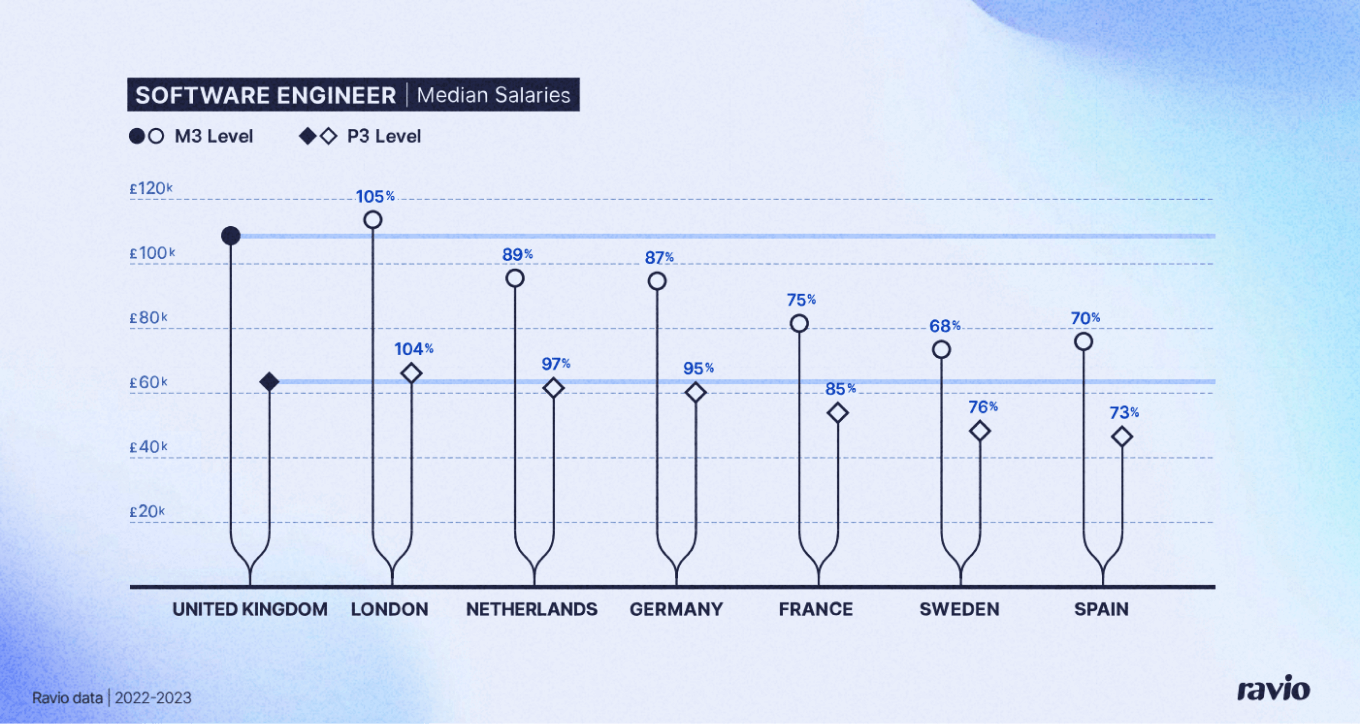

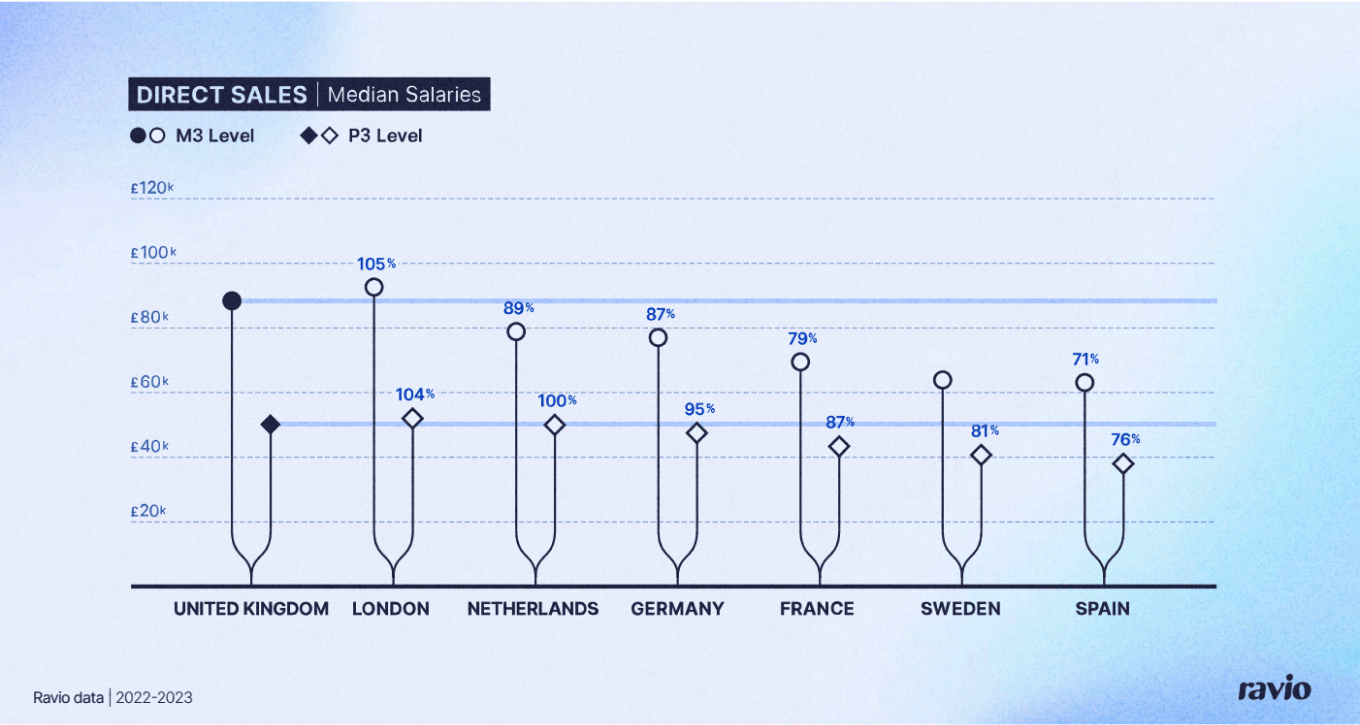

As an indication, let’s take a look at the current median salaries in two different job positions: a software engineering and direct sales P3 and M3 (a P3 is an established professional / individual contributor and an M3 a senior manager – see Ravio’s levelling framework).

And, we’ll also explore how these median salaries change across different locations and company stages to see the importance of salary benchmarking against relevant data.

😔 What a ‘fair and competitive salary’ looks like also changes depending on employee gender – but it shouldn’t

When evaluating the fairness and competitiveness of salaries within your company, it’s of course also important to understand discrepancies when it comes to internal pay equity.

The gender pay gap is a key metric in understanding this. Ravio data shows that overall in European tech there is still a 26% gender pay gap (unadjusted, median). Further, only 19% of executives in the European tech industry are women.

For more insights on the Gender Pay Gap in European tech, go to pages 13-14 of the Ravio Compensation Trends 2024 report ➡️

Software engineering salaries in European tech

Extract from Ravio's Compensation Trends 2024 Report

The median salary for a P3 Software Engineer in the UK is £63,500 and for an M3 Software Engineer in the UK is £108,700 (Ravio data, Nov 2023).

Looking at the above graph, we can clearly see how these median salaries change depending on location. Notably salaries in Sweden and Spain are consistently lower than elsewhere in Europe – which is why it’s so important to define your location-based pay strategy if you have employees working in multiple places.

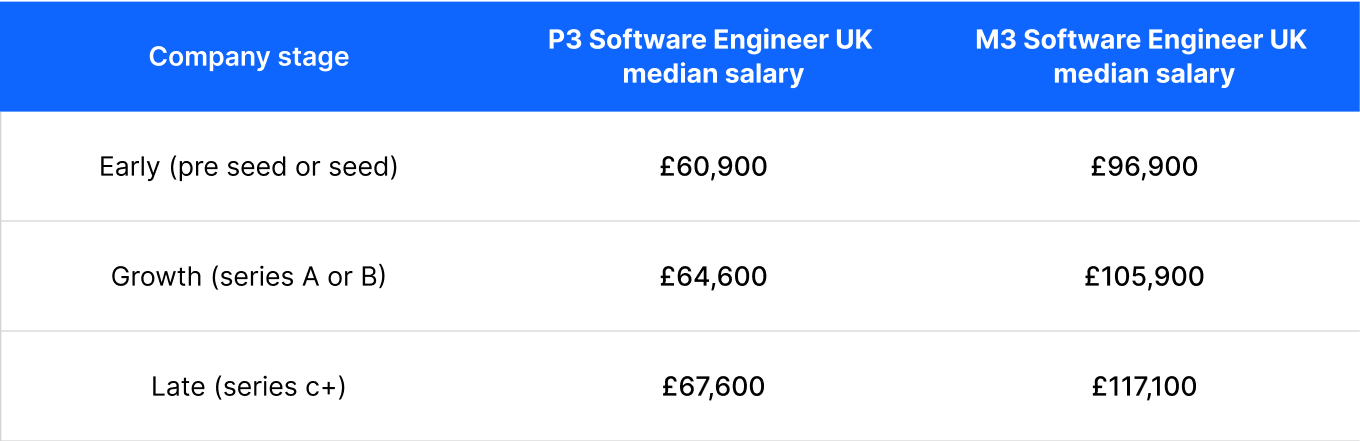

And our data also shows how median salaries for these roles change across different company stages too. Looking at the UK, for example:

Extract from Ravio's Compensation Trends 2024 Report

💡Have software engineering salaries in tech changed compared to last year?

There has been no significant change in median salaries across the Software Engineering job family in the past year (2022 to 2023).

Hiring for Software Engineering roles has been down by approximately 40% across Europe this year compared to last year – which could explain why we haven’t seen a significant change in salaries this year.

Direct sales salaries in European tech

Extract from Ravio's Compensation Trends 2024 Report

The median salary for a P3 in Direct Sales in the UK is £50,100 and for an M3 in Direct Sales in the UK is £88,400 (Ravio data, Nov 2023).

Whilst this indicates a lower base salary in commercial roles compared to engineering, it’s also important to note that tech start ups typically offer variable pay for sales roles on top of their base salary – in fact, our total compensation data shows that 74% of tech companies offer variable pay for roles in Direct Sales.

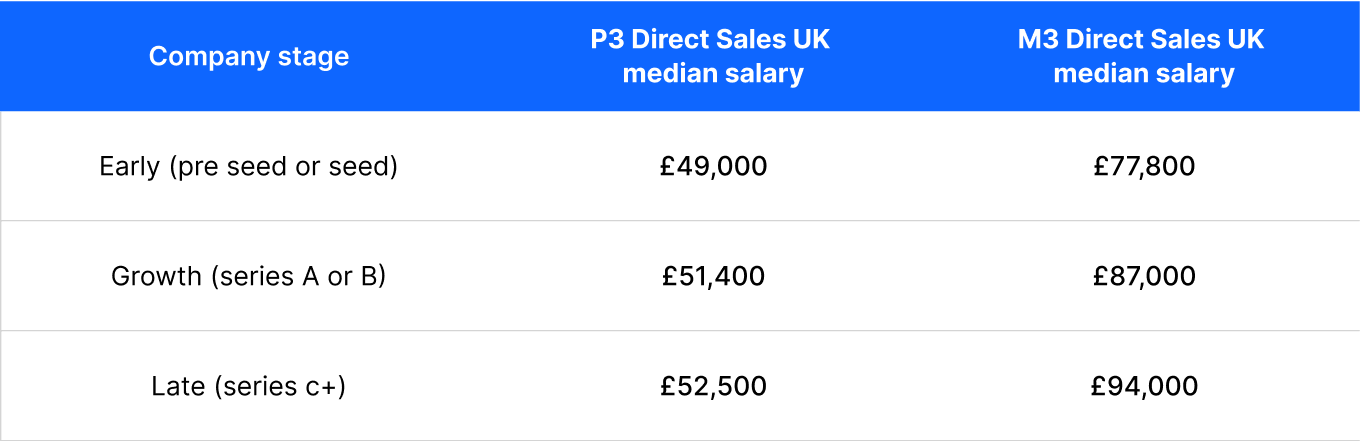

Again, looking at the graph we can see how median salaries vary across Europe for these Direct Sales roles. And the same is true for variance across company stages too:

Extract from Ravio's Compensation Trends 2024 Report

💡Have sales salaries in tech changed compare to last year?

In the past year there has been a slight (but statistically significant) decrease in the median salary for the Direct Sales job family as a whole.

This is due to a shift in hiring.

There has been an increase in employees hired at lower levels within Direct Sales and a decrease in mid-level hires – leading to a decrease in salary overall, whereas, at the individual job levels in direct sales there hasn’t been a significant change.

With cash tight, can total compensation increase your competitiveness as an employer?

In the difficult economic environment of today, cash is tight for most companies.

We can see this reflected in the median salaries highlighted above, which haven’t increased significantly since last year. In fact, whereas employees in European tech could expect an 8% salary increase in 2022, in 2022 this has dropped to 4.8%.

It’s also reflected in hiring rates, which are down by up to 50% compared to last year and are very likely to stay that way going into 2024

These are both trends we dive deeper into in our Ravio Compensation Trends 2024 report.

If the need to keep headcount costs down means you aren’t able to compete with salaries and pay raises this year, what else can keep you competitive as an employer?

Well, today ‘competitive compensation’ means more than just cash.

It’s the total compensation package.

Which means understanding what companies like yours are offering when it comes to equity compensation and variable pay (both of which are included in Ravio).

And it also means having a stellar employee benefits package that reflects what your employees actually want.

So what does a competitive benefits package look like in 2023?

- Going above statutory on paid time off. 20% of UK tech companies give employees unlimited holidays, and 20% give 26-30 holiday days (with 25 days the statutory minimum).

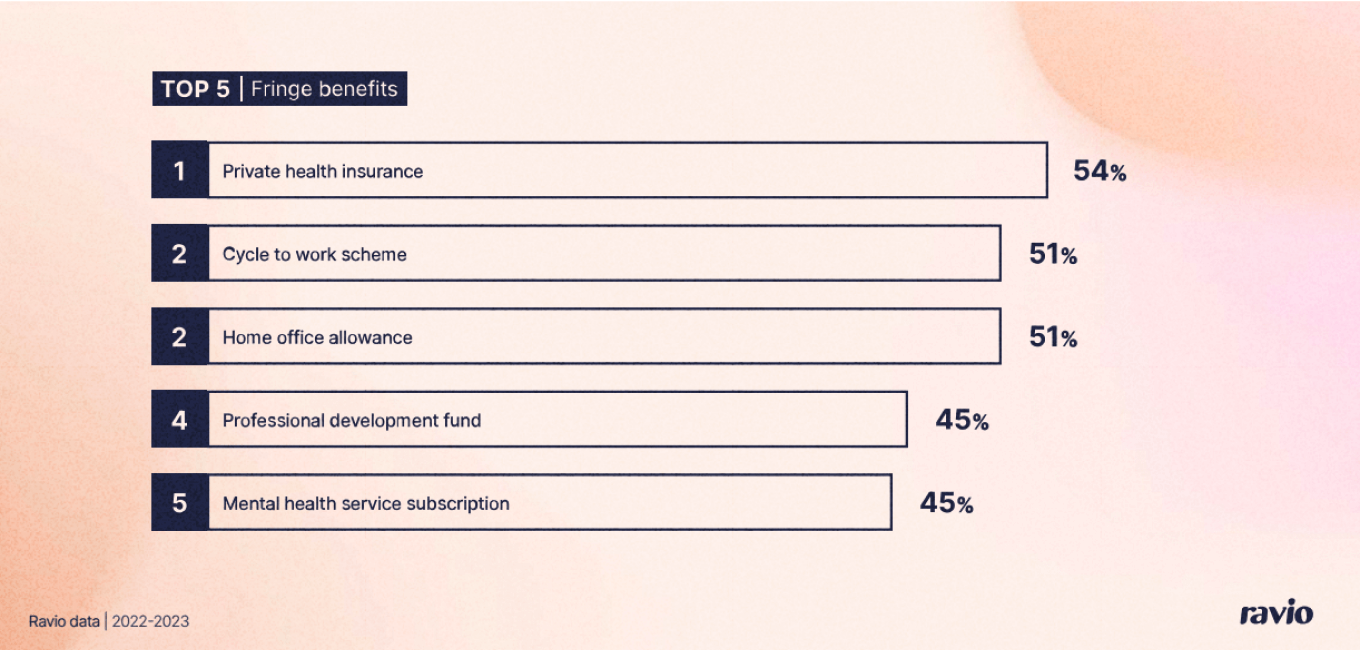

- Supporting employee wellbeing. 54% of UK tech companies offer employees private health insurance as a benefit, and 45% offer a mental health service subscription.

- Flexible working. 77% of UK tech companies have a hybrid working model (2 mandatory office days is the most common split) and 36% give the option of working fully remote.

- Learning and development opportunities. Although many companies are unable to commit to promotions and pay rises currently, they are making career progression a priority through improved L&D offerings – for the 50% of people teams that are planning to adjust their benefits package in 2024, learning and development is the most common area of change.

Extract from Ravio's Compensation Trends 2024 Report